For small businesses in search of the right accounting and bookkeeping software, it’s hard to go wrong with either Xero or QuickBooks — at least for major tasks and processes. Both are popular platforms for individual entrepreneurs, freelancers, and small businesses. Both are cloud-based financial platforms for business use, and they offer a 30-day free trial to help you fully explore their features.

Yet for all their similarities, Xero and QuickBooks offer significantly different experiences at different price points. Depending on your budget, accounting experience, and preference for simplicity versus need for complexity, you might favor one program, while a similarly situated competitor would do much better with the other.

If picking a new accounting platform is on your to-do list, you might be wrestling with questions. In this article, we’ll take a deep dive into both Xero and QuickBooks by examining their features, target audiences, plans and limitations.

An introduction to Xero

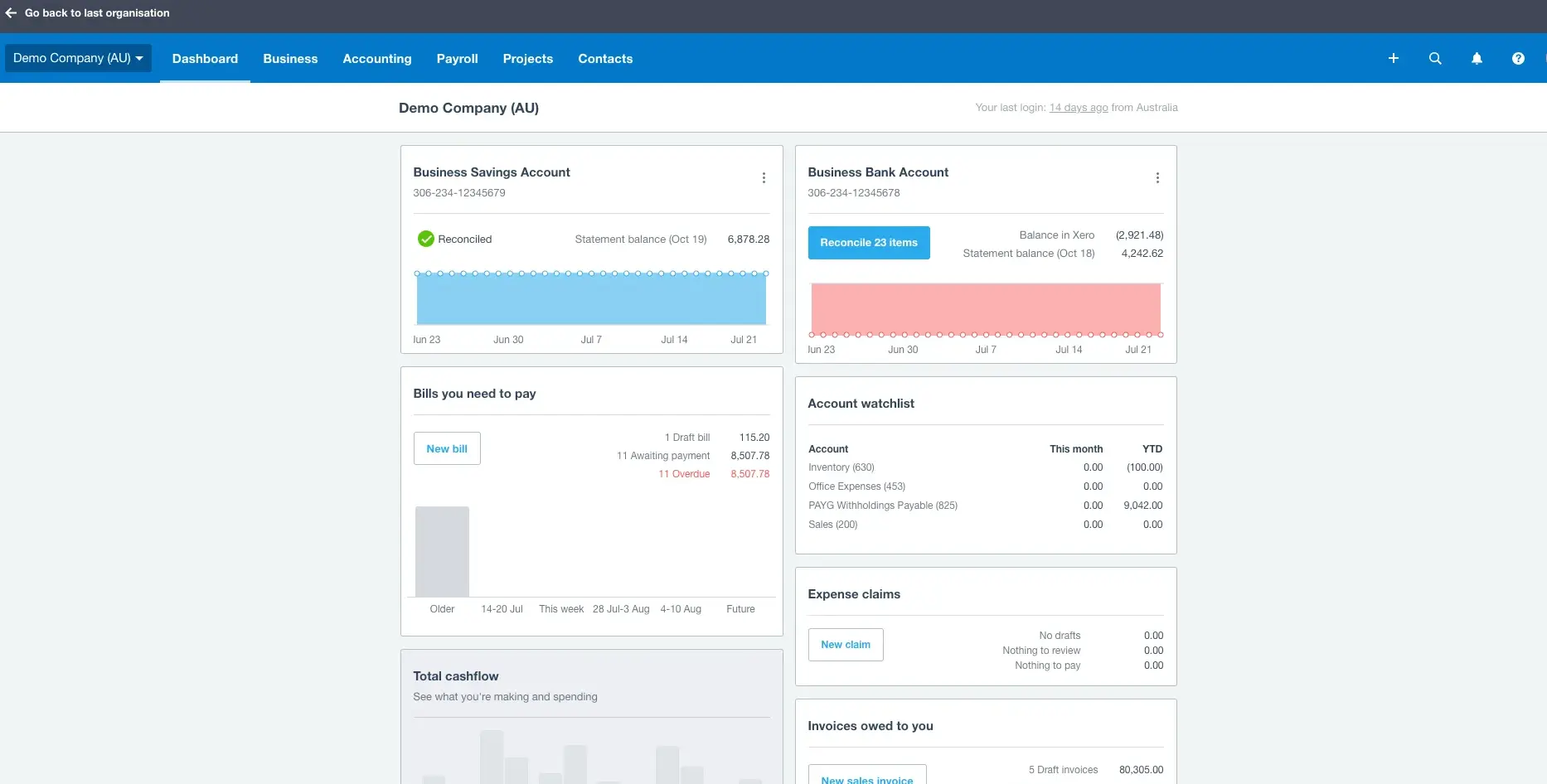

Xero is cloud-based software for accounting and bookkeeping that’s designed specifically for small businesses. The company is based in New Zealand, with offices in multiple countries, including the United States and Canada.

Built on the software as a service (SaaS) model, Xero’s users praise it for its ease of use, its tools to support multiple currency use, its accessibility, and, perhaps most of all, its lack of user limits (i.e., you can give access to your company’s Xero account to as many users as you want).

An introduction to QuickBooks

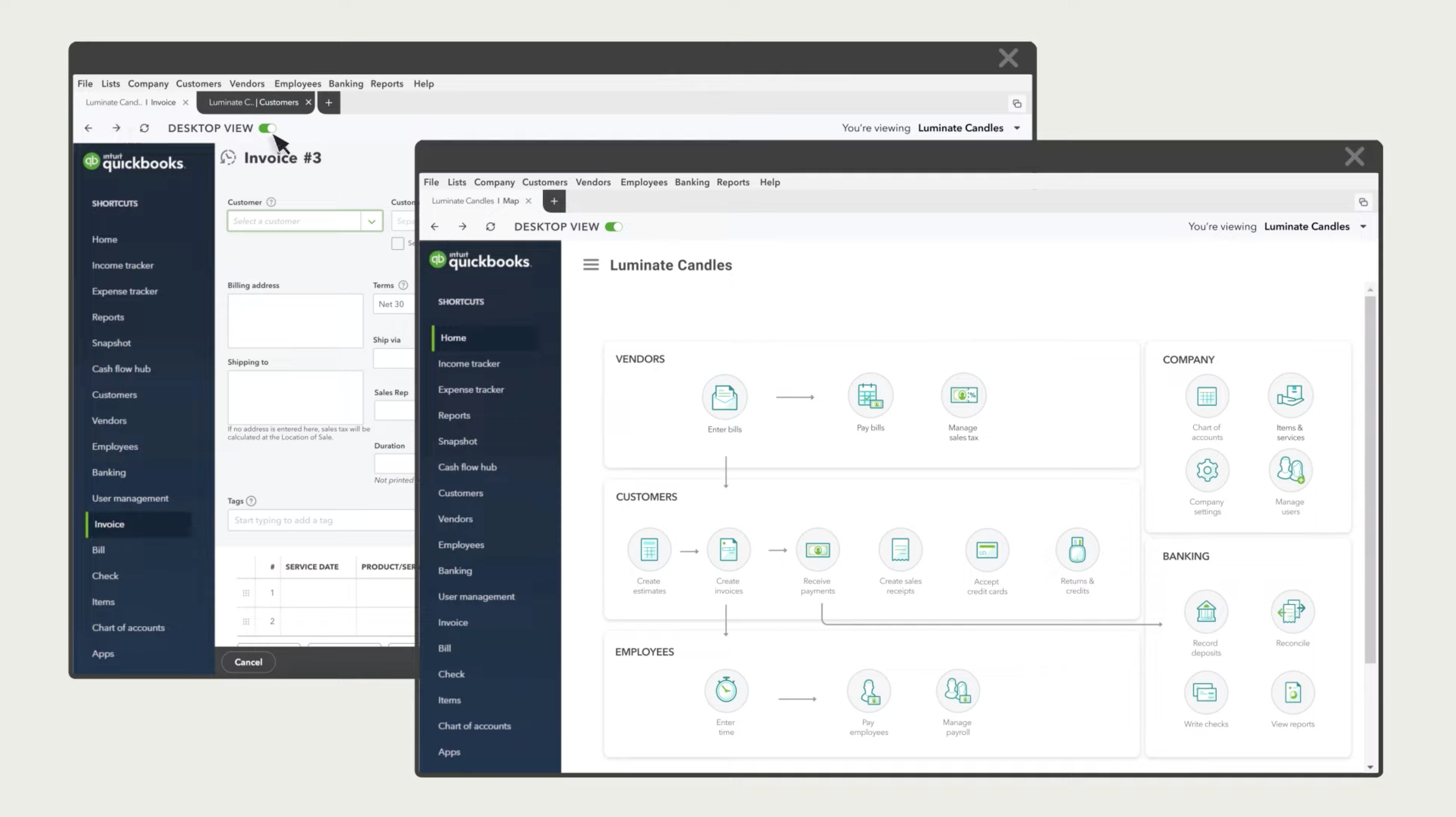

Available both online and through a desktop interface, QuickBooks offers its users a comprehensive suite of money management tools. While it strives to maintain its user-friendliness throughout its layout and functionality, QuickBooks comes with a slightly steeper learning curve. Its plans offer access for up to 25 users, depending on the plan, and they come with a variety of features to help you manage your business finances, including inventory management and more.

Target audience for Xero

Xero is primarily designed for small businesses and nonprofit organizations in any niche or field. It’s also particularly well-suited for non-accountants and others who don’t have a lot of extensive experience with accounting software, thanks to an intuitive and user-friendly interface.

Target audience for QuickBooks

QuickBooks is suitable for businesses and nonprofit organizations of all sizes and in all fields. However, due to its depth and complexity, it might offer more than very small businesses or freelancers require. For that reason, it might be better suited for small to mid-sized companies (as opposed to very small businesses and freelancers) and for accounting firms.

Key features of Xero

Xero offers access for an unlimited number of users at all plan levels. Powered by AI, Xero has also recently improved its tax preparation and planning functionality.

New users may also benefit from Xero’s onboarding experts, who they can consult with for the first 90 days. Plus, Xero offers integrations with over 1,000 other third-party programs and platforms to help further streamline and automate financial workflows.

Key features of QuickBooks

QuickBooks is highly regarded for its scalability. The platform makes it easy for a company to scale quickly due to unexpected growth. Simply moving up to the next plan level will easily accommodate new needs and users.

Additional key features of QuickBooks that users particularly appreciate include integration capabilities with over 750 third-party apps and tools. That includes shopping cart sites and platforms, such as Etsy. Plus, many users appreciate the ability to easily share their books and accounts with outside service providers, including bookkeepers and accountants.

Common features of Xero and QuickBooks

As Xero and QuickBooks are both accounting and bookkeeping platforms designed for small business and nonprofit needs, they obviously share a great deal in common. Both are finance management platforms built on the SaaS model, where users subscribe to the platform for continued access. Both include basic accounting and bookkeeping tools based on the double-entry accounting method, and both support the accrual and cash-basis approaches as well.

Both Xero and QuickBooks also offer extensive connections or integrations with third-party services, tools, and sites to simplify and centralize a business’s financial controls. You can integrate your Xero or QuickBooks account with your bank accounts to ensure a closer capture of key financial data and with other third-party tools to help customize and automate your workflows.

Unique features of Xero and QuickBooks

The key differences between Xero and QuickBooks lie in the number of users that can access a single account, the pricing of their tiered plans, and the complexity of some of the more advanced accounting features. Xero offers access to an unlimited number of users at every plan level, while QuickBooks has strict limits, from one to 25 users, depending on the plan selected.

Speaking of plans, Xero’s three plans are less expensive than QuickBooks’ plans, whereas QuickBooks offers more plans at a variety of price points, which might accommodate different budgets better, especially for companies that are growing quickly.

Overall, most reviewers and users agree that QuickBooks is somewhat more complex and advanced than Xero and perhaps not quite as easy for new users to learn. On the other hand, Xero is a more user-friendly tool, has lower prices overall, and is perhaps better for more budget-conscious businesses.

Side-by-side comparison of key features

| Feature | Xero | QuickBooks |

|---|---|---|

| User-friendliness | Easy to learn, customizable dashboard with a more simplified layout | Customizable dashboard, with a steeper learning curve and more advanced features |

| Customer support | No live chat, but access to online support topics | More support channels offered, including live chat during business hours |

| # of integrations | Over 1,000 apps | Over 750 apps |

| User limits | No limitations on number of users in any plan | Access for 1 to 25 users, depending on the plan |

| Free trial | 30 days | 30 days, or a reduced price for first three months |

Pricing and plans

Each of these platforms offer tiered plans with access to increasingly advanced tools and functions. The overall pricing and specific features vary.

Xero pricing and plans

Xero offers three plans, starting at $15 per month and aimed at different phases of a business’s life cycle — Early, Growing, and Established. All of its plans offer access to an unlimited number of users per company account. That makes it easier to plan and scale your company’s use, since you won’t have to budget in some amount to account for a growth in your workforce. For each plan, you’ll be able to explore Xero with a 30-day free trial.

The Early plan is aimed at new small businesses and startups. You can send up to 20 invoices and pay up to five bills each month. This plan also comes with integration with business bank accounts and receipt capture to help track every expenditure and invoice paid.

The Growing plan is best for companies that want to scale up and need more robust financial features. It allows you to send unlimited invoices and pay unlimited bills, giving you the ability to properly account for and track all your transactions. It also offers bulk transaction reconciliation to help save some time as your financial dataset expands.

Under the Established plan, users get full access to the entire suite of Xero’s features, with all of the functionality in the Early plan plus some bonus features, such as multi-currency support, project tracking, and more advanced analytics for deeper insights into your company’s finances as you grow.

QuickBooks pricing and plans

Starting at $35 per month, QuickBooks offers four different plans for business users. Pricing is based on both the selected plan type and the number of users you want to include. As with Xero, each plan comes with an optional free 30-day trial.

At the entry level, the Simple Start plan offers the basics that most small businesses need most often to keep their finances in order. This includes tools that manage income and expenses, create and send client invoices, capture data from receipts, track mileage, and more, with the option to connect and integrate one sales channel.

The Essentials plan builds on Simple Start features, by adding access to more advanced reporting tools, tools to track time, multi-currency support, and up to three users, with integration for three sales channels.

At the Plus level, users get everything offered in Essentials as well as more comprehensive tools for reporting, inventory management, and project profitability management. You can also give access to up to five users and connect an unlimited number of sales channels.

For larger companies, the Advanced plan comes with a host of tools and features, including priority access to round-the-clock support, up to 25 users, tools to manage fixed assets, batch invoicing and expense management, and more advanced reporting tools.

Jotform: A powerful alternative

Both QuickBooks and Xero are accounting and bookkeeping software programs, so they have similar features with some minor differences.

Jotform can be a robust alternative to both of these tools with its advanced features for your bookkeeping needs. Jotform also serves as invoicing software for small businesses.

With Jotform, you can track daily expenses, and with approval templates, finance teams can easily collect, approve, and decline financial requests such as invoices, expense reimbursements, and more.

You can also use Jotform together with QuickBooks and Xero. With the native QuickBooks integration and QuickBooks forms, you can turn your form submissions into QuickBooks invoices. Although there’s no native integration with Xero, you can connect Jotform and Xero via Zapier. You can also easily create and send invoices with Jotform’s invoice templates.

Photo by Beyzanur K.

Send Comment: