The SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis has long been a popular business tool. Ask any company owner or manager if they know what a SWOT analysis is, and many will not only answer yes but tell you how they’ve used it.

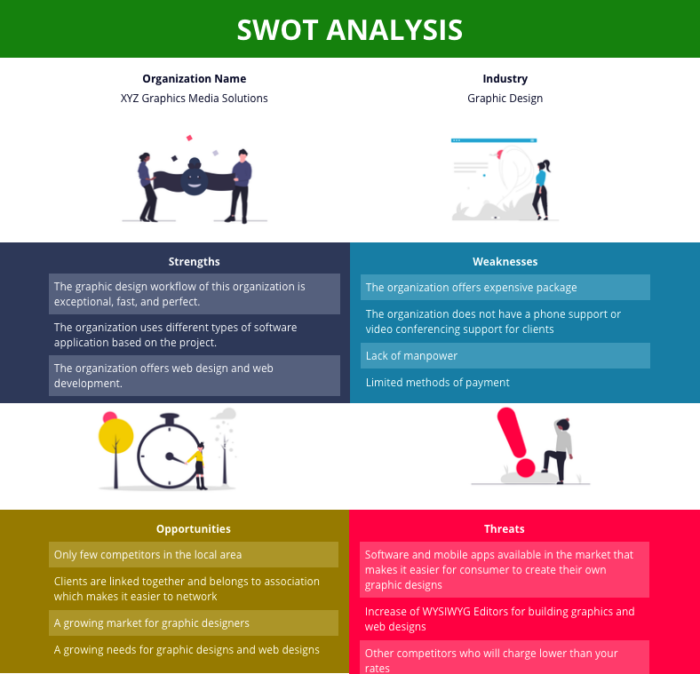

A SWOT analysis is a type of gap analysis. Using a SWOT diagram is a great way to take stock of where a company stands, its position in the competitive landscape, what it’s doing well, and what it could be doing better.

A SWOT analysis provides one method of assessing gaps in a company or business activity. However, it won’t get to the finer details that other types of gap analyses can. Let’s take a look at gap analysis versus SWOT analysis — how they’re different, how they overlap, and when you should use one instead of the other.

SWOT looks outward, while a gap analysis looks inward

How a company functions internally is a critical part of its success or failure. But equally important are the external influences, including competitors, industry trends, and the state of the economy.

The SWOT analysis mostly focuses on what’s going on outside of the company and how that affects the workings of the company. For example, the threats and opportunities a company faces are intertwined with the market situation and the activities of the company’s competitors.

A gap analysis, on the other hand, largely looks at a company’s internal processes and what’s missing that could help boost performance. A gap analysis sometimes also includes external forces, as in a market gap analysis, which specifically focuses on what a business needs to succeed in a specific market. Even in this case, however, the gap analysis eventually turns the focus back on what the company can do to improve.

The SWOT analysis is always going to focus on how the company looks as a player on a much bigger field.

SWOT has a big-picture focus, while a gap analysis is a high-res picture

One great advantage of the SWOT analysis is that it provides a broad picture of the company and its current state. It looks at the larger, sweeping markers — strengths and weaknesses, threats and opportunities — rather than focusing on minutiae — such as sales campaign figures or employee retention rates. Think of a SWOT analysis as an overall scan of the whole “body” rather than a surgical operation that dives deep into every organ.

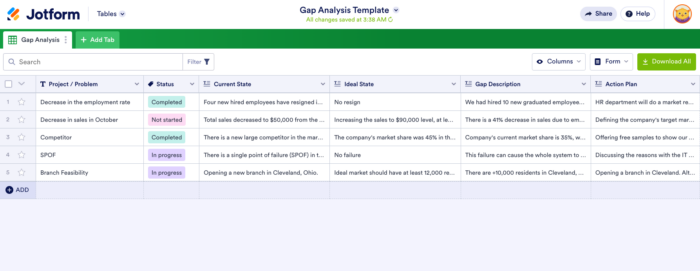

A gap analysis, on the other hand, has many different methodologies. You can create a gap analysis for any situation or process, no matter how finely you need to examine it.

When you’re tackling the big questions about a company, its performance, market position, and functioning in the industry landscape, a SWOT analysis is a good choice. For high-resolution assessments of specific processes, projects, or issues, a gap analysis model will be better.

SWOT has a set framework, whereas a gap analysis can be what you make it

The SWOT analysis uses a simple four-block grid framework to help managers visualize their business from four set perspectives. Although every SWOT analysis is a bit different — with varying outcomes and conclusions — the structure is always the same: strengths, weaknesses, opportunities, and threats.

A SWOT analysis is an invaluable tool — that’s why it has stuck around since the 1960s and why business schools still teach it today. However, it never deviates from the basic outline.

A gap analysis, on the other hand, can take many different forms, and analysis developers can adapt the framework depending on the business’s needs. There are several main gap analysis tools and models in use today, each with a different focus. The Nadler-Tushman model, for instance, looks at organizational performance, while the fishbone (or Ishikawa) diagram tackles manufacturing or product development. Even if you don’t use one of the standard models, you can design your own gap analysis with the help of a spreadsheet or basic table chart.

SWOT is great for organizations starting out, while a gap analysis is great anywhere, anytime

Another way that SWOT and gap analyses differ is in when they are best put to use. As a sweeping, big-picture analysis, a SWOT analysis is a great tool for businesses just starting out or when assessing the viability of a new business idea. It’s also appropriate when a business is looking to pivot in another direction or enter a new market.

Although an organization can easily adapt a SWOT analysis for any kind of process or project — even smaller ones — it’s particularly useful when a company is trying to understand its position and potential with a bird’s-eye perspective of the business landscape.

The gap analysis comes in many shapes and styles, so a company can use it just about any time they want to assess where they are and where they’re going. If you’re trying to understand why sales figures aren’t reaching their targets this quarter, a SWOT analysis is too wide-reaching and nonspecific to cover it. A gap analysis, however, is the perfect tool to tackle this issue — and just about any other issue (no matter how particular) that may arise.

Similar but different

When comparing a gap analysis to a SWOT analysis, it’s important to remember one thing: SWOT is just one type of gap analysis. At the same time, a SWOT analysis stands alone as a highly effective way to assess a company’s performance and market position.

Using a SWOT analysis doesn’t discount the need for other types of gap analysis. Rather, when looking for ways to boost performance and close gaps that are holding back your business, choose the right tool for the specific goal — whether SWOT or any other type of gap analysis.

Send Comment: