What is a survey?

When it comes to data collection — for personal and business use alike — surveying is one of the most effective information-gathering methods available. A survey is a quick and easy tool to get the answers you need — whether you’re asking teachers about their favorite instruction methods or asking baby boomers whether they prefer to shop at Walmart or Target.

But exactly what is a survey? Let’s take a deep dive for answers.

Definition of a survey

Put simply, a survey is a structured way to collect information or feedback. Niles Koenigsberg, digital marketing specialist at FiG Advertising + Marketing, provides a more detailed description: “A survey is a primary research method that samples individuals of a population segment to collect data and gain information. This research method ultimately provides insights on a given topic, usually for the benefit of a business to help it identify areas of improvement, unknown shortcomings, and potential threats.”

For example, a survey can be used externally to collect information from customers, such as their opinions on a service or product they recently used. Internally, a survey can be used to collect feedback from employees and other key stakeholders, perhaps regarding their satisfaction with recent or upcoming company changes.

Pro Tip

Need to collect feedback through your website? Learn how to create a survey, customize it, and embed it using Jotform.

What is the purpose of a survey?

The primary purpose of a survey is to gather information through a systematic, scientific process.

Sarkis Hakopdjanian, director of strategy at The Business Clinic, says that many business owners make assumptions about their customers. They assume they know who customers are, what their needs are, what they like, what they don’t like, why they chose to purchase specific products or services, and so on.

“Sometimes these assumptions are right, but often they’re wrong,” Hakopdjanian says. “Instead of guessing, [companies] can use surveys to get real data they can use to make more informed decisions about their business.”

Survey expert Trevor Wolfe, director of product management at Mailchimp, provides additional insight: “Surveys are intended to reduce the amount of bias and subjectivity in the way humans provide and request feedback…. Surveys also offer a convenient way to aggregate results and spot trends.”

Pro Tip

Build the structure your survey needs to get high-quality responses with Jotform’s customizable survey templates. Try one today!

What are the components of a survey?

While all surveys are not created equal, they do tend to have several common components:

- An invitation, which briefly summarizes what the survey involves and how long it should take to complete

- An introduction, which outlines what the survey is about and provides any additional context, instructions, and disclaimers the participant needs to know

- A set of screening questions, which helps narrow down the pool of participants and improve the quality of survey responses

- A set of screening responses, which are provided by participants and used to determine their eligibility for answering the survey questions

- A set of survey questions, which prompts participants for the information you’re seeking

- A set of survey responses provided by participants

- A confirmation, which informs participants that the survey is complete. This may be in the form of a person-to-person interaction (for in-person surveys) or a final thank-you page (for digital surveys).

How are surveys typically conducted?

Surveys can be conducted in the field with pen and paper or via mobile devices, like tablets. This method can be difficult because you’re limited to surveying people who are physically present. You may also face rejection from people who aren’t willing to participate in a survey when you ask.

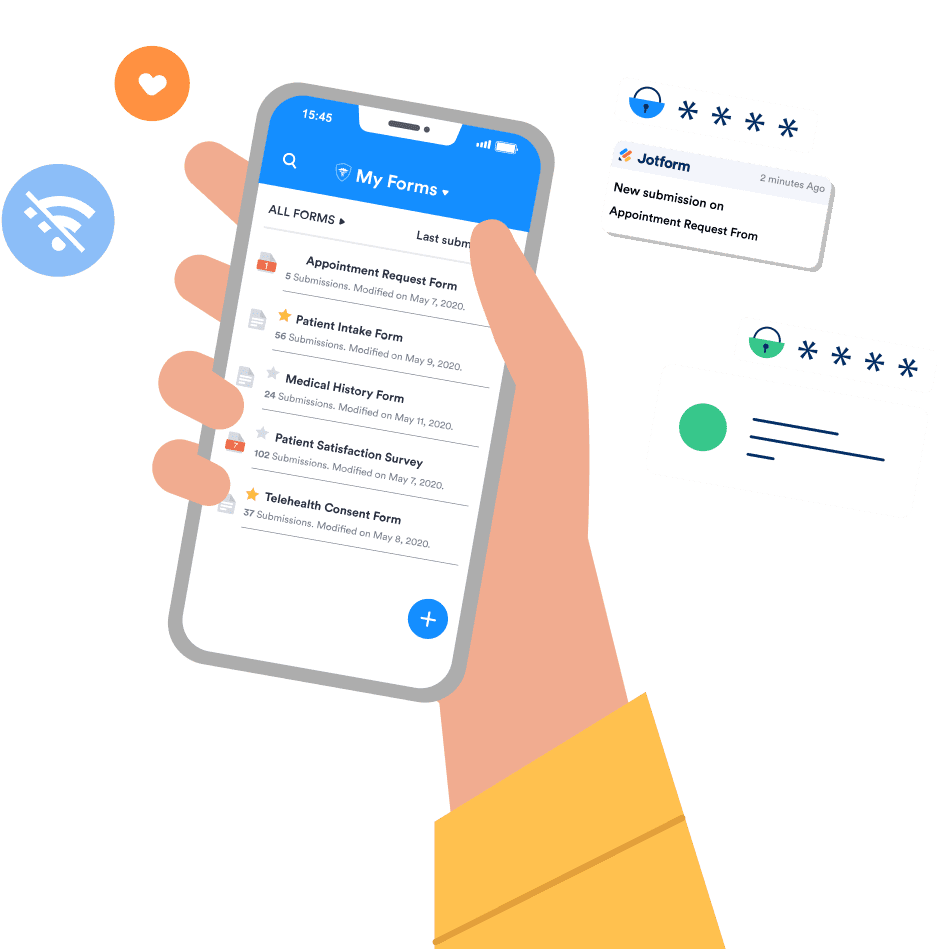

Another common way of conducting surveys is with online tools like Jotform, Google Forms, and SurveyMonkey. It’s typically easier to distribute surveys with this method, as you can reach just about anyone who has a computer or mobile device and an internet connection, especially if you use a paid service to increase your reach.

Survey types

Understanding the purpose of surveys will help you better realize their value to your business. However, understanding surveys in general is only half the battle. Be sure to choose the right type of survey to get the information you need.

Online Surveys

Many businesses rely on online surveys due to their wide range of features, ease of use, and general flexibility. Online surveys allow your team to reach a large audience regardless of where they’re located.

Users can easily access surveys using their computer or mobile device, and most surveys are optimized for mobile for even further ease of access. Online surveys are best when you’re trying to reach a large group of respondents, as they streamline the process of distributing numerous surveys.

Online surveys also reduce the pressure for recipients to respond immediately, allowing them to complete the survey at their convenience.

Focus groups

Focus groups are a particularly effective method of in-person surveying. To perform a focus group, an interviewer gathers a diverse group of individuals to get their honest opinions on any number of issues or topics. These individuals are often given incentives to participate such as gift cards, free products, or other rewards. This survey style is commonly used to collect feedback about products, services, advertisements, businesses, or even individuals.

These surveys are most effective if you are looking for real-time, honest feedback. The other benefit of this survey is that it allows respondents to openly discuss their opinions with one another. One individual’s opinion may spark a thought from another, leading to more discussion and more detailed, beneficial feedback.

Phone Survey

Collecting data through phone surveys requires staff or volunteers. To perform a phone survey, an interviewer calls potential respondents and asks a series of questions to gather their opinions. This survey method takes more time and effort than most survey types to coordinate, and the success of each survey largely depends on the interviewers.

If an interviewer is particularly effective, you could receive high-quality customer feedback. However, a sub-par interviewer could lead to less than satisfactory results. The other main hurdle of this survey type is that many people don’t like receiving unsolicited calls and may not answer, which could limit your response rate.

Mail Surveys

Mailing surveys to your target audience reduces labor costs by using the post office to deliver each survey. These surveys should be short — preferably one page or less. Surveys should also look official. Respondents may be cautious of scams, so including your logo and branding should help put them at ease.

To increase the odds of getting responses, include a prepaid response envelope. Although it will raise your campaign costs, respondents are less likely to pay to send their answers back — especially without any incentive. Including an incentive offer and providing a prepaid response envelope increases your chances of getting their response.

Face-to-face Surveys

Another labor and time-intensive survey type, face-to-face survey interviews require hiring and training an interviewer to gather information from your respondents. In face-to-face interviews, respondents meet at a specified time and location with an interviewer from your organization to answer questions. These interviews require a great deal of coordination and will take up more time than other methods, but they can also provide in-depth feedback.

To make the most of face-to-face interviews, record them, so no information is lost. Interviewers should also be well-prepared with open-ended questions and follow-up questions to delve deeper into key issues.

Text Surveys

Most people are seldom without their phone, so text surveys help you to reach respondents where they are in a format that fits their busy schedules. Before sending a text survey, be sure you have permission from each respondent to contact them. Unsolicited text messages could backfire on you, as recipients may feel their privacy is being invaded.

If you receive permission, you can send a text survey manually or through an SMS marketing solution. Users can respond at their leisure. Text surveys should use multiple-choice or rating questions rather than open-ended questions, as respondents are unlikely to provide long-form responses through their phones.

Survey methodology: Pros and cons

Each survey type offers unique benefits that may make it the best fit for your needs. However, each also has drawbacks you need to account for during your strategic planning process.

Let’s take a closer look at some of the top pros and cons of each method, so you can choose the right ones for your business.

Online Survey

Pros

- Access to online form builders with premade survey templates

- Easy to duplicate and customize

- Low cost, wide reach

Cons

- Requires an internet connection

- Requires respondents to be somewhat comfortable with digital technology

Focus group

Pros

- Allows for group discussion that provides more in-depth information

- Offers deeper insight into customer feedback

- Allows facilitator to ask follow-up questions

Cons

- Group setting could make some respondents nervous to speak

- Potential for a single person to dominate the discussion

- Cost- and time-intensive

Phone Survey

Pros

- Provides a personal touch

- More cost-effective than in-person surveys

- Allows you to collect a large volume of responses

Cons

- Limited amount of time to conduct interviews (respondents don’t want to stay on the phone too long)

- Potential respondents may screen calls

- Risk of irritating respondents with unwanted calls

Mail Survey

Pros

- Allows you to target specific geographic areas

- More cost-effective than phone or in-person surveys

- Doesn’t require interviewers

Cons

- High effort for respondents

- Involves printing and mailing costs

- Requires you to manually compile responses

Face-to-face Survey

Pros

- Allows you to collect in-depth information

- The interviewer can clarify questions or ask follow-up questions in the moment

- Provides opportunities to ask open-ended questions

Cons

- Time-intensive

- Lack of anonymity

- Quality of responses are dependent on the interviewer’s skill

Text Survey

Pros

- Flexible and easy to access

- Allow you to reach respondents wherever they are

- High open rates

Cons

- Permission to contact respondents needed

- Restricted to mostly quantitative data

- Could be costly depending on the method of sending

Each survey type brings its own set of advantages and challenges. Identifying which survey types best suit your needs will enable you to better focus your efforts.

Surveys vs other data-collection methods

Surveys are often considered the most effective method of gathering data because they are so versatile. However, there are other data collection methods that offer other benefits.

Depending on the type of data you’re trying to collect, your budget constraints, and the level of effort you’re willing to put in, each of these data collection methods may offer a unique result.

Observation

Observing user behavior is a method that involves asking no questions at all — you simply observe users interacting with a product, app, website or other offering on their own. Setting up proper observation can be difficult, however, and often requires special tools. Let’s say you want to better understand your customers’ experience with your website, for example. You’ll likely need to employ third-party tools or services to observe and record how they interact with your site.

Observational methods allow you to collect unfiltered feedback from users without influencing their responses through prompts or incentives. After collecting the data, however, you’ll then have to interpret the information. The challenge here is that whoever reviews the results may have an existing bias or opinion, whether positive or negative, that could influence their interpretation of the results.

Observational methods also lack the structure of surveys. You could risk spending time observing your users for a specific purpose, only to gather information that is irrelevant to your goal.

Document and record reviews

Similar to the observation method, analyzing documents and records allows you to gather data without asking any questions. Using existing records like order histories, customer service conversations, financial statements, and more, you can gather insights to inform your strategies.

This method is likely the most inexpensive of all data collection methods because the data already exists — it just needs to be organized and analyzed. However, when analyzing documents and records, your team can only make connections and draw conclusions from whatever data is available — rather than gathering the exact information they need, like in surveys.

Oral histories

Oral histories are similar to interviews in that they collect in-depth information directly from individuals through interviews, though they focus on a single event or phenomenon. Oral histories consist of collecting the personal histories, anecdotes, and experiences of individuals who share a common experience. For example, if you want to gain insight into an event you hosted from an attendant’s perspective, you could gather oral histories from a few willing participants.

The trouble with oral histories is that they also depend on an interviewer’s skill and could be influenced by interviewer bias. If an interviewer fails to gather the right data, you could lose out on valuable information. If your interviewer records information selectively to fit their biases, you could end up with skewed, inaccurate conclusions.

Selecting the best data collection method for your needs is vital to the success of any research project, whether it’s business-related or personal. However, even with the perfect data collection methods and processes, how you analyze your data determines how useful it is.

Analyzing survey results

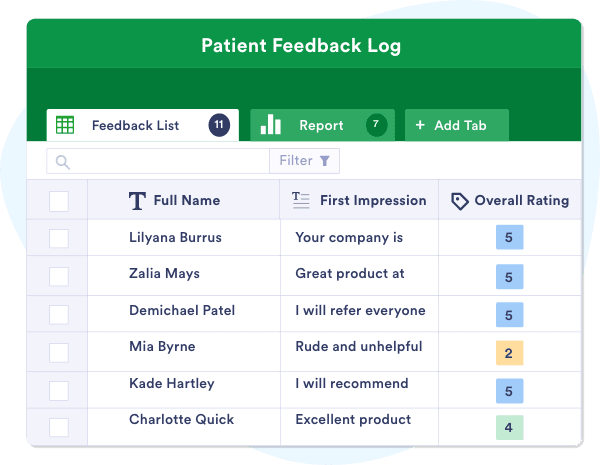

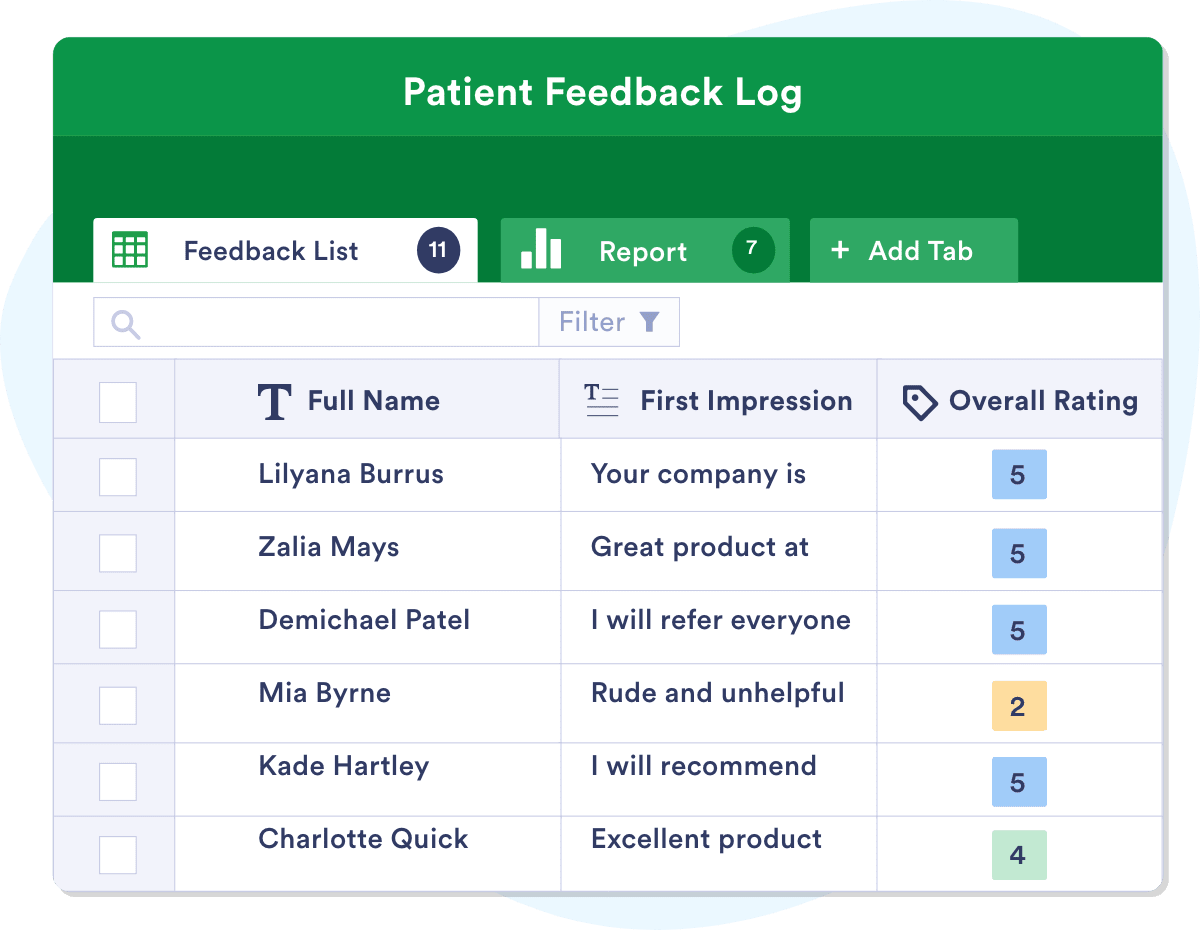

Online survey tools like Jotform provide data analysis tools that can easily build reports to see your data at a glance. But you also need to understand how to analyze these reports to get the most out of your data.

Check out these common ways to turn your data into actionable results:

- Identify and separate data types

- Review questions

- Cross-tabulate research

- Check your results against previous research

- Focus on what’s relevant

To better interpret your data, separate the qualitative responses from the quantitative response. Qualitative data, which often comes from open-ended questions, will need more interpretation. Quantitative data, which typically is produced by multiple choice questions, will be easier to calculate. Understanding the type of data you have gathered will help you perform better analysis and streamline your process.

Before conducting an analysis, double check that your survey questions still align with the goal of your research. If you find that your research needs have shifted during the research process due to new revelations or priorities, consider adjusting your survey and fielding it again. This may also be a good idea if you discover that your questions did not produce the information you hoped to gather.

Identify common characteristics among your respondents to paint a clearer picture of your results. For example, you can separate the responses to a question by the occupation, age, or other demographic of the respondents. This method can help you identify trends in the responses of different groups.

If you have previously performed similar research, compare those results to your new survey results. This will provide insight into how respondents or their responses have changed over time. If this is your first survey on a topic, consider using it as a benchmark for future research.

One crucial part of sifting through survey results is understanding what data is valuable and what is not. Positive results from a demographic outside your target audience may not be as useful as less favorable results from the users that you need to reach.

Now that you’re in the know about surveys, it’s time to build one. Check out these easy-to-use survey templates to get started.