Formularios de solicitud de crédito

Acerca de Formularios de solicitud de crédito

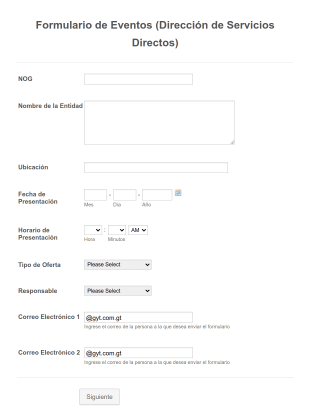

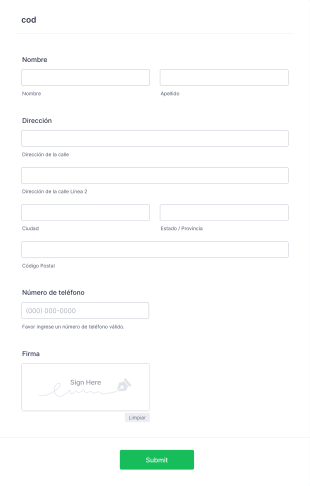

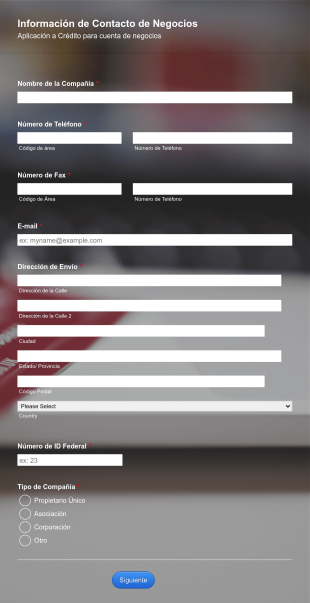

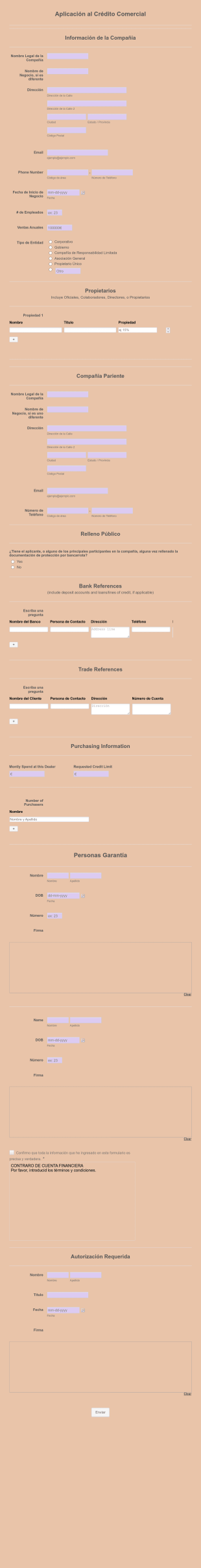

Los formularios de solicitud de crédito son herramientas esenciales utilizadas por instituciones financieras, empresas y proveedores de servicios para recopilar datos detallados de individuos u organizaciones que buscan crédito. Estos formularios generalmente recopilan datos como información personal o comercial, historial financiero, información laboral, referencias y el monto de crédito solicitado. Los formularios de solicitud de crédito son fundamentales para evaluar la solvencia crediticia de los solicitantes, agilizar el proceso de aprobación y garantizar el cumplimiento de los requisitos regulatorios. Son ampliamente utilizados en la banca, el comercio minorista, la venta de automóviles, los alquileres de propiedades y las transacciones B2B, lo que los convierte en un elemento significativo en cualquier escenario donde se otorgue crédito.

Con Jotform, los usuarios pueden crear, personalizar y gestionar formularios de solicitud de crédito en línea fácilmente sin conocimientos de programación. El creador de formulario intuitivo de arrastrar y soltar de Jotform le permite agregar o modificar campos, integrar pasarelas de pago y establecer condiciones lógicas para adaptar el formulario a sus necesidades determinadas. Los envíos se almacenan y organizan automáticamente en Jotform Tablas, lo que simplifica la revisión de solicitudes, el seguimiento de estados y la colaboración con su equipo. Ya sea un propietario de una pequeña empresa, oficial de préstamos o administrador de propiedades, Jotform za el proceso de solicitud de crédito, mejora la precisión de los datos y le ayuda a tomar decisiones informadas rápidamente.

Casos de Uso de Formularios de Solicitud de Crédito

Los formularios de solicitud de crédito se utilizan en múltiples industrias y propósitos, cada uno con requisitos y beneficios únicos. A continuación, le mostramos cómo se pueden adaptar a diferentes escenarios:

1. Posibles casos de uso:

- Solicitudes de Préstamos Personales: Las personas solicitan préstamos personales, requiriendo información detallada financiera y laboral.

- Solicitudes de Crédito Comercial: Las empresas solicitan líneas de crédito o crédito comercial, generalmente requiriendo referencias y datos financieros del negocio.

- Crédito de Tiendas Minoristas: Los clientes solicitan tarjetas de crédito de la tienda u opciones de financiamiento para sus compras.

- Financiamiento Automotriz: Los concesionarios de automóviles recopilan información del comprador para préstamos o arrendamientos de vehículos.

- Alquileres de Propiedades: Los propietarios evalúan la solvencia crediticia de los inquilinos antes de aprobar los contratos de alquiler.

2. Puntos clave para la resolución de problemas:

- Estandariza el proceso de recopilación de datos para decisiones crediticias más rápidas y precisas.

- Reduce el papeleo y los errores manuales mediante la digitalización de solicitudes.

- Garantiza el cumplimiento de los estándares legales y regulatorios.

- Permite el almacenamiento seguro y la fácil recuperación de información confidencial del solicitante.

3. Posibles propietarios y usuarios:

- Bancos, cooperativas de crédito y otras instituciones financieras.

- Minoristas y concesionarios de automóviles.

- Administradores de propiedades y propietarios.

- Proveedores y prestadores de servicios B2B

4. Diferencias entre los métodos de creación:

- Solicitudes Personales vs. Empresariales: Los formularios personales se centran en detalles individuales, mientras que los formularios empresariales requieren información de la empresa, identificaciones fiscales y referencias comerciales.

- Minorista vs. Automotriz: Los formularios de crédito minorista pueden incluir detalles de compra y opciones de programa de lealtad, mientras que los formularios automotrices requieren información del vehículo y detalles del seguro.

- Solicitudes de alquiler: Puede incluir secciones para historial de alquiler, co-solicitantes y contactos de emergencia.

En resumen, los formularios de solicitud de crédito se pueden adaptar para ajustarse a una amplia variedad de industrias y necesidades, con contenido y campos que varían según el tipo de crédito y el solicitante.

Cómo Crear un Formulario de Solicitud de Crédito

Crear un formulario de solicitud de crédito con Jotform es un proceso sencillo que se puede personalizar para cualquier caso de uso, ya sea que esté recopilando solicitudes para préstamos personales, créditos comerciales, financiamiento minorista o alquileres de propiedades. A continuación, le mostramos una guía paso a paso para diseñar un formulario de solicitud de crédito efectivo que cumpla con sus requisitos específicos:

1. Empiece con la plantilla adecuada o un formulario en blanco:

- Inicie sesión en su cuenta de Jotform y haga clic en "Crear" en la página de Mi Espacio de Trabajo.

- Elija "Formulario" y empiece desde cero o seleccione una plantilla de solicitud de crédito relevante de la extensa biblioteca de Jotform.

2. Seleccione el diseño adecuado:

- Decida entre un Formulario Clásico (todas las preguntas en una página) para visualizaciones rápidas o un Formulario de Tarjeta (una pregunta por página) para una experiencia guiada y fácil de usar.

3. Agregar campos esenciales del formulario:

- Utilice el creador de formulario con arrastre y suelte para incluir campos como:

- Información personal o comercial del solicitante (nombre, dirección, datos de contacto)

- Número de Seguridad Social o Identificación Fiscal (si corresponde)

- Detalles laborales o comerciales

- Información financiera (ingresos, activos, pasivos)

- Importe del crédito solicitado y propósito

- Referencias y detalles del co-solicitante (si es necesario)

- Casillas de verificación de consentimiento y autorización

- Para créditos comerciales o automotrices, agregue campos para el registro de la empresa, detalles del vehículo o información del seguro según sea necesario.

4. Personalice el diseño del formulario:

- Haga clic en el icono del rodillo de pintura para acceder al diseñador de formulario.

- Ajuste los colores, las fuentes y el diseño para que se adapten al estilo de su marca u organización.

- Agregue el logotipo de su empresa y personalice la URL del formulario para darle un toque profesional.

5. Configurar Condición Lógica:

- Utilice la condición lógica de Jotform para mostrar u ocultar campos según las respuestas del usuario (por ejemplo, mostrar los campos del co-solicitante solo si el solicitante selecciona "Sí" para tener un co-solicitante).

6. Integre Pasarelas de Pago (si es necesario):

- Si su proceso de aplicación requiere una tarifa de aplicación, integre opciones de pago seguras como PayPal o Stripe.

7. Configurar notificaciones por email:

- Configure emails de autorespuesta para confirmar la recepción de la solicitud al solicitante.

- Habilite las notificaciones por email para que su equipo revise los nuevos envíos al instante.

8. Publique y comparta su formulario:

- Haga clic en "Publicar" y comparta el enlace del formulario por email, su sitio web o redes sociales.

- Integre el formulario directamente en su sitio web para un acceso sin inconvenientes.

9. Pruebe y gestione envíos:

- Previsualice el formulario y envíe una entrada de prueba para asegurarse de que todo funciona correctamente.

- Monitoree y gestione las solicitudes en Jotform Tablas, utilizando filtros y búsquedas para organizar y revisar los envíos de manera eficiente.

Siguiendo estos pasos, puede crear un formulario de solicitud de crédito personalizado que optimiza su flujo de trabajo, garantiza la precisión de los datos y proporciona una experiencia perfecta tanto para los solicitantes como para su equipo.

Preguntas frecuentes

1. ¿Qué es un formulario de solicitud de crédito?

Un formulario de solicitud de crédito es un documento utilizado por prestamistas, empresas o propietarios para recopilar datos de personas u organizaciones que buscan crédito, préstamos o financiamiento. Ayuda a evaluar la solvencia y elegibilidad del solicitante.

2. ¿Por qué son importantes los formularios de solicitud de crédito?

Estandarizan el proceso de recopilación de datos, reducen errores y garantizan que se recopile toda la información necesaria para tomar decisiones crediticias informadas, cumpliendo con los requisitos legales.

3. ¿Qué información se requiere normalmente en un formulario de solicitud de crédito?

Los campos comunes incluyen datos personales o comerciales, información de contacto, historial financiero, datos laborales o empresariales, referencias y el monto y propósito del crédito solicitado.

4. ¿Hay diferentes tipos de formularios de solicitud de crédito?

Sí, los formularios pueden variar según el tipo de crédito (personal, empresarial, minorista, automotriz, de arrendamiento) y los requisitos específicos del prestamista o proveedor de servicios.

5. ¿Quién puede usar formularios de solicitud de crédito?

Los bancos, cooperativas de crédito, minoristas, concesionarios de automóviles, administradores de propiedades y proveedores B2B suelen utilizar estos formularios para evaluar y procesar solicitudes de crédito.

6. ¿Cómo se protege la privacidad del solicitante al usar formularios de solicitud de crédito?

La información confidencial recopilada a través de formularios de solicitud de crédito debe manejarse de forma segura, con cifrado de datos y controles de acceso implementados para proteger la privacidad del solicitante y cumplir con las regulaciones de protección de datos.

7. ¿Se pueden personalizar los formularios de solicitud de crédito para industrias específicas?

Por supuesto. Los formularios se pueden personalizar para incluir campos específicos de la industria, como detalles del vehículo para préstamos de automóviles o información financiera empresarial para solicitudes de crédito comercial.

8. ¿Qué sucede después de enviar un formulario de solicitud de crédito?

La información enviada es revisada por el prestamista o proveedor de servicios, quien puede verificar los datos, evaluar la solvencia crediticia y tomar una decisión sobre la aprobación o denegación de la solicitud de crédito.