6 of the most popular NFC payment apps

You’ve no doubt heard about NFC payment apps like Apple Pay. But as a merchant, you need to stay on top of your customers’ favorite payment methods and accommodate them as best you can. In case you aren’t aware of the other NFC payment apps you could be offering, take a look at the list below, which includes the most popular ones currently on the market.

6 of the most popular NFC payment apps

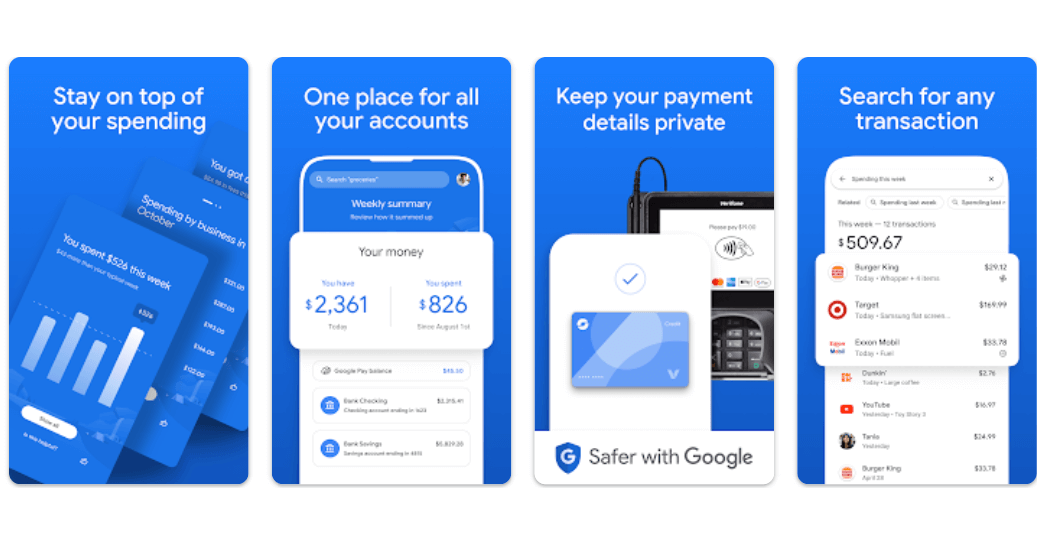

1. Google Pay

Google’s reach goes far beyond search — it extends to phones, online ads, and apps like Google Pay, which facilitates online, in-store, and person-to-person payments.

Google Pay works on Android and iOS devices as well as the web. “It uses a token system that adds an extra layer of security,” says Brian Crane, founder of Spread Great Ideas. “The system substitutes actual card data with encrypted, virtual data. In addition, Google Pay offers gift cards and loyalty programs.”

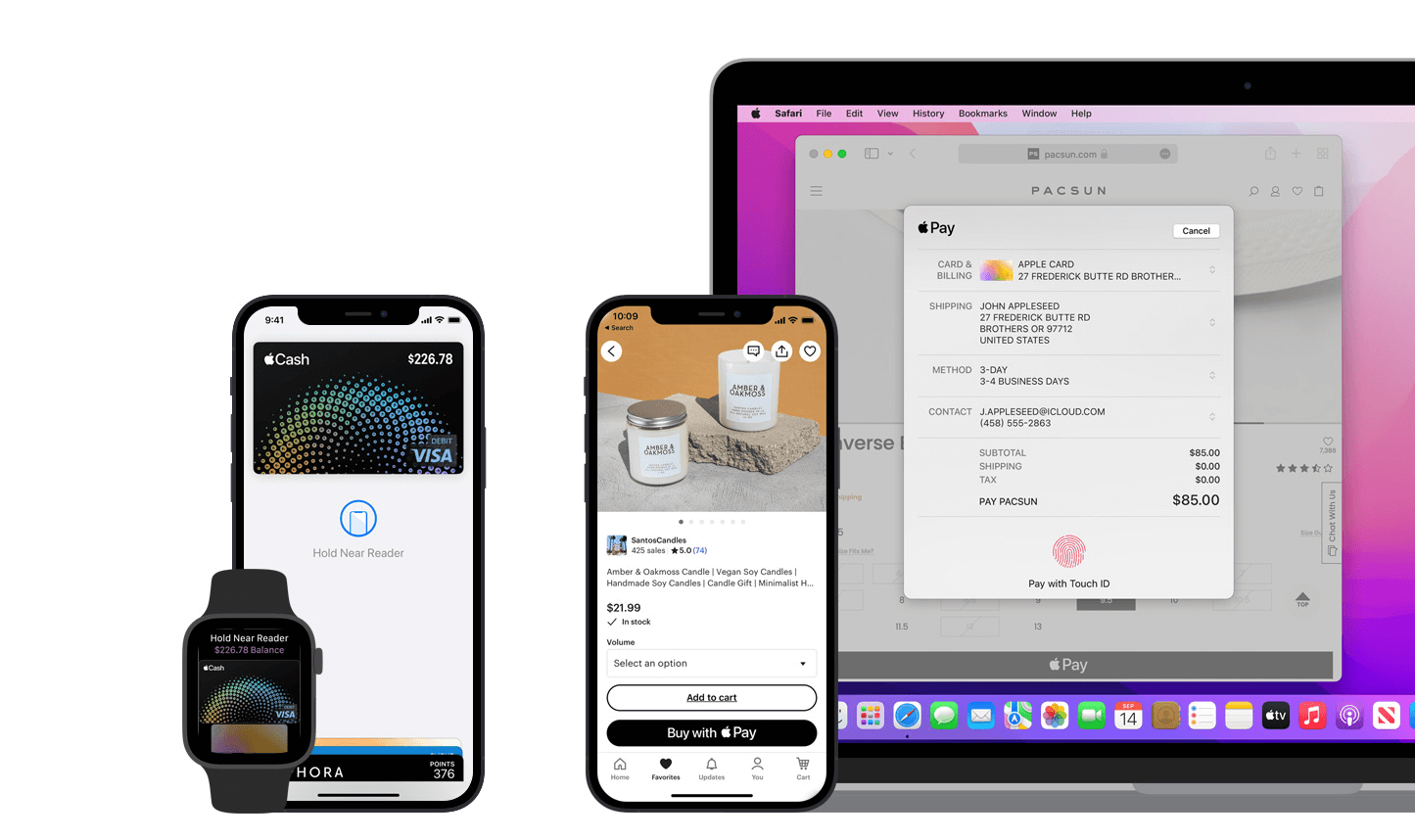

2. Apple Pay

“Apply Pay may be limited to iPhone users only, but the host of features it provides makes it a great choice in NFC payment apps,” says Crane. Like Google Pay, it uses a tokenization system that keeps credit card details private and encrypted. “The app also offers customers high-reward credit card options, and it can be used to get discounts on movie tickets and other third-party purchases.”

No wonder it’s such a popular option among payment apps. And with so many users, any merchant that offers it in their stores is making a smart move.

3. Samsung Pay

Like Apple Pay and Google Pay, Samsung Pay uses a tokenization system. It’s now part of the Samsung Wallet app. Many Samsung phone owners make use of the app, especially as it provides other benefits such as cash back when shopping with certain merchants.

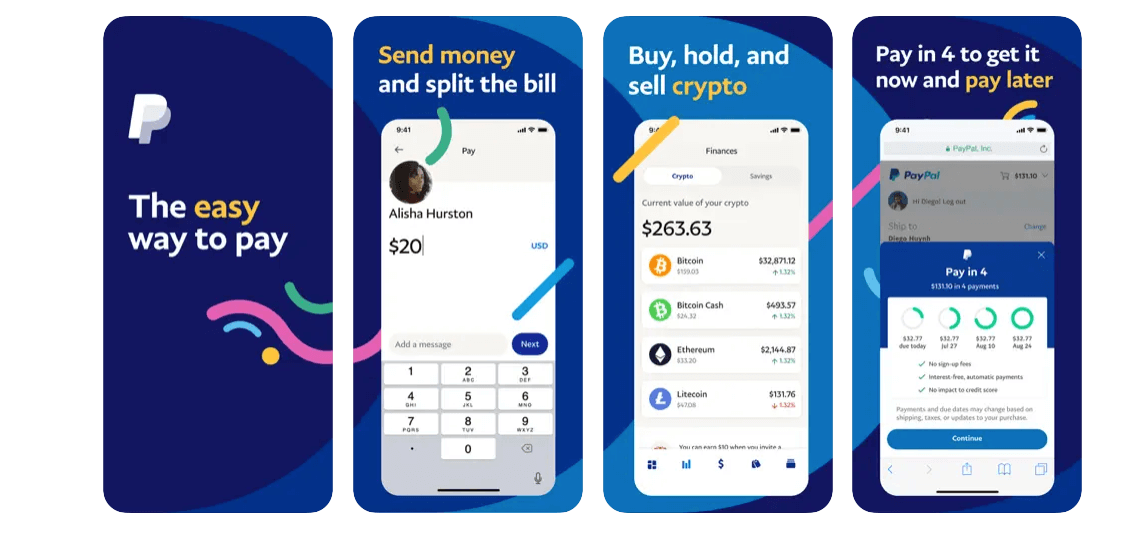

4. PayPal App

Crane says PayPal is already a big player in international money transfers, along with being convenient and easy to use. “Its robust and efficient security protocols for these transfers — in addition to its core competencies in peer-to-peer payments and online purchases — also makes it a safe choice as a payment app.”

But if customers want to use PayPal in a store with NFC, they’ll have to either make use of its contactless payment card or connect it to their Google Pay account and use PayPal as one of the payment methods. This is useful information to know if an uninformed customer shops at your store — you could not only ensure the sale but also foster goodwill and loyalty.

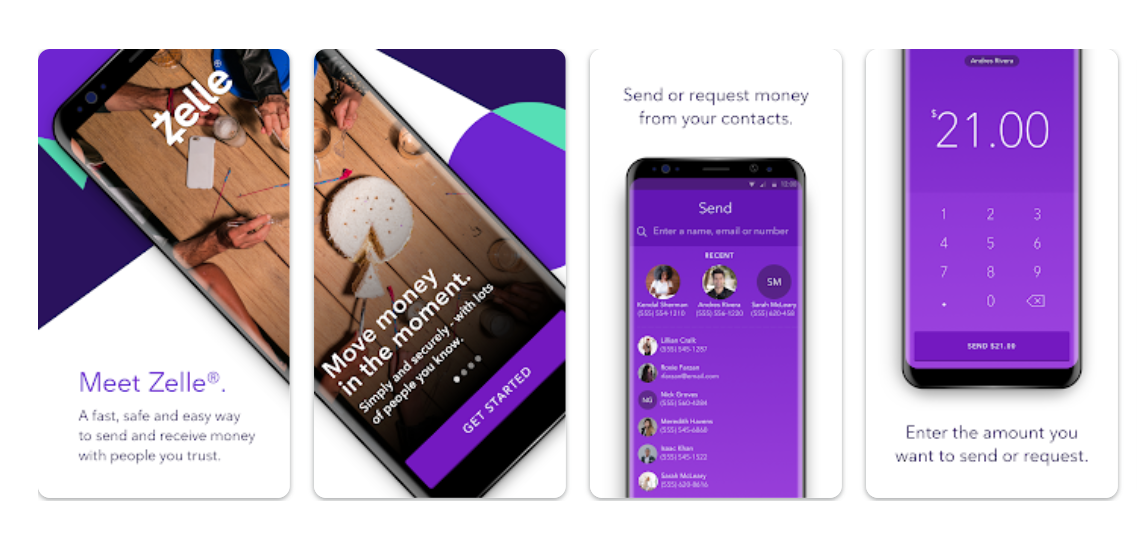

5. Zelle

“Zelle is considered one of the simplest ways to send money, as it sends money straight to your bank account with one click,” says Crane. “The best thing about it is that customers don’t need a different app — it works inside most bank applications. There are also no fees for sending payments.”

6. Venmo

Crane says Venmo is another popular and effective platform for making payments, especially mobile-centric payments. “The ease of use is appealing when sending and receiving money. Plus, it has low transaction costs.”

Like PayPal, customers will need to use a contactless card to pay in stores. Alternatively, they can make use of a QR code that you’ve set up and placed near the register.

Behind the scenes: What’s happening when your customers use NFC payment apps?

Near field communication (NFC) is short-range wireless technology found in devices such as speakers, tablets, gaming consoles, and smartphones that enables quick data transmission between compatible devices.

“NFC is based on radio frequency identification, or RFID, a technology that’s been around for decades,” says Matt Hudson, a longtime programmer and founder of the mobile app development platform BILDIT. “Except NFC requires that you be really close and only be transmitting a small amount of information between devices.”

Given these limitations, it’s no surprise that NFC is commonly used in smartphones to make mobile payments. As Crane adds, “In a mobile payments context, NFC enables a phone and a payments terminal to communicate with one another when in physical proximity.” This allows people to send or receive payments in real time.

Hudson notes that while NFC technology has made good progress with its expansion into payment applications, the hardware we use for NFC in the U.S. still has some room for improvement. “If we compare the typical payment terminal in the U.S. to some other countries, its counterparts tend to transmit a clearer signal and work faster. Still, the terminals we do employ offer consumers and businesses a ton of convenience.”

An enhanced payment experience with Jotform

Thousands of merchants use Jotform, a powerful online form builder, to collect information and payments from customers. It’s simple to build a seamless checkout experience using one of our 800+ customizable order form templates and then integrate the form with Google Pay, Apple Pay, Venmo, PayPal, or a number of other payment processing options.

Photo by Blake Wisz on Unsplash

Send Comment:

1 Comments:

More than a year ago

I want to hook up Google pay