Best 9 payroll apps for small businesses

Managing payroll is a crucial aspect of running a small business, but it involves more than just calculating wages. Accurately tracking hours, managing tax deductions, and ensuring timely payments are all essential components of the payroll process.

A payroll app simplifies these tasks, making it easier for small business owners to manage payroll in less time. Follow along as we discuss why using a payroll app is vital and how to choose the right one. We’ll also review some of the top payroll apps available today.

Reasons to use a payroll app for your small business

Using a payroll app for your small business improves the efficiency and accuracy of payroll processes. These apps automate repetitive payroll tasks, reducing human error and ensuring consistent calculations for wages, taxes, and deductions. Not only will you maintain sound financial practices but you’ll also free up time to focus on growth and other key areas of your business.

Moreover, payroll apps help you comply with evolving tax laws and labor regulations by providing timely updates. Their cloud-based nature also enhances accessibility, allowing business owners and employees to access payroll information from any device, anywhere.

Tips for choosing the right payroll app

When selecting a payroll app for your small business, consider the following factors:

- Ease of use: The app should have an intuitive interface that’s easy to use without extensive training.

- Features: Look for features that match your business needs, such as direct deposit, tax filing, employee self-service options, and integration with accounting software.

- Customer support: Reliable customer support is crucial, especially when dealing with sensitive payroll issues while meeting deadlines.

- Cost: Evaluate the pricing plans to fit your budget. Some apps offer tiered pricing based on the number of employees you have, which can benefit smaller firms.

- Scalability: Choose an app that can grow with your business so you can add features and handle more employees as needed.

Top payroll apps for small businesses

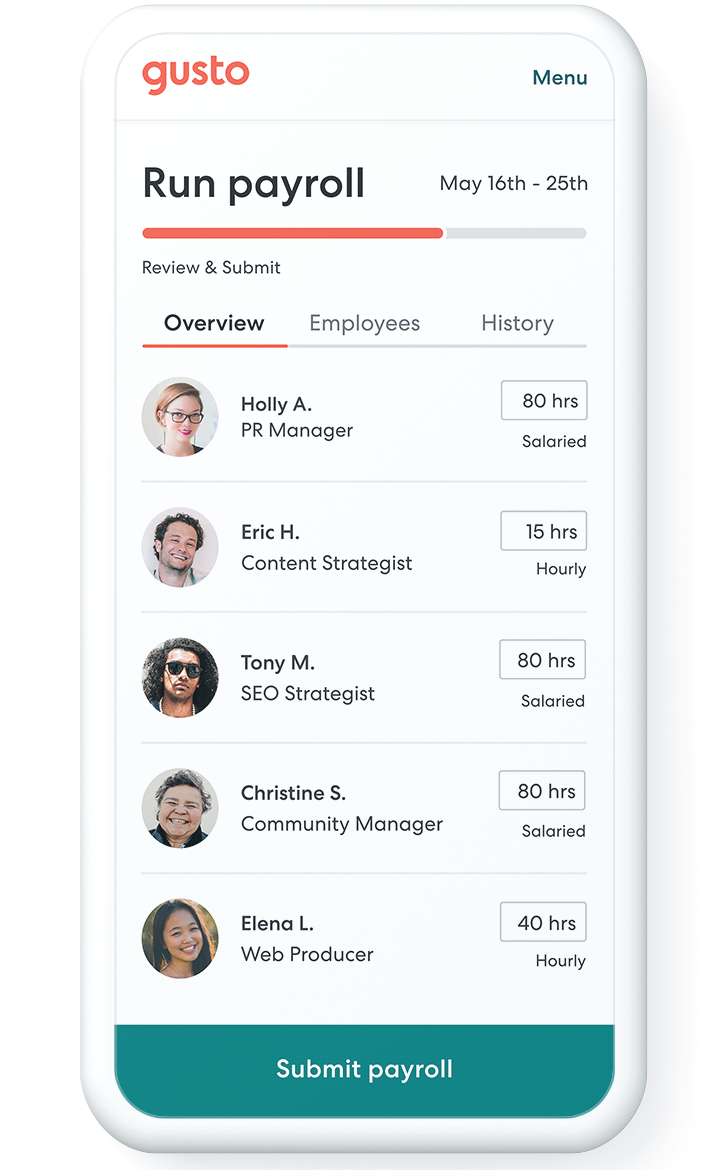

1. Gusto

- Key features: Full-service payroll features, benefits administration, employee self-service portal, time tracking

- Pros: Easy-to-use tool, comprehensive HR features

- Cons: Pricier option for large teams

- Plans/pricing: Starting at $40 per month, plus $6 per employee per month

- Available platforms: Web (for payroll administrators); iOS, Android (for employees)

- Ratings: 4.8 on App Store, 4.4 on Google Play

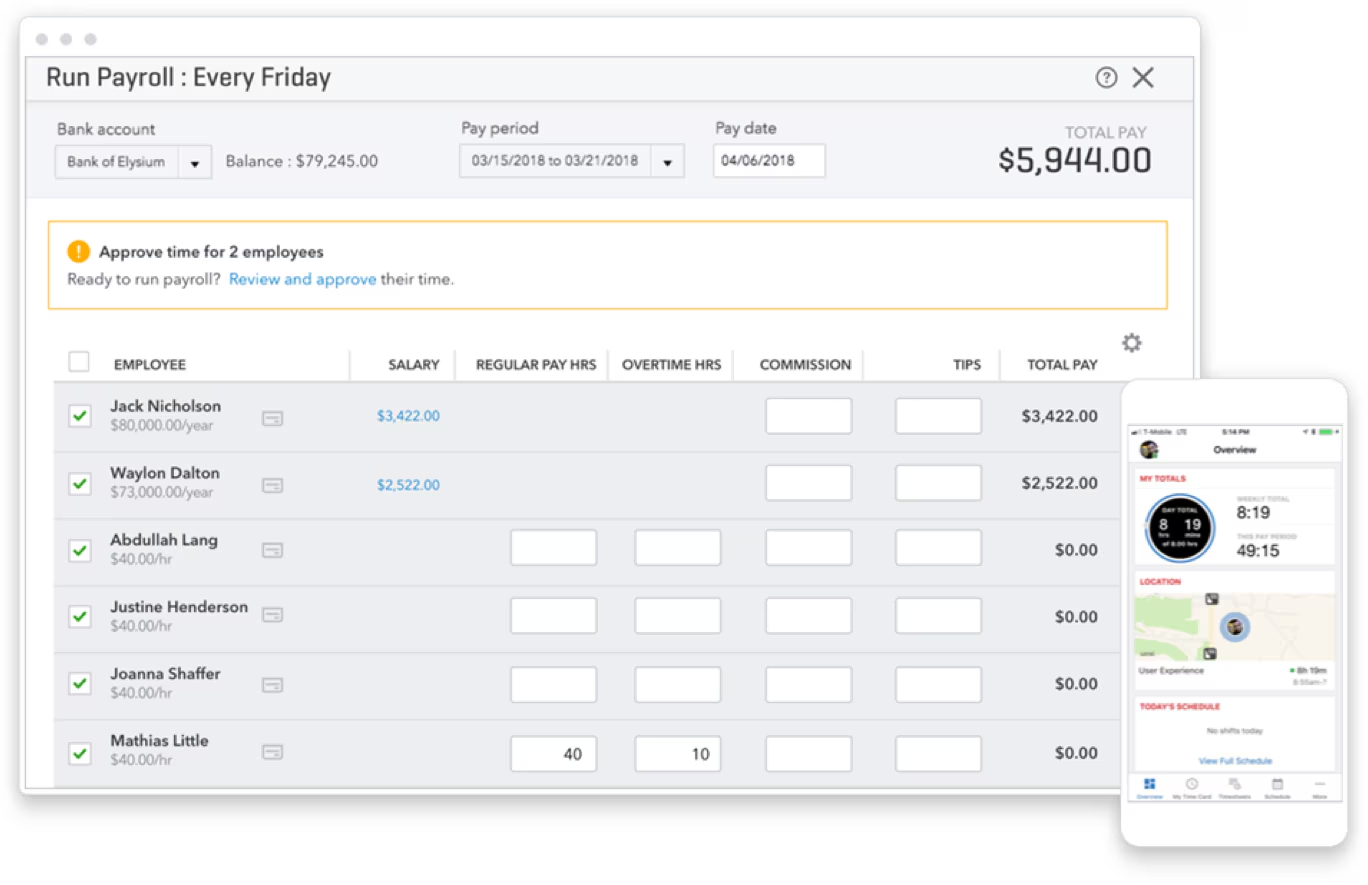

2. QuickBooks Payroll

- Key features: Automatic payroll runs, tax penalty protection, comprehensive bookkeeping

- Pros: Seamless integration with QuickBooks, excellent customer support

- Cons: Best with commitment to the QuickBooks ecosystem (and potentially expensive with add-on features)

- Plans/pricing: Starting at $45 per month plus $6 per employee per month

- Available platforms: Web, iOS, Android

- Ratings: 4.6 on App Store, 4.4 on Google Play

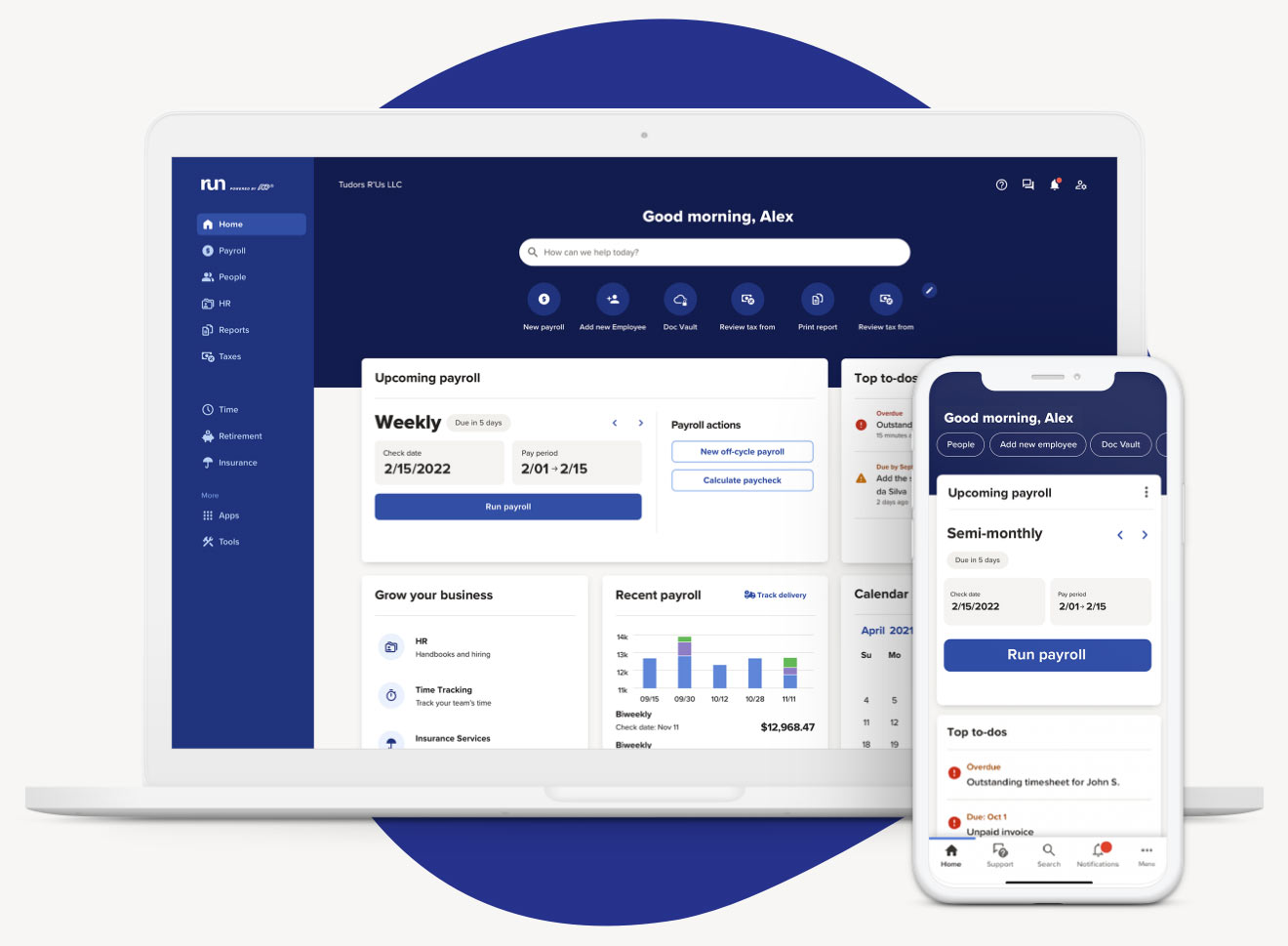

3. RUN powered by ADP

- Key features: Payroll processing, tax filing, employee access, and self-service features

- Pros: Scalable solutions, robust reporting

- Cons: Higher cost when including add-on features

- Plans/pricing: Custom pricing based on business needs

- Available platforms: Web, iOS, Android

- Ratings: 4.9 on App Store, 4.9 on Google Play

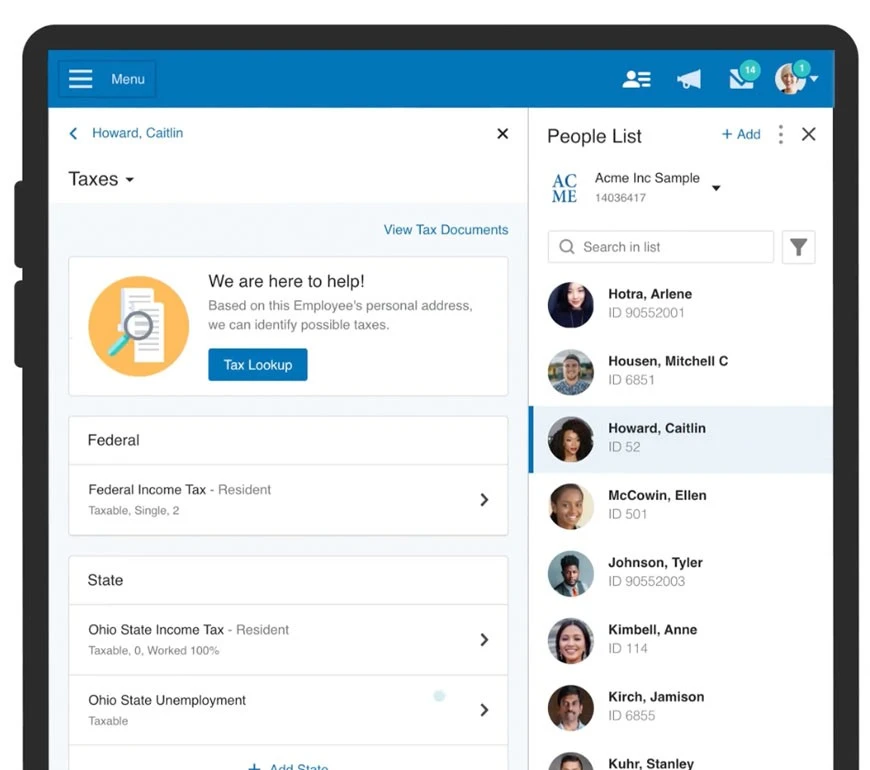

4. Paychex Flex

- Key features: Payroll and tax services, benefits administration, HR services

- Pros: Flexible plans, robust customer support

- Cons: Pricing is only available upon request.

- Plans/pricing: Available upon request

- Available platforms: Web, iOS, Android

- Ratings: 4.8 on App Store, 4.5 on Google Play

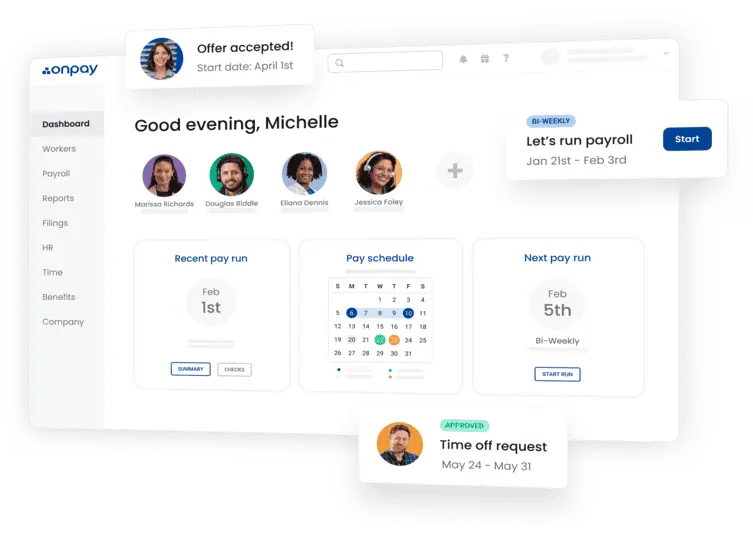

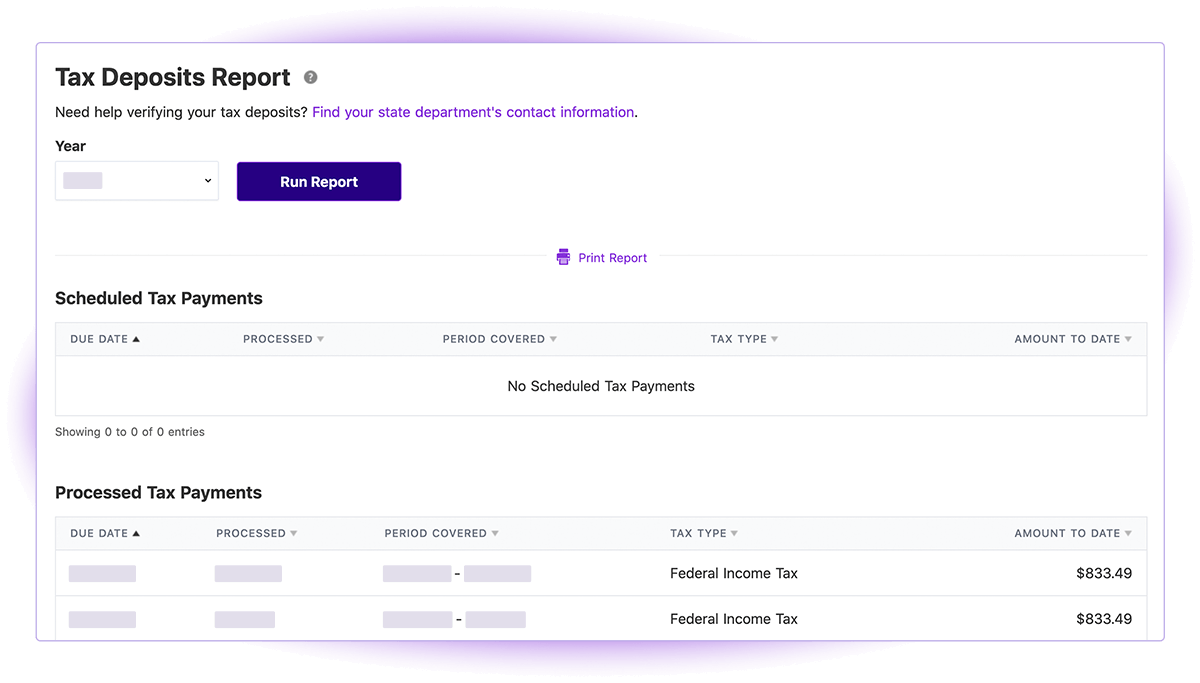

5. OnPay

- Key features: Full-service payroll services, 401(k) retirement management, benefits management

- Pros: Extensive resources, easy setup

- Cons: Poor reviews for mobile apps

- Plans/pricing: Starting at $40 per month, plus $6 per employee per month

- Available platforms: Web, iOS, Android

- Ratings: 1.7 on App Store, 2.5 on Google Play (4.8 overall rating on Capterra)

6. Patriot Payroll

- Key features: Full-service payroll services, tax-filing services, time and attendance tracking

- Pros: Cost-effective option, user-friendly interface, straightforward pricing structure

- Cons: The mobile app is focused on allowing hourly employees to fill out timesheets, not on payroll administration.

- Plans/pricing: Starting at $17 per month plus $4 per employee per month for basic payroll

- Available platforms: Web, iOS, Android

- Ratings: 5.0 on App Store, 4.5 on Google Play

7. Wave Payroll

- Key features: Payroll processing, tax-filing services, automatic payroll journal entries, workers’ compensation management

- Pros: Integrated with Wave’s accounting software, detailed reports, reliable tool

- Cons: No time clock feature, need for additional filing options

- Plans/pricing: From $20–$40/month (depending on which state your organization is located) plus $6 per employee

- Available platforms: Web, iOS, Android

- Ratings: 4.4 on App Store, 3.5 on Google Play

8. TriNet

- Key features: Payroll administration services, HR outsourcing, time and attendance tracking

- Pros: Comprehensive HR suite, in-depth tax and compliance specialist guidance

- Cons: The most expensive option on the list

- Plans/pricing: $33 per month per employee

- Available platforms: Web, iOS, Android

- Ratings: 4.8 on App Store, 2.4 on Google Play

A powerful option for creating your own payroll app: Jotform Apps

What if you want an app that you can customize to your needs without any coding skills? With Jotform Apps, creating, customizing, and updating your app is as simple as dragging and dropping elements across the screen.

Or you can choose from our ready-to-use app templates and customize them to include specific payroll features. By combining different Jotform products and features, you can create a customized payroll app tailored to your business needs. Here are just a few things you can do with your custom payroll app:

- Track payroll information. Use the Jotform Tables payroll template to track hourly rates, tax rates, and deductions.

- Submit payroll information. Use Jotform’s form templates to submit payroll information to processing companies.

- Collect employee tax information. Gather tax information with W-4 forms and W-9 forms for employees and contractors.

- Gather e-signatures. Seamlessly collect e-signatures with Jotform Sign.

- Upload important files securely. Enable employees to upload necessary documents easily with file upload forms.

Choosing the right payroll app is essential for managing your small business effectively. The right app can save time, ensure accuracy, and help you comply with tax laws. Whether you choose a dedicated payroll app or create your own with Jotform’s versatile tools, investing in the right solution will pay off in the long run. Why not try Jotform for free today and see what’s possible?

Photo by Priscilla Du Preez 🇨🇦 on Unsplash

Send Comment: