Top QuickBooks alternatives

If you’re looking for a way to manage your personal or business finances, chances are you’ve considered Intuit QuickBooks. However, it might not be the perfect solution for your needs, so we’ve gathered a list of the top 10 alternatives to QuickBooks for 2025 here. But let’s start by taking a closer look at QuickBooks.

An overview of QuickBooks

QuickBooks is a user-friendly accounting and money management software solution for both personal and business use. Users can choose a desktop version for either PC or Mac computers or opt for a mobile-friendly cloud-based version that’s accessible from the web.

QuickBooks gets a lot of praise for its usefulness in planning for and preparing tax returns. It provides support in the form of video tutorials, webinars, and community forums to help you make the most of the product.

Plans and pricing

QuickBooks offers four tiered plans: the Simple Start plan at $30 per month, the Essentials plan at $60 per month; Plus at $90 per month; and Advanced at $200 per month. Each plan allows a certain number of users (starting at one and scaling to 25 as you go up in tiers) and adds more advanced features to the standard features in the tier below. All plans offer a free 30-day trial period, and users may cancel at any time.

User reviews

- G2 users gave QuickBooks Online an average rating of 4.0 out of five stars in over 3,000 reviews.

- Capterra users gave QuickBooks Online an average rating of 4.3 out of five stars, with over 6,500 reviews.

Reasons to look for a QuickBooks alternative

Small businesses and solopreneurs might be interested in finding a QuickBooks alternative for a number of different reasons. For example, if your company has grown significantly since its startup stage and QuickBooks is no longer as helpful as it once was, you may need to find a better fit. Or maybe you adopted QuickBooks initially and then simply tacked on additional elements to your financial tech stack as your business grew, resulting in an unwieldy and poorly integrated solution.

Top 10 QuickBooks alternatives

Fortunately, you’ll find several robust accounting solutions to explore. Start with the following list of the top 10 QuickBooks alternatives, and you may find the ideal solution for your financial needs.

1. Jotform

Key features

Thanks to Jotform’s advanced features and products, you can use it as a complete bookkeeping solution. It offers a variety of templates to keep track of expenses and other financial activities, and you can share that data with your finance team and others. You can also use Jotform to gather, track, and manage client intake information.

Jotform also offers invoice templates that are designed for a variety of industries and a simplified invoice template that small businesses will find useful. Tracking form submissions and invoice submissions is easy with Jotform Tables.

With Jotform Approvals, you can also automate expense approval processes. In fact, there are several approval templates specifically designed for financial processes that you can use to save time and effort. You can even integrate Jotform with QuickBooks to supplement its functionality.

Pros

- It has a user-friendly layout and interface.

- All plans give you access to the same set of features.

Cons

- It’s not a dedicated financial tool.

Plans and pricing

Jotform offers five levels of access at different price points, beginning with a free plan that makes it easy to take Jotform for a test drive. Paid tiers, which start at $34 per month, come with higher limits on the number of forms and submissions you can have, as well as more storage and other features.

User reviews

- G2 users gave Jotform an average rating of 4.7 out of five stars and more than 3,000 reviews.

- Capterra users gave Jotform an average rating of 4.6 out of five stars and 1,900-plus reviews.

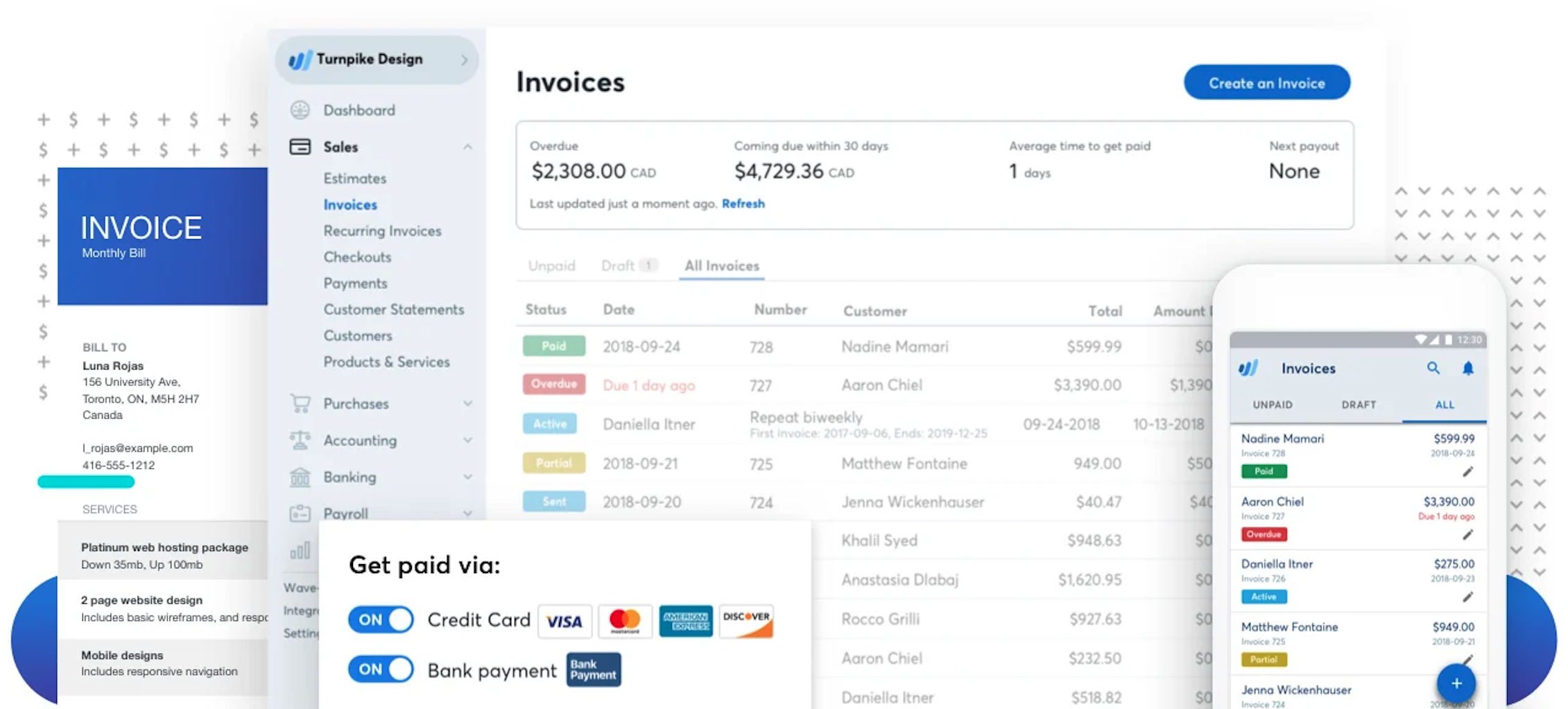

2. FreshBooks

Key features

FreshBooks is a great choice of accounting software, especially for freelancers and small businesses. It offers a mobile app that lets you communicate with clients about invoicing and payment issues while you’re on the go.

Small teams and solopreneurs will find it simple to set up and use, thanks to its user-friendly interfaces and navigation. With excellent phone-based customer support, users can quickly get the help they need to resolve any issues that pop up.

Pros and cons

Pros

- Time-tracking features are included in all plans.

- Invoices can include billable hours and expenses.

Cons

- Each additional user costs extra ($11 per user per month).

- The least expensive plans may be too lightweight for many users.

Plans and pricing

FreshBooks offers four paid plans. At the entry level, users can select the Lite plan, starting at $19 per month (with a discount for the first four months). One step up is the Plus plan at $33 per month and the Premium plan is $60 per month (both with discounts for the first four months). It also offers a customized Select plan. Each plan offers a higher limit on the number of allowed clients.

User reviews

- G2 users gave FreshBooks an average rating of 4.5 out of five stars, with over 700 reviews.

- Capterra users gave FreshBooks an average rating of 4.5 out of five stars and more than 4,000 reviews.

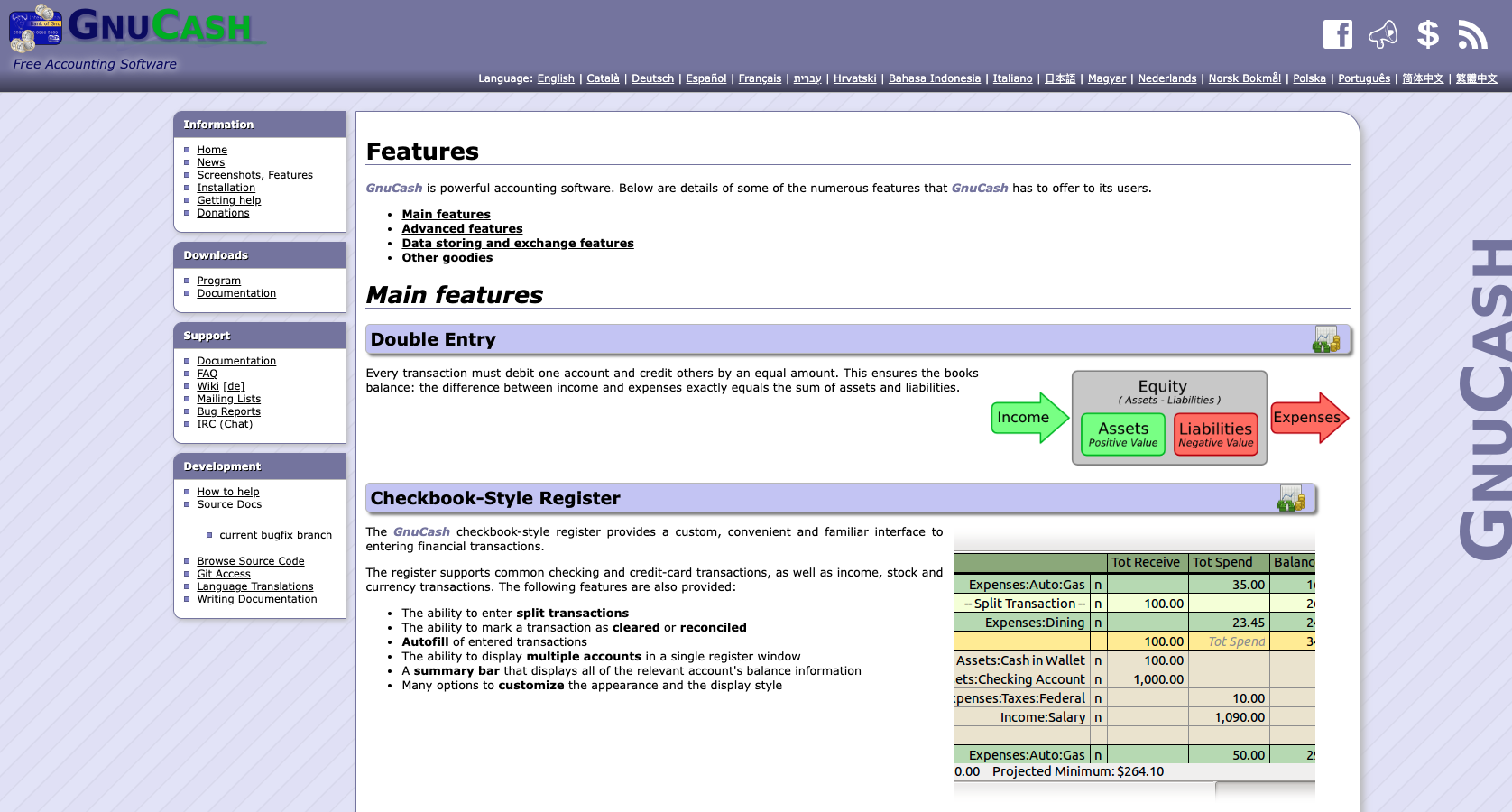

3. GnuCash

Key features

GnuCash may be the least well-known QuickBooks alternative on our list, but for the right users, it’s an enticing option. It’s a free application for both PC and Mac desktops, developed and supported by volunteers.

GnuCash uses the double-entry accounting methodology. International business users may appreciate the ability to use multiple types of currency, while most organizations will find the expense tracking, bank account reconciliation, and transactional management features useful.

Pros and cons

Pros

- It has a large community of users who can help you get the most from the app.

- Users can run reports in pie chart and bar chart formats.

Cons

- It may require a lot of time to set up.

- Some users find the documentation confusing or difficult to use.

Plans and pricing

GnuCash is free to use.

User reviews

- G2 users gave GnuCash an average rating of 4.2 out of five stars, with more than 20 reviews.

- Capterra users gave GnuCash an average rating of 4.5 out of five stars, with over 40 reviews.

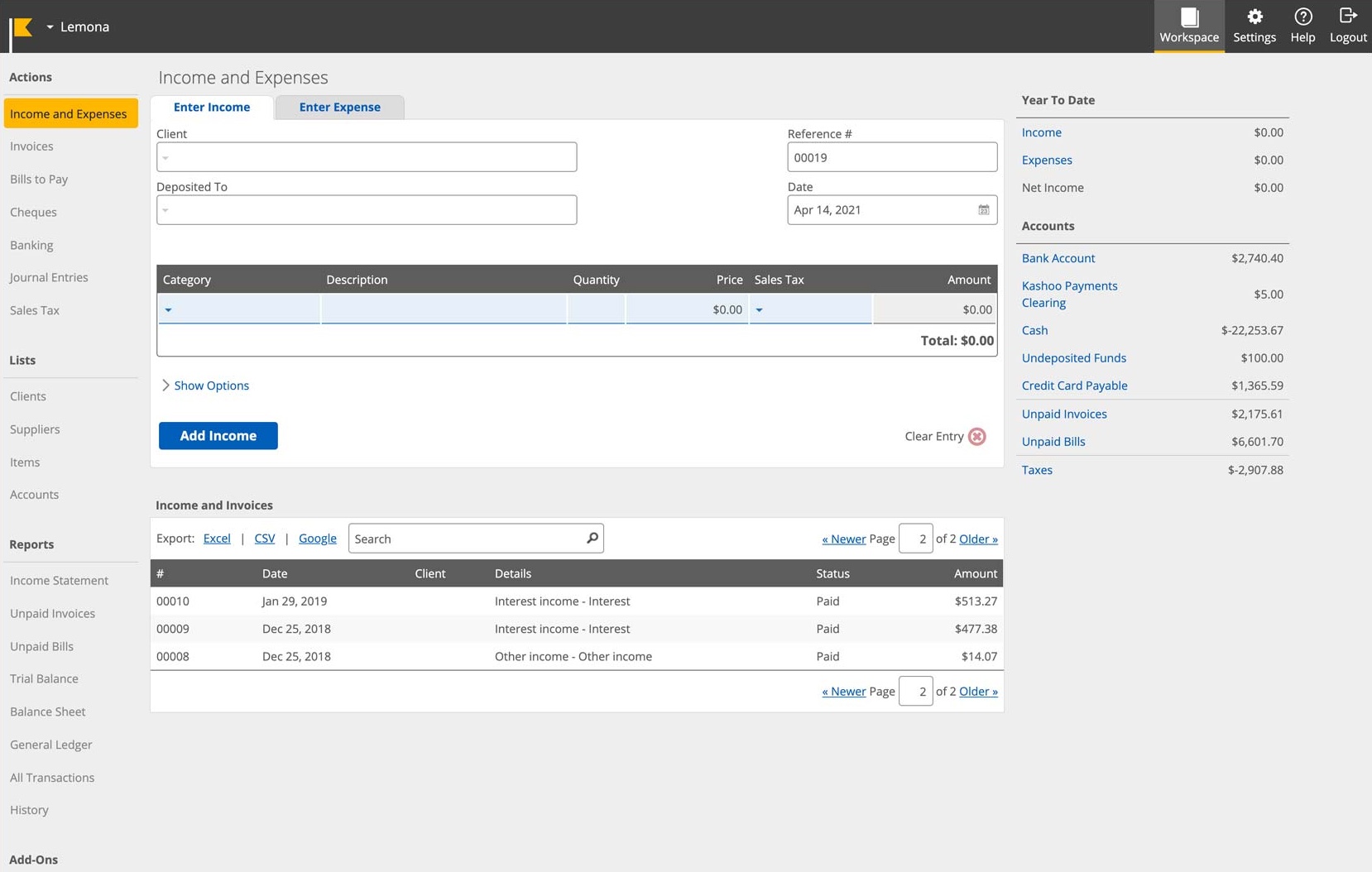

4. Kashoo

Key features

Kashoo, a cloud-based accounting solution, offers two different products: TrulySmall, aimed at the small business market, and Kashoo for larger companies and organizations. Kashoo offers access to tools for invoice creation, transaction tracking, and even payroll tasks, all from a single platform. Kashoo also provides solid report generation tools to help you make better data-driven decisions about your company’s finances.

Pros and cons

Pros

- TrulySmall offers free invoice templates.

- There are no restrictions on the number of users you can have.

Cons

- The free trial lasts for 14 days, while other solutions offer 30 days.

- It offers fewer integrations with other software than other solutions. The only payment processor integrations offered are with Stripe and WePay.

Plans and pricing

TrulySmall offers an accounting solution for small businesses for $216 per year. Kashoo costs $324 per year and has more advanced features.

User reviews

- G2 users gave Kashoo an average rating of 4.6 out of five stars and more than 50 reviews.

- Capterra users gave Kashoo an average rating of 4.5 out of five stars and 125-plus reviews.

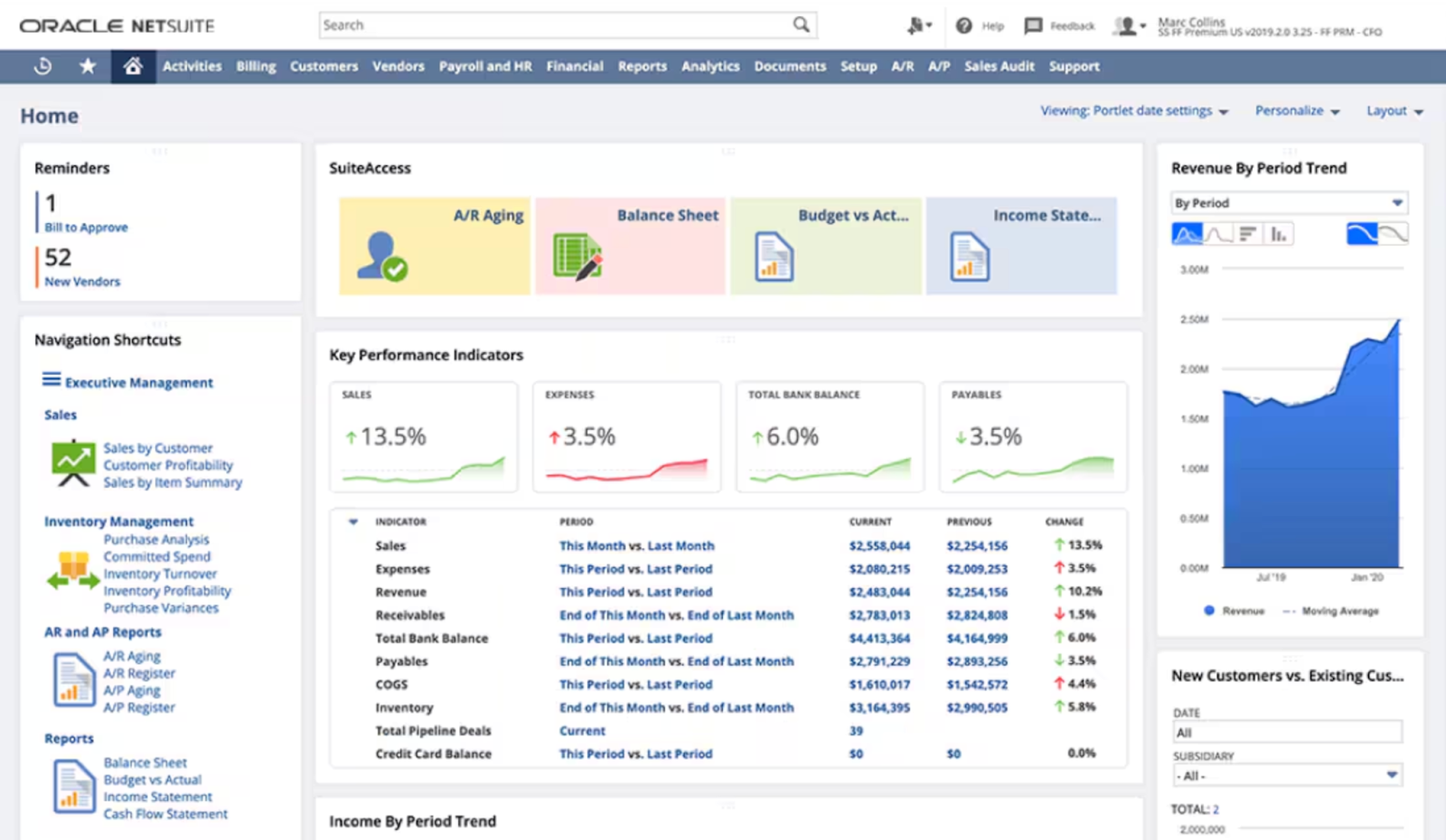

5. NetSuite

Key features

Oracle’s NetSuite is one of the most comprehensive enterprise resource planning (ERP) solutions on the market today. For that reason, it may have the most robust tools and features to address most business needs, including accounting, procurement, project management, and more. However, that also means NetSuite might be more than your small business needs.

Pros and cons

Pros

- It’s highly versatile and it offers a broad set of features.

- It offers strong inventory management tools.

Cons

- It presents a potentially steep learning curve.

- It can be overwhelming for some users.

Plans and pricing

NetSuite asks interested users to schedule a free consultation in order to get a quote.

User reviews

- G2 users gave NetSuite an average rating of 4.0 out of five stars with more than 3,000 reviews.

- Capterra users gave NetSuite an average rating of 4.1 out of five stars with more than 1,500 reviews.

6. Quicken (Classic Business & Personal)

Key features

Quicken is a high-quality software solution for financial tracking and management. However, it’s probably best suited to those looking to manage their personal finances rather than small business owners looking for a QuickBooks alternative. It doesn’t offer payroll features, for example, which even small organizations likely need.

Pros and cons

Pros

- It’s a trustworthy cornerstone product that’s been serving this niche market for decades.

- It provides alerts when expense category limits are exceeded.

Cons

- It’s not aimed at the small business market, so it might not be a good fit for this audience.

- Some reviewers note a lack of robust support.

Plans and pricing

Quicken’s Classic Business & Personal edition is available for both PC and Mac desktop users at $9.99 per month, billed annually. If paid monthly, the cost rises to $10.99 per month.

User reviews

- G2 users gave Quicken an average rating of 4.2 out of five stars with 70 reviews.

- Capterra users gave Quicken an average rating of 3.9 out of five stars with more than 400 reviews.

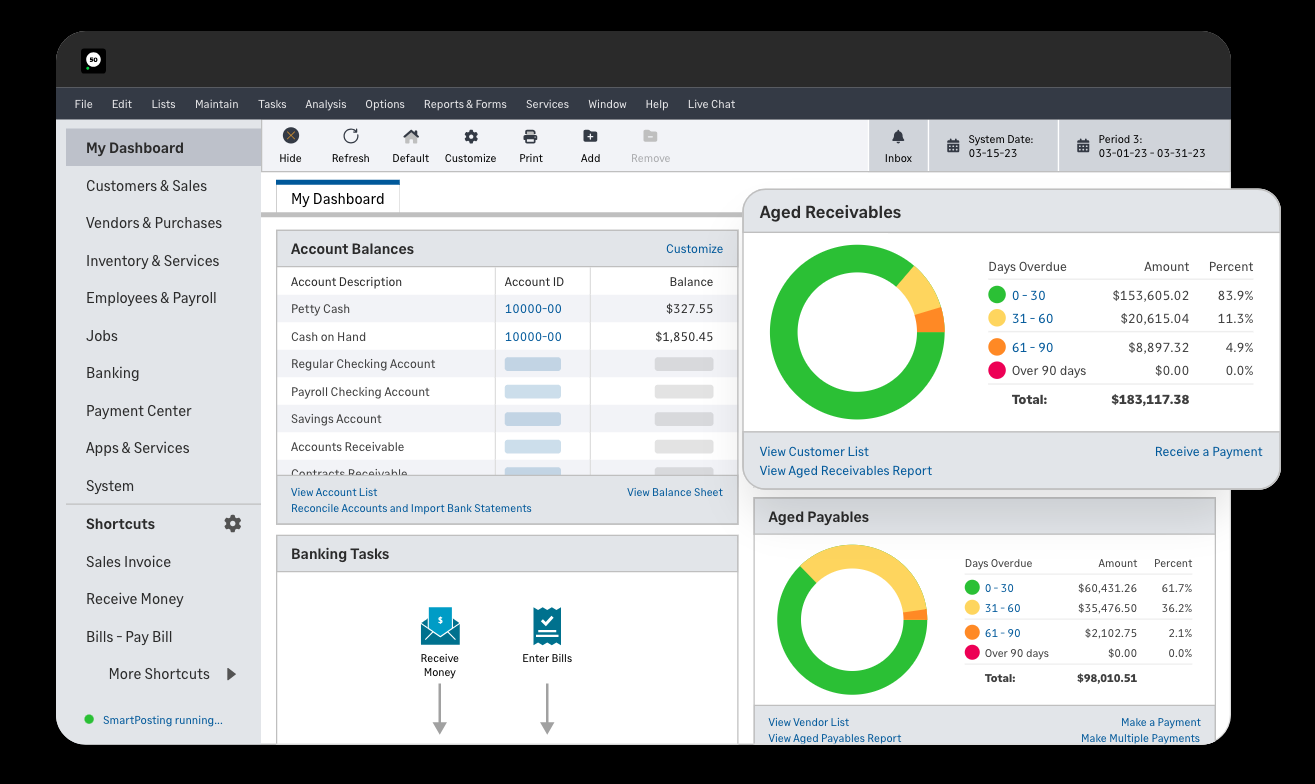

7. Sage 50

Key features

Sage 50, a desktop product with cloud connectivity, is meant for small business owners who want to take charge of their financial and inventory management. Many users consider it a particularly robust solution, thanks to its thorough reporting, inventory tracking, and tools that help small business owners take full control of their company’s finances.

Pros and cons

Pros

- It includes high-level features such as customized reports, profit tracking, and cash-flow management.

- It features native compliance tools that help prevent errors for more accurate reporting.

Cons

- It doesn’t offer a Mac version.

- It doesn’t offer a mobile app to date.

Plans and pricing

Sage 50 is more expensive than many other alternatives on this list. Its Pro entry plan begins at $58.92 per month for one user and offers a simplified set of tools aimed at smaller businesses and solopreneurs. Premium and Quantum plans are available for added features and more users, beginning at $101.92 and $172 per month respectively.

User reviews

- G2 users gave Sage an average rating of 3.8 out of five stars and more than 140 reviews.

- Capterra users gave Sage an average rating of 3.9 out of five stars and over 380 reviews.

8. Wave Accounting

Key features

Consistently ranked at the top accounting software lists for years, Wave Accounting uses double-entry accounting tools that are targeted toward small businesses. Some of the most valuable features include the ability to integrate with and sync to online bank accounts and its suitability for companies that use different currencies. It also provides a mobile app for on-the-go access.

Pros and cons

Pros

- Many features are available with the free plan.

- It offers automatic reminders for invoices.

Cons

- It offers limited customer support through a chatbot and self-service resource center.

- It offers somewhat limited customization options for invoices.

Plans and pricing

Wave offers a free Starter plan for businesses that are just starting out or in need of the basics. Alternatively, you can choose the Pro plan for $16 per month for more features, such as automatic importing of bank transactions, automatic reminders for late invoices, and the ability to offer discounted online payments to clients and customers.

User reviews

- G2 users gave Wave an average rating of 4.4 out of five stars and over 275 reviews.

- Capterra users gave Wave an average rating of 4.4 out of five stars and over 1,500 reviews.

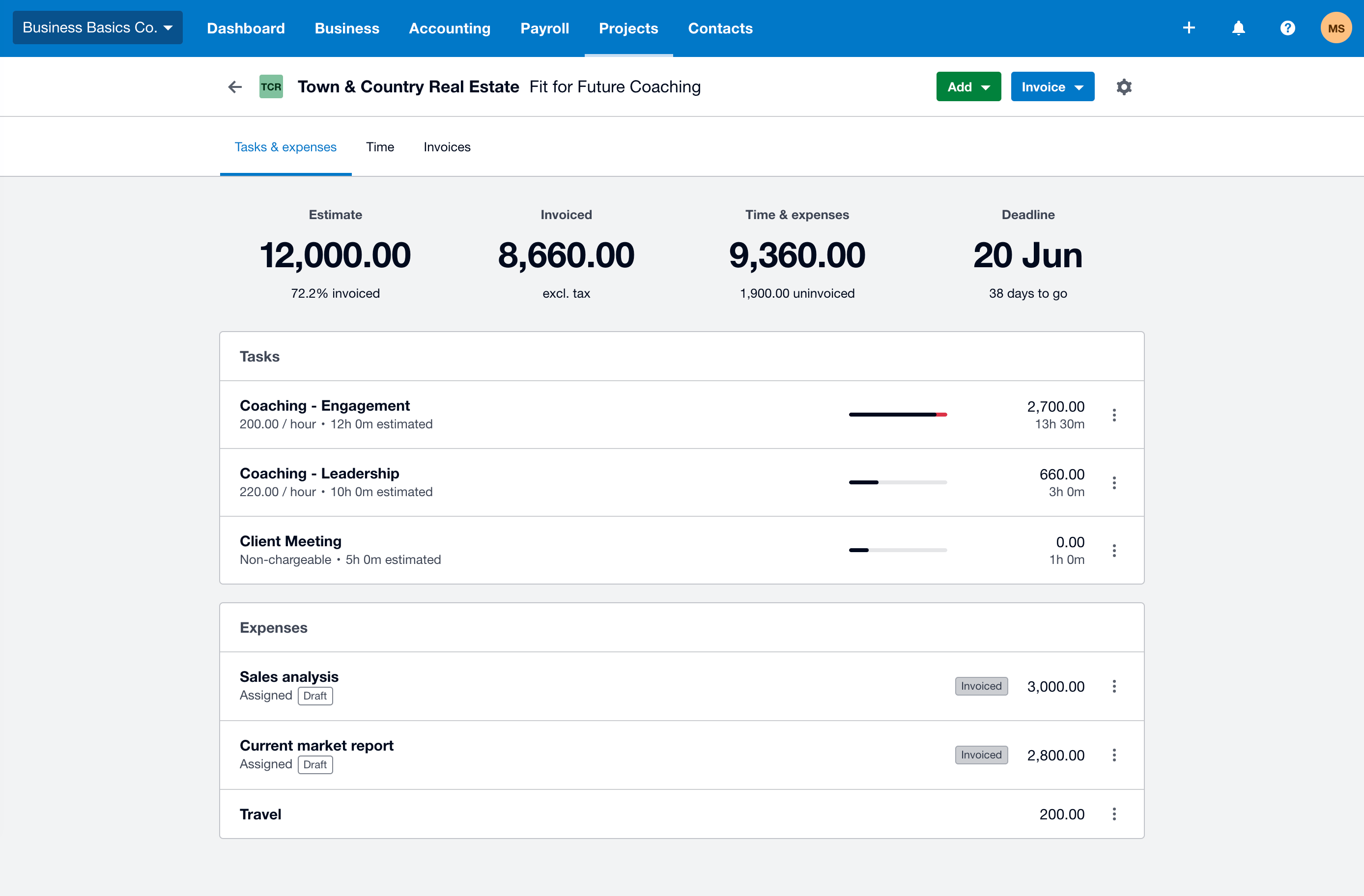

9. Xero

Key features

Interested in using AI to revitalize and streamline your business’s double-entry accounting tasks? Xero might be just the solution you need. It’s been updated within the past few years to include better tax preparation and planning support, and unlike some solutions, it offers affordable access for multiple users. Use the generous 30-day trial period to evaluate Xero’s suitability for your own company’s needs.

Pros and cons

Pros

- It offers mobile app access.

- It supports multiple currencies.

Cons

- It offers limited inventory management features.

- The navigation options can be confusing, especially for those with limited accounting experience.

Plans and pricing

For small businesses with limited invoicing needs, Xero’s Early plan at $15 per month allows 20 invoices and five bills per month. For companies that are scaling up, Xero offers the Growing plan ($42 per month, with unlimited invoicing and billing) or Established ($78 per month, which adds support for multiple currencies, among other advanced features).

User reviews

- G2 users gave Xero an average rating of 4.3 out of five stars with more than 675 reviews.

- Capterra users gave Xero an average rating of 4.4 out of five stars and more than 2,900 reviews.

10. Zoho Books

Key features

Part of the Zoho One Productivity Bundle, Zoho Books is a user-friendly, cloud-based accounting solution that offers a competitively featured free plan. It’s particularly well-suited to small and medium-sized businesses. Small business owners in particular will appreciate the customization options for invoicing. Zoho Books also allows users to link bank accounts and set up automatic categorization to simplify the process of reconciliation.

Pros and cons

Pros

- Its mobile app is highly rated.

- It offers an array of customer support options, including phone, email, and live chat.

Cons

- It only allows access to a maximum of 10 users.

- It offers fewer integrations than other tools.

Plans and pricing

For businesses with revenue under $50,000, the Zoho Books free plan offers invoice and quote creation, mileage tracking, a self-service customer portal, and more. When paid annually, the Standard plan is $15 per month, while the Professional plan is $40 per month and the Premium plan is $60 per month.

User reviews

- G2 users gave Zoho Books an average rating of 4.5 out of five stars in more than 275 reviews.

- Capterra users gave Zoho Books an average rating of 4.4 out of five stars with 620-plus reviews.

Photo by cottonbro studio

Send Comment: