Today’s business climate can be chaotic. Supply chains break, shipping options suddenly freeze due to accidents or weather, and even regular customers are happy to shift loyalties to save some money.

With this type of uncertainty as the norm, companies and their leadership are eager to find technological solutions that can save time and effort. Accounting and bookkeeping tasks are often ideal candidates for optimization and streamlining — if you have the right tool.

NetSuite and QuickBooks are two of the most popular software options for financial management and data tracking. Both of these platforms offer a wide range of tools and functions that will help you maintain firm control over your corporate finances.

However, they’re different from each other in a number of important ways. One is limited in its scope related to finance, while the other offers a far broader business management experience for its users. But is that wider scope really useful to your company, or would you simply be paying more for functionality you don’t really need?

Read on to learn more about both NetSuite and QuickBooks, what they share in common, how they differ, and how to evaluate both.

NetSuite overview

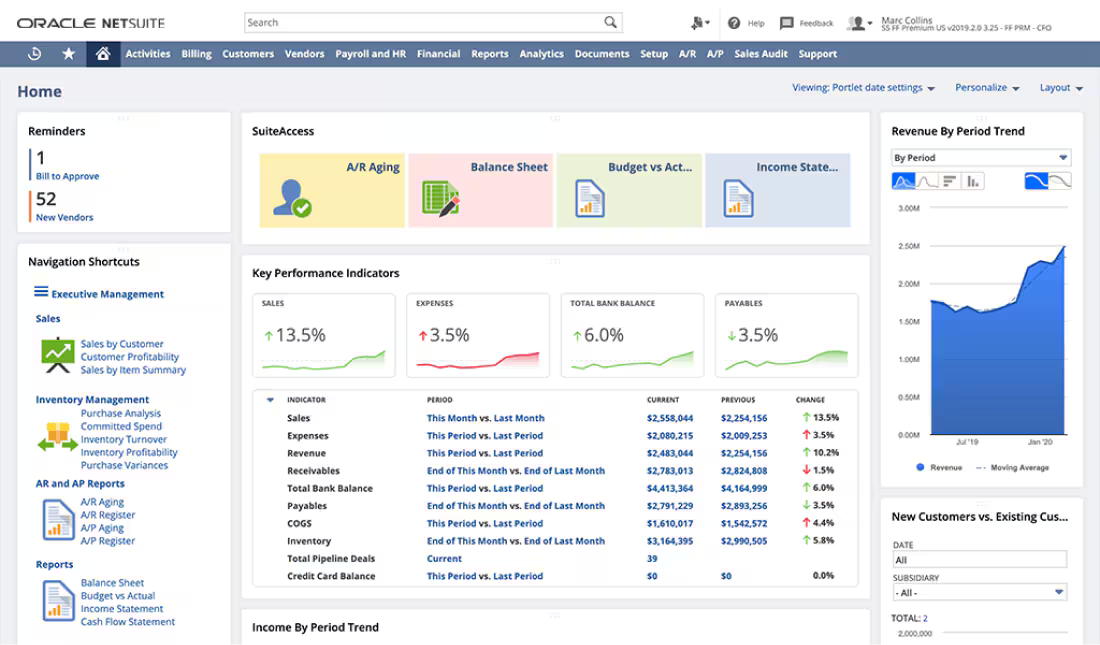

NetSuite is a software as a service (SaaS) platform that provides users with a wide variety of business and finance management tools. With a number of modules and a variety of customization options, NetSuite remains a versatile and powerful solution for businesses in any niche and of any size.

Now a subsidiary of Oracle, NetSuite has been around since 1998. In fact, it was one of the first software companies to adopt the use of cloud technology. Currently, it enjoys a four-star (out of five) average rating on G2 from over 3,200 users. Reviewers praise NetSuite for its ease of use and customization, among other things, while also commenting that it has a significant learning curve.

QuickBooks overvie

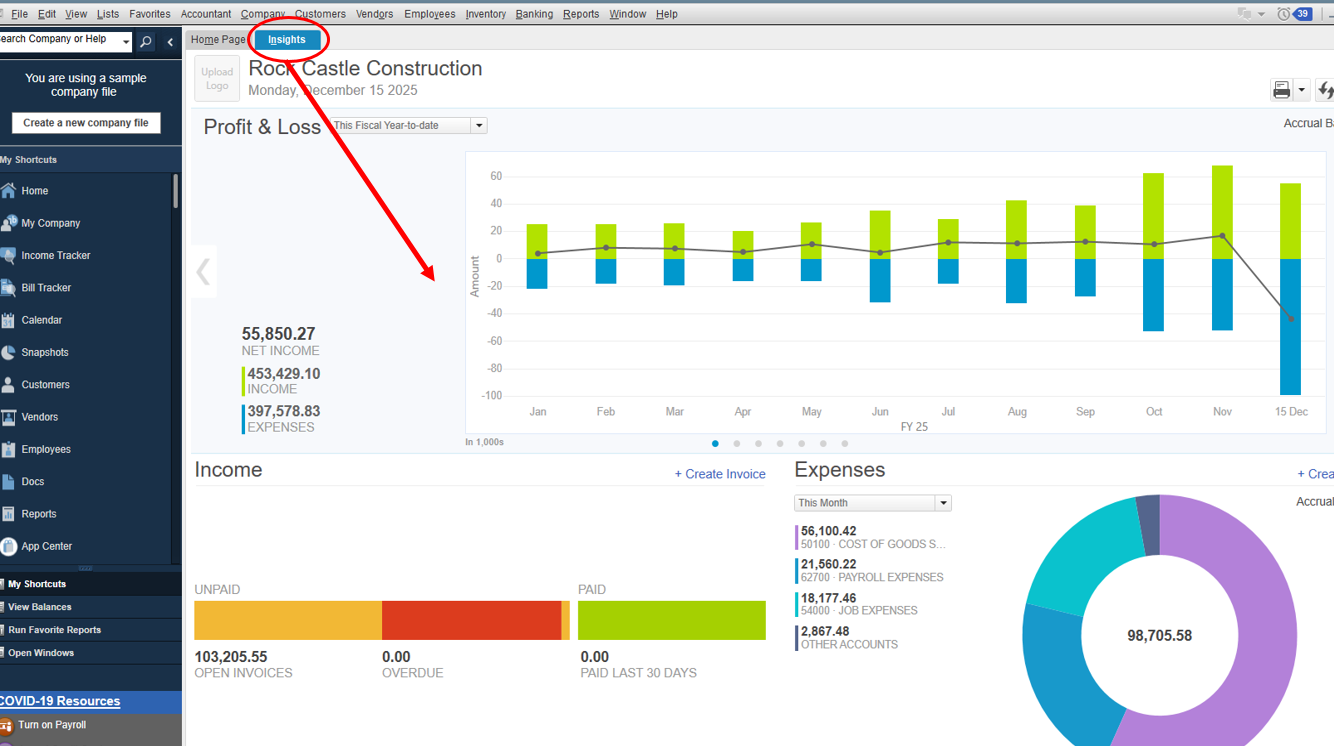

The QuickBooks suite, also an SaaS product, offers robust money management tools for businesses of all sizes. Users rely on QuickBooks for a plethora of business finance functions, including bookkeeping, accounting, payroll and payroll tax filings, expense and inventory management and other similar functions.

QuickBooks, an Intuit product, offers versions for several different languages and geographic regions. Currently, QuickBooks holds a four-star rating on G2, where over 3,000 reviewers praise QuickBooks for its ease of use, cloud-based structure, and accessibility. Some users also express dissatisfaction with its customer support.

Target audiences

Both NetSuite and QuickBooks are aimed squarely at the business market, targeting companies of all sizes and in just about any niche. If you’re in a highly specialized industry, carefully evaluate both programs before making a final decision.

Key features of NetSuite

As a cloud-based enterprise resource planning (ERP) platform, NetSuite goes well beyond a financial accounting solution with its robust functionality as well as customizable add-on modules. Some of NetSuite’s key features include

- Payroll management tools

- Customer relationship management (CRM) tools

- E-commerce tools

- Tax management tools

- Add-on modules that allow for greater functionality, including human resources management, demand planning, contract management and renewals, fixed assets management, and more

Key features of QuickBooks

Some of the key features of QuickBooks include

- Several customer service options, including phone and chat access, plus a wide assortment of tutorials and self-service support resources

- Customized reports to see invoicing, expense, and other data more clearly

- Significant scalability, meaning that your QuickBooks access and use can grow as your company does

- Shareability with outside vendors and providers, such as accounting or bookkeeping contractors

- Access to more than 700 integrations, including shopping platforms such as Etsy, payroll systems, and more

Common features of NetSuite and QuickBooks

Despite the differences in scope and customization, both NetSuite and QuickBooks provide full-featured solutions for business bookkeeping and accounting. While QuickBooks is a somewhat simpler program, that’s due mostly to its tighter focus on financial management and NetSuite’s status as a diversely featured ERP.

Both programs are built on a SaaS or subscription model. They also offer tools for business users to manage invoicing, payroll management, and mileage tracking. Both also offer tax reporting features. You can use either program to manage cash flow, project budgets and profitability, accounts receivable, accounts payable, and payments to vendors and clients or customers.

Finally, both NetSuite and QuickBooks provide access to time tracking, employee shift and time-off management, and payroll processing.

Pricing and plans: NetSuite vs QuickBooks

Most business users realize that evaluating any new technology solution solely on the basis of price can lead to problems. However, it’s never wise to completely ignore the financial ramifications of any new software purchase or subscription. It’s important to be aware of both your budget and the costs, both explicit and hidden, of any business expense.

NetSuite’s pricing and plans

NetSuite doesn’t disclose set pricing plans. Instead, you’ll need to schedule a consultation with its sales department to receive a quote. Pricing includes a per-user fee in addition to a recurring annual fee for licensing the software.

QuickBooks pricing and plans

QuickBooks offers four plans:

- Simple Start: This tier offers expert tax assistance, income and expense management, invoicing and cash flow management, and other functions for $30 per month.

- Essentials: In addition to basic tools in Simple Start, Essentials includes two additional sales channels, three authorized user accounts, and the ability to track time entries and manage multiple currencies for $60 per month.

- Plus: This tier delivers everything in Essentials plus two additional user accounts, inventory management tools, project profitability, and assistance with financial planning for $90 per month.

- Advanced: The highest tier includes all features from other plans, access for up to 25 users, workflow automation tools, employee expense tracking and management, data restoration, and access to around-the-clock support for $200 per month.

NetSuite vs QuickBooks: A side-by-side comparison

Use this table to evaluate the two platforms side-by-side:

| Feature | NetSuite | QuickBooks |

|---|---|---|

| Target audience | Businesses of all types and sizes, though it may offer more than small businesses or solopreneurs need | Businesses of all types and sizes, though it may be better suited for small businesses or solopreneurs |

| Integration options | Customization through dozens of modules aimed at specific tasks or functions | Ability to integrate with over 750 different SaaS platforms and apps |

| Pricing | Undisclosed, consultation required for quote, no free trial | Between $30 and $200 monthly, depending on which of four plans you select; 30-day free trial |

| Scalability | Highly scalable solution, ability to choose additional modules and/or more users | Highly scalable solution, ability to choose the next plan up as your company grows |

| Scope of features | A more comprehensive business platform offering features for a wide variety of needs, from CRM to ERP solutions | A complete business financial management platform offering accounting and bookkeeping tools |

| Customer service | Support by phone, online tickets, and a searchable knowledge base; no live chat available | Support by phone, web chat, community forum, and a resource library; access to 24-7 support from experts for Advanced users |

Jotform: A great NetSuite and QuickBooks alternative

We’ve taken an analytical look at both QuickBooks and NetSuite and learned more about how these platforms help businesses manage their financial position. Jotform is a highly customizable alternative to these two solutions, whether you’re more interested in ERP functions, bookkeeping software, or both.

Jotform’s adaptability and advanced feature set mean it can perform several functions as an alternative to these platforms. It’s a robust and versatile form builder, which makes it a versatile solution for different needs. If you need a CRM solution, you may find Jotform Tables helpful. Many users rely on Jotform Tables as a CRM tool.

You can collect information with lead generation forms and contact forms, and you can use Jotform Tables to organize, analyze, and manage the contact information you collect from your clients or leads. You can even create visual reports to have a better overview of your key marketing and sales data. And with Jotform Approvals, you can also create an enterprise resource planning (ERP) workflow.

For your bookkeeping needs, Jotform’s expense tracking forms and invoice templates can make bookkeeping tasks easier. Use the online invoice generator to keep your invoicing workflow centralized.

Jotform also easily integrates with other platforms to fit existing workflows. You can integrate Jotform with several CRM tools, and if you want to use Jotform together with QuickBooks or NetSuite, take a look at Jotform’s native QuickBooks integration and NetSuite integration.

NetSuite vs QuickBooks: The right solution for your needs

Choosing a new technology or software platform for a growing company can be an overwhelming experience. It’s often hard to discern which set of tools, which approach, and which UI/UX (user interface/user experience) is the right choice for your team.

When it comes to solutions for finance and operations management, those decisions can get even more complicated. Each company must analyze any software decision and evaluate the available options against its budget, specific needs, expansion plans, and other features unique to it.

Another crucial step in making smart tech decisions for your company depends on practical experience with the tool in question. Here, QuickBooks offers a free trial, so you can evaluate its user-friendliness, scope, and performance. While NetSuite doesn’t have a free trial period, you can test its suitability for your company through a scheduled demonstration and online reviews.

In either case, go into your evaluation process with a list of your business’s needs, wants, and limitations, so you can check each factor off as you go.

Photo by Karolina Kaboompics

Send Comment: