Loan Application Workflow Templates

About სესხის განაცხადი Workflow Templates

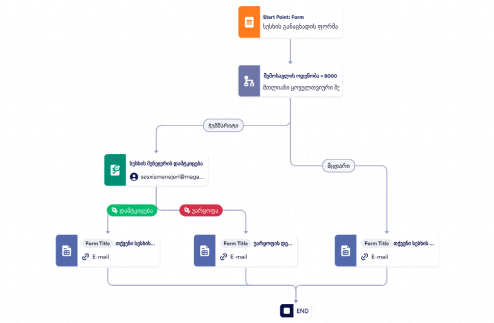

Streamline the workflow processes for your bank or other financial company with Jotform’s free online Loan Application Workflow Templates! When you receive a loan application, it will automatically be forwarded to the first person in your workflow — who will choose to approve, deny, or forward the request to another company member in a single click from any device. Once the decision has been made, the applicant will be informed automatically via autoresponder email. It's not only about approvals, you can also add integrations, task assignments or payment collection forms within your workflows. We offer templates for home loans, car loans, business loans, and more, but if you need to customize one of our Loan Application Workflow Templates to better match your needs, do it easily with our drag-and-drop builder! Add approvers and extra steps, personalize autoresponder emails, set up notifications and time limits, and much more.

ხშირად დასმული კითხვები

1) What are loan application workflow templates?

Loan application workflow templates are pre-built automation tools designed to streamline the loan application process, including applicant data collection, document verification, approval workflows, and communication with applicants. These templates help financial institutions and lenders manage the entire process more efficiently.

2) How can loan application workflow templates benefit lenders and financial institutions?

Loan application workflow templates automate repetitive tasks like gathering applicant information, reviewing documents, and managing approval processes. This reduces manual effort, speeds up the loan approval process, and ensures a more seamless experience for both lenders and applicants.

3) What types of loan application processes can be automated using workflow templates?

Loan application workflow templates can automate processes such as initial application submission, document verification, credit check approvals, loan officer assignments, and status updates. This improves the efficiency of managing multiple loan applications.

4) How do loan application workflow templates integrate with other tools used by lenders?

Loan application workflow templates can integrate with third-party apps like Google Drive, Dropbox, and OneDrive for document storage and management, Slack and Microsoft Teams for team communication, and QuickBooks for automating financial records and payment tracking.

5) Are loan application workflow templates customizable for different types of loans?

Yes, loan application workflow templates are fully customizable to suit different types of loans, including personal loans, mortgage loans, auto loans, and business loans. Lenders can modify the templates to align with specific application criteria, compliance regulations, and approval workflows.

6) How can loan application workflow templates improve communication with applicants?

Loan application workflow templates can automatically send notifications and updates to applicants via integrations with tools like Slack, Microsoft Teams, or email services such as Mailchimp and ActiveCampaign. This ensures that applicants are kept informed about the status of their loan at every stage of the process.

7) How do loan application workflow templates help with document management?

Loan application workflow templates streamline document management by automatically collecting and verifying applicant documents. Integrations with Google Drive, Dropbox, and OneDrive allow loan officers to securely store and access documents throughout the application process.

8) Can loan application workflow templates help with approval workflows?

Yes, loan application workflow templates automate the approval process by routing applications to the appropriate loan officers or decision-makers. Approval notifications and reminders can be sent via tools like Slack or Microsoft Teams, speeding up decision-making.

9) What are the benefits of using loan application workflow templates for financial tracking?

Loan application workflow templates can integrate with QuickBooks to automate financial tracking, ensuring that approved loans, repayments, and financial records are accurately recorded. This reduces the risk of manual errors and simplifies financial management for lenders.

10) How do loan application workflow templates ensure compliance with regulatory requirements?

Loan application workflow templates help ensure compliance by automating necessary steps like document verification, applicant consent collection, and credit checks. They also create audit trails, making it easier for lenders to track every action in the loan approval process and meet regulatory standards.