15 great small-business tax tips

- Collect and manage your tax information in an easier way

- Reduce income tax with specific strategies and deductions

- Save money with professional help

- Fine-tune payroll management

- Stay as organized as possible

- Use tax software as a backup

- Leverage available tax credits

- Keep track of evolving tax legislation

- Evaluate your business entity structure

- Explore retirement savings plans

- Manage personal and business expenses separately

- Track your business mileage

- Develop a year-round tax plan

- Prepare an emergency fund for tax surprises

- Revisit your tax strategy annually

The following suggestions are for informational purposes only. For official IRS guidance, go to https://www.irs.gov.

As a small business owner or entrepreneur, you have to pour your heart and soul into your business plan, your customers, and your work.

But why not apply the same rigor to your taxes?

Yeah, we know taxes aren’t sexy — or even fun. They take up valuable time, and in some cases, they can be a real pain. But taking a professional approach to your taxes can have positive outcomes for your business that go beyond avoiding legal trouble.

It turns out many of those outcomes are central to the success of your business. Here are just a few of the biggest benefits you can see if you stay on top of your taxes in an organized way:

- You can save money.

- It frees up time for you to do what you love.

- It can reduce your stress levels.

- You’ll simplify a complicated process.

- Your tax-related data will be easily accessible.

While the general small business tax rate is between 10 and 37 percent, those rates and calculations can vary based on location and your business structure. And since you may be both a small business owner and one of its employees, you can get hit with tax liability both coming and going.

As a result, taxes present a business challenge — but they’re also a hidden opportunity.

Pro Tip

Boost efficiency during tax time with automated document creation from Jotform’s AI Document Generator!

Turning your small business taxes into an asset

We’ve compiled 15 small-business tax tips that will help you proactively take on tax season and potentially provide benefits for you and your business.

1. Collect and manage your tax information in an easier way

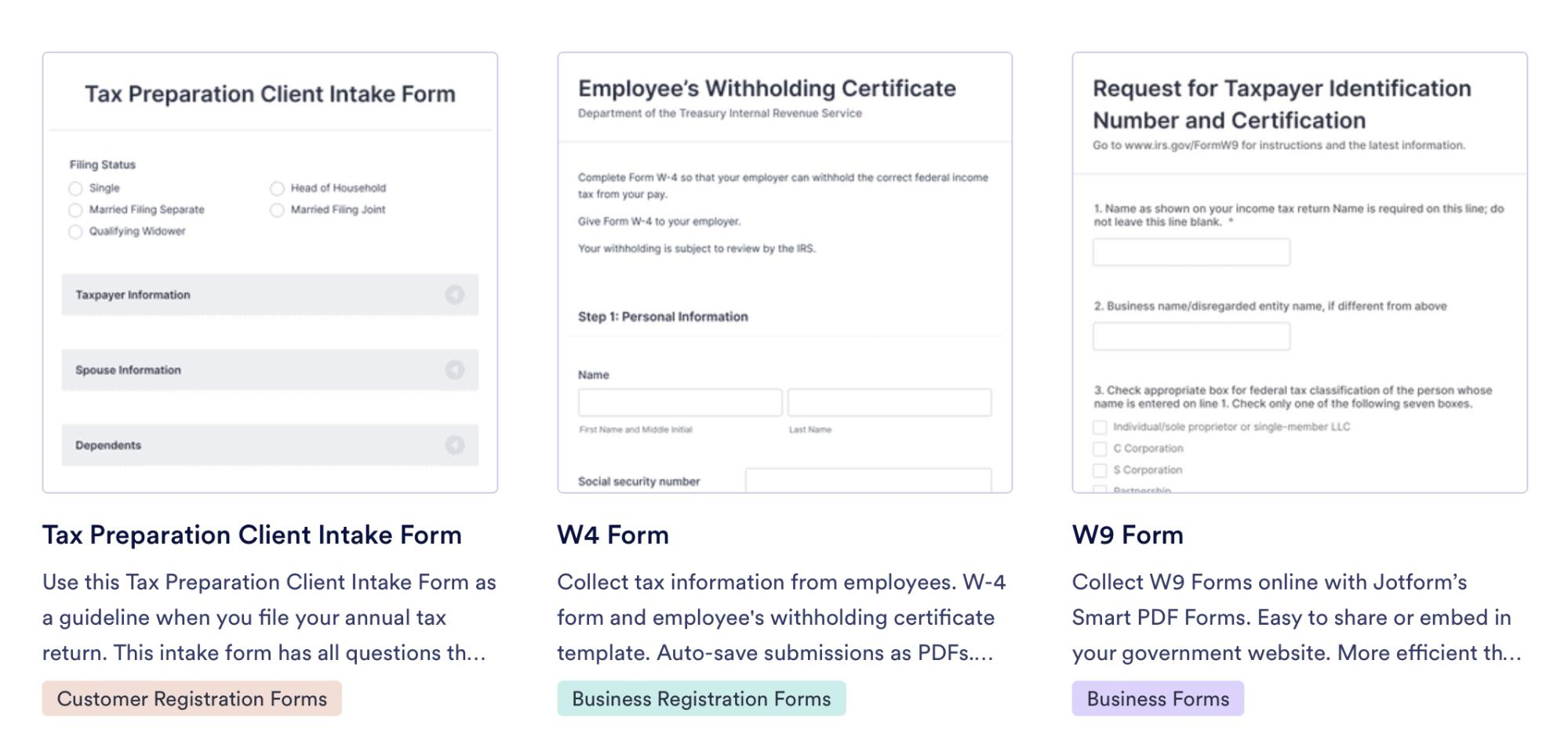

Jotform’s tax templates can help simplify tax season by turning your paper tax forms into digital ones.

Whether it’s a W-4 (employee withholding certificate), a 1040-ES (estimated tax on self-employment income not subject to withholding), or a 1040-SE (self-employment tax), simply use our Smart PDF Form templates to turn tax PDFs into online forms and back into PDFs again.

Doing so will allow you and those you work with to complete these records easily. Plus, you can safely store data within Jotform and download PDFs to save for your records and future reference.

Tax season doesn’t have to be a headache — especially when you have the right tools. Jotform’s tax form generator is here to streamline the process, helping you turn cumbersome paper tax forms into efficient digital ones. Whether it’s a W-4 (employee withholding certificate), a 1040-ES (estimated tax for self-employment income not subject to withholding), or a 1040-SE (self-employment tax), you can simplify your workflow by converting tax PDFs into online forms and back into PDFs with ease.

By digitizing these forms, you’ll save time and make it easier for your employees, contractors, or clients to complete their tax-related tasks. Additionally, with Jotform, you can securely store all your data in one place and easily download PDFs for your records or future use. Say goodbye to filing cabinets and hello to an organized, accessible tax process.

Pro Tip

Boost efficiency during tax time by leveraging Jotform’s Tax Form Generator. It’s a quick and easy way to manage your tax forms and stay organized year-round!

2. Reduce income tax with specific strategies and deductions

Here’s where you can really turn the ritual of doing taxes into an asset for your small business. You might be able to take advantage of little-known deductions and methods to reduce your taxes.

Consider and fully vet these options with experts before pulling any triggers, but if you can legally reduce your tax liability, your small business will benefit.

3. Save money with professional help

Using a tax professional — whether you go with a CPA, a tax attorney, or an enrolled agent — might come with some upfront costs, but a professional can save your business money year after year.

Tax professionals understand the pros and cons of different business structures and the kinds of deductions and tax strategies that put you in the best position. For example, a tax professional will know how to help your small business deduct charitable contributions or even student loan repayment assistance for employees.

Professional expertise can not only help your business through deductions (including a tax preparer’s fees), but if you ever have to deal with an audit, you’ll have organized and thorough tax records on hand.

4. Fine-tune payroll management

Whether you have a few employees or hundreds, you need to manage employment taxes accurately.

You’re required to withhold employment taxes from your employees’ wages so you can pay them on a particular cadence, whether that’s monthly, quarterly, or annually.

The good news? You can easily compute and collect the right amount, especially if you manage your employees’ W-4s with online forms. For instance, with Jotform Tables, the data from those submissions is automatically saved in a neat table, allowing you to perform calculations using formulas and lookups for connected data entries.

5. Stay as organized as possible

Whether you’re using a tax professional or going it alone, keeping a clean log of business receipts and accounting at the ready is critical.

Just as the kind of food you put in your body impacts your health, your taxes can only help your business if the information that goes into the forms you file is accurate. Spending time digitizing your tax forms and business receipts helps you reduce errors, minimize your dependence on paper, and keep all of your files at the ready.

Additionally, consider investing in a good accounting system. Detailed accounting helps you track and summarize transactions into reports that help your preparer and inform your operational efficiency.

6. Use tax software as a backup

Tax software can be a lifesaver, especially for small businesses that are growing but not ready for a fully outsourced finance department. By investing in reliable tax or accounting software, you gain access to automated calculations, easy data imports, and potentially helpful prompts that point out available deductions. Even if you’re already working with a professional, using tax software as a supplementary tool can be a smart move.

Another advantage is the built-in checks for errors and compliance issues. Software solutions often update automatically when new tax laws or rates come into effect, giving you peace of mind that the numbers you’re crunching are correct. And remember, the cost of most tax software subscriptions is also deductible, so you get a double benefit: improving your accuracy while reducing your taxable income.

7. Leverage available tax credits

Tax credits can reduce your tax bill dollar for dollar, making them particularly valuable to small businesses. Whether you’re offering health insurance to employees, investing in new technology, or implementing green initiatives, there may be federal or state incentives to help offset these costs. Credits are often overlooked, so researching or consulting a professional to identify the ones you qualify for can significantly improve your bottom line.

Also, remember that some credits are temporary or tied to specific legislative programs that change over time. Keeping a close eye on local, state, and federal developments ensures you won’t miss out on newly introduced benefits. By consistently monitoring available credits, you’ll maximize your opportunities for tax relief and reinvest that saved capital into growing your business.

8. Keep track of evolving tax legislation

Tax laws are far from static — they can change from year to year or even in the middle of a year. A new law could introduce beneficial deductions for small businesses, tighten regulations in certain industries, or alter how particular expenses should be reported. Staying on top of these changes is crucial to ensuring that your business remains compliant and doesn’t accidentally miss out on new money-saving strategies.

One way to stay informed is to sign up for newsletters from reputable tax or accounting firms and official sources like the IRS. Regularly reading on financial news or joining industry associations can also inform you of legislative shifts that impact your sector. Maintaining an ongoing understanding of tax developments, you’ll be well prepared to adapt quickly and keep your financial processes running smoothly.

9. Evaluate your business entity structure

The way your business is structured — sole proprietorship, LLC, S corporation, C corporation, or partnership — has a direct impact on how you pay taxes. Sometimes, a structure that was perfect when you first launched may no longer be the best fit once your business grows or pivots. That’s why it’s worth periodically assessing whether your current business entity is still the most tax-efficient choice.

Consulting a tax professional or attorney can clarify whether another structure offers advantages like limited liability, different tax rates, or the ability to claim specific deductions. Restructuring can feel daunting, but the potential savings and asset protection benefits can make it worthwhile. When considering any entity change, always factor in both the short—and long-term implications for your business’s tax obligations.

10. Explore retirement savings plans

Offering or participating in retirement plans isn’t just about planning for the future; it can also create immediate tax benefits. Business owners who contribute to retirement plans like SEP IRAs, SIMPLE IRAs, or 401(k)s may reduce their taxable income, while also giving employees a valuable benefit. If you’re a solopreneur, certain self-employed retirement accounts can help you save significantly more per year than a traditional IRA.

Beyond the immediate tax deductions, retirement plans are a fantastic way to attract and retain talented employees. Many workers prioritize stable benefits packages, so providing a way for them to plan for their golden years can strengthen loyalty and reduce turnover. In this way, you’re optimizing your tax strategy and nurturing your company’s long-term health through a motivated workforce.

11. Manage personal and business expenses separately

Blurring the lines between personal and business finances can lead to many problems, from bookkeeping nightmares to potential legal risks. For instance, if you frequently use your credit card for business expenses, tracking and categorizing costs accurately at tax time becomes more difficult. You also risk having the IRS question your business deductions if your records appear muddled or inconsistent.

To avoid these headaches, open a separate bank account and use distinct credit cards strictly for the business. Doing so makes accounting much easier, especially when pulling monthly or quarterly statements to reconcile expenses. Clear financial boundaries help you accurately file your taxes and provide a better picture of your business’s economic health.

12. Track your business mileage

If you use a business vehicle, tracking your mileage can unlock valuable deductions. Every mile driven for work-related tasks — such as meeting clients, traveling to conferences, or picking up supplies — could be deductible. However, you’ll need a detailed log that records dates, destinations, and the purpose of each trip to meet IRS requirements.

Thanks to smartphone apps and mileage trackers, you no longer have to remember to jot down the mileage in a paper logbook. These tools can even automatically categorize trips as personal or business-related. By diligently recording your mileage, you’ll simplify your tax prep and ensure you don’t miss out on a deduction that can add up quickly if you spend a lot of time on the road.

13. Develop a year-round tax plan

One of the biggest mistakes small business owners make is cramming their tax prep into a frenzied few weeks each spring. By adopting a year-round approach, you can monitor your cash flow, keep tabs on your estimated tax payments, and make strategic decisions when they can have the most impact. This proactive planning helps you avoid the last-minute rush — and possible oversights — associated with hurried filings.

A continuous tax plan also allows you to adapt as your business evolves. Your tax obligations might shift if you hire new employees, expand into a different market, or pivot your product offerings. Adjustments throughout the year will align your strategy with your current reality, ensuring you take advantage of every deduction and credit while maintaining compliance.

14. Prepare an emergency fund for tax surprises

Even with diligent planning, tax surprises can still arise. Perhaps a new law increases your liability, or you need to pay an unexpected penalty. Building a small emergency fund specifically for tax-related expenses can buffer the financial blow, preventing you from dipping into operational cash meant for payroll, rent, or inventory.

To create this safety net, set aside a small percentage of each month’s revenue into a separate account earmarked for taxes. Over time, you’ll accumulate a comfortable cushion that can cover any unanticipated fees or adjustments. This approach offers peace of mind and protects your day-to-day business operations from sudden financial strain.

15. Revisit your tax strategy annually

Your business isn’t static — it evolves, as should your tax strategy. By scheduling an annual review with a tax professional, you can identify any regulatory changes, new credits or deductions, or shifts in your business that might affect your filing. This annual check-in ensures you don’t let valuable opportunities slip through the cracks.

During this review, take the time to analyze your budget, business goals, and growth trajectory for the upcoming year. Are you planning on hiring more staff, launching new products, or entering a different market? Each of these moves can have tax implications. Staying proactive with your tax planning means you can optimize your strategy, maintain compliance, and keep more of your hard-earned revenue.

Taking the sting out of taxes

The last couple of years, in particular, have been hard on small businesses. It’s understandable that the last thing you want to deal with is taxes.

But if you give them the attention they need by getting professional assistance, maintaining complete records, and understanding various business deductions, you can make things a little easier for yourself and your business.

Send Comment: