Feeling overwhelmed by financial management tasks? The right software can act as a vessel that propels you through the tumultuous waters of accounting, payroll, and expense tracking.

Aplos and QuickBooks are two financial software tools that can help you navigate the challenges of financial management. However, each targets different situations. For the small business owner or nonprofit leader striving to make every dollar count, choosing the right tool can be a game-changer.

As we explore both software solutions, you’ll discover which one aligns best with your needs. Cast off those uncertainties and set sail with confidence!

QuickBooks overview

QuickBooks is a powerhouse in financial management software. It’s a reliable choice for businesses that need a broad set of financial tools. Some features that make it especially appealing include

- A comprehensive toolset: QuickBooks offers invoicing, payroll, time-tracking, expense-tracking, and detailed financial reports. It’s an all-in-one suite for those who need diverse functionality.

- Integration capabilities: QuickBooks works with various third-party apps, from payroll services to CRM solutions.

- Scalability: Whether you’re running your organization alone or you have a large team, QuickBooks scales with your needs. It offers a Simple Start plan for beginners up to an Advanced tier for larger entities.

QuickBooks offers four pricing plans, starting at $30 per month. For example, the Simple Start plan is excellent for new solopreneurs. As the business grows and you need to add users, more advanced plans like the Essentials plan may be a better fit.

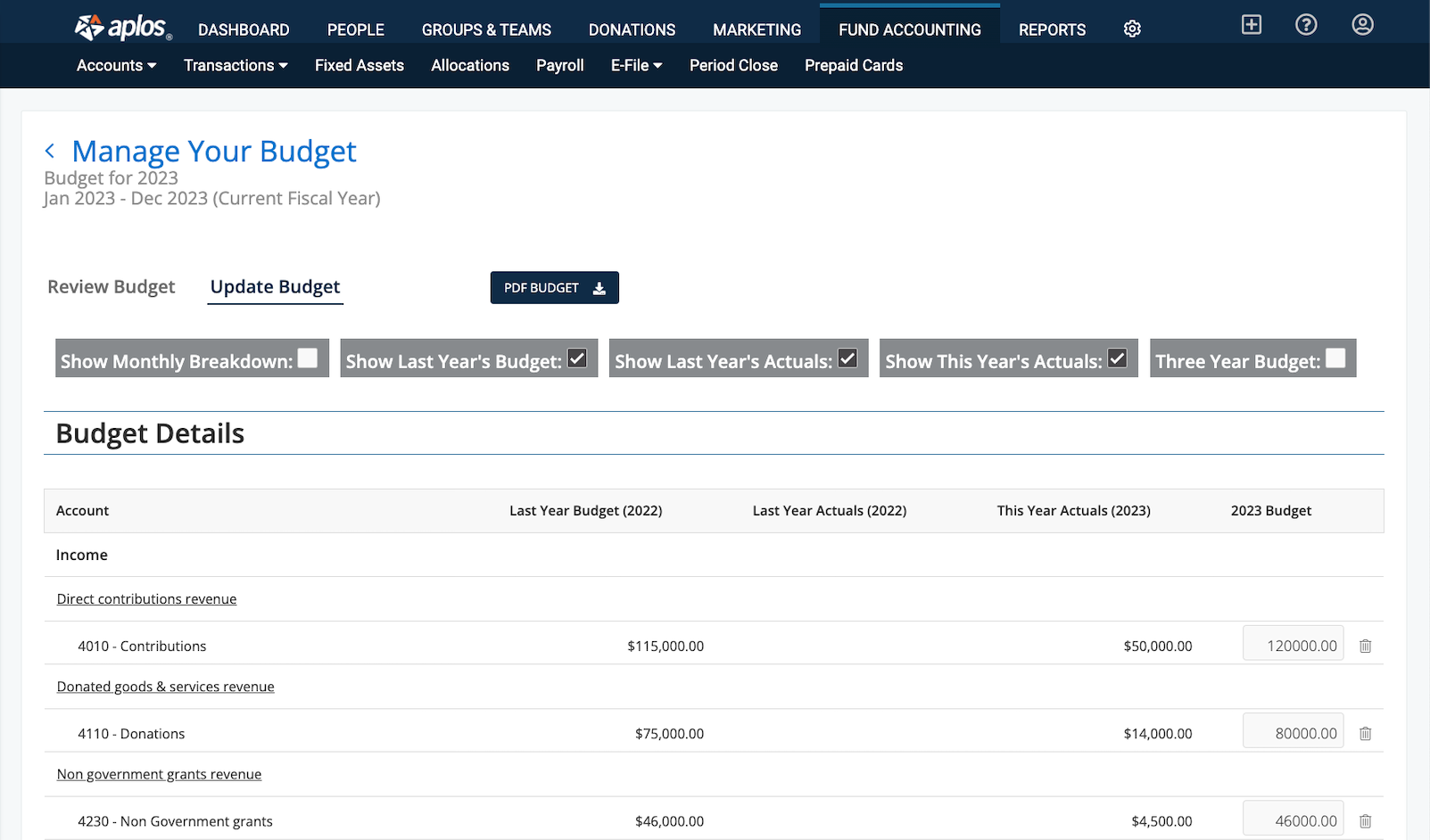

Aplos overview

Aplos is specifically designed for nonprofit organizations. While it provides many of the advanced accounting features that QuickBooks does, its focus on nonprofits helps organizations navigate the complexities of that sector. Consider a few of its key features:

- Fund accounting. This feature ensures nonprofits can track every penny with a customizable chart of accounts.

- Donor management. Aplos offers donor management tools that allow you to recognize, track, and engage with your supporters like never before.

- Event and registration tools: Are you hosting an event? From registration to ticketing, Aplos offers an integrated solution to make your events successful.

Aplos plans start at $79 per month for the basic plan, which comes with a free trial. From there, organizations can opt for a Core plan for $99 per month or request pricing for customized solutions.

Jotform: A nimble and powerful option

We’ve analyzed Aplos vs QuickBooks, two tools that can help nonprofits navigate financial waters. But sometimes, less is more. Enter Jotform, an online form builder and data collection platform that can also serve as a financial management tool.

- Simple: Jotform is a user-friendly tool. You don’t need to be tech-savvy to use the software. With its intuitive drag-and-drop interface, you’ll be collecting data in no time.

- Lightweight: Jotform offers customizable online forms to help you build the system you need. Its powerful tools help you track everything in one place.

- Cost-effective: Jotform provides a cost-effective solution for any organization that needs straightforward data collection.

- Agile: Jotform offers seamless integrations with more than 200 popular third-party tools.

Even if you need a more complex financial solution, Jotform can work in tandem with your other tools. For example, you can use Jotform’s QuickBooks integration to generate invoices, create customer records from form submissions, and collect a variety of client- or customer-specific data with each form. Try Jotform for free today.

Photo by Mikhail Nilov

Send Comment: