The COVID-19 pandemic has sent shockwaves through our working lives, and its impact is showing up in new ways — like how workers are reevaluating their lifestyles. In 2018, the number of job seekers who were moving for work dipped to an all-time low. But by October 2020, Upwork estimated that 14 to 23 million people were planning to move thanks to a rise in remote work, which allows people the flexibility to work from anywhere.

However, opportunities are constantly shifting, and plenty of people are moving toward jobs as well. Cities such as Topeka, Kansas, and Savannah, Georgia, are offering cash incentives for incoming remote workers, while cities like Miami are welcoming an influx of new companies.

After all, while remote work is cheaper, some industries simply need people together in a physical space. And although many employers may be willing to accommodate remote workers for now, they might want them to come to the office in the future.

That’s why it’s important for business owners to revisit their policies on moving expense reimbursement. If your expense approval processes are still manual — or if you haven’t decided what kinds of moving expenses you’ll repay employees for — you need to prepare for continuing upheaval in hiring trends as qualified workers continue to move around the country.

Moving expense basics

Deciding to offer moving expense reimbursement to new employees shows that you care about their success and you’re willing to lay out the cash to prove it. It also makes you more attractive to other potential employees and raises your industry profile.

These are some basic moving expenses you can consider reimbursing either fully or partially:

- Moving company services

- Transportation, including tolls and gas

- Packing supplies

- Storage

- Meals

- Shipping of personal items and household goods

- Travel to a new location

- New car registration

- Hotel stays during relocation

- Car rentals or airplane tickets

- Pet transportation and lodging

- Miscellaneous expenses related to home buying, such as closing costs

Types of reimbursements

Some companies offer relocation bonuses as an incentive to move or include them as part of relocation packages with a variety of other perks. However, any bonuses related to relocation actually count as employee income, and the IRS will tax employees for that, thanks to the 2017 Tax Cuts and Jobs Act. To make the package more palatable to new employees, businesses may choose to adjust lump sum amounts to cover taxes, a practice known as “grossing up.”

Still, most finance departments may stick to simple moving expense reimbursement processes — where employees submit a claim (sometimes with receipts) and the employer pays them back according to its relocation policies. Reimbursements are a straightforward way of covering expenses, and they’re flexible enough for employers who also want to cover the taxes employees will incur.

No matter the intricacies of your reimbursements, it’s worth revisiting your business relocation policies to increase your business’s resilience to economic changes. Here’s a case in point: Employees will once again be able to deduct moving expenses when the 2017 Tax Cuts and Jobs Act expires in 2026.

The moving expense approval process

To efficiently reimburse employees for their moving expenses, you need an organized approval workflow in which various stakeholders review and approve an expense reimbursement form. Follow these steps to set one up.

Write or update policies

Moving expense reimbursement policies clarify what moving expenses the company will cover, any caps on that coverage, and deadlines for submitting claims. These rules empower reviewers to make the right approval decisions and provide clarity to new, relocating employees.

For example, if you cap meal coverage at $50 per day, a human resources professional can effectively approve the form or send it back to the future employee for adjustment without having to spend time double-checking with a manager.

After you define which relocation categories you’ll cover with your policy, you’ll be better able to design reimbursement forms for new employees to submit their claims.

Assign form approval responsibilities

The approval form will go from the employee to your team, starting with a human resources employee. It may go to the assistant manager of human resources, who approves the amount and then forwards it to the accounting department for final approval. Or if your business is smaller, the form might go to one human resources professional and then straight to the financial officer.

However you decide to arrange the form’s route through your company, make sure to keep the process simple and the number of steps to a minimum. You don’t want too many people approving forms, and you don’t want managers bogged down with multiple forms to approve. Keeping the process as easy to complete as possible is the key to an efficient approval workflow.

Automate approvals

Once employees know the policies and who receives forms, it’s time to automate the process with software.

In the modern workplace, even a small organization has a hard time justifying the use of slow, manual processes, which involve tracking down lost emails, chasing down managers for approvals, and correcting numerous mistakes, which create reimbursement delays. Multiple Microsoft Word copies of reimbursement forms, for example, can quickly become disorganized.

The solution is to use highly adaptable software that integrates with your accounting systems. These programs automatically enforce policies while protecting your budget.

An electronic approval system is faster to complete, easier for employees to follow, and transparent enough to require only minimal managerial oversight. When your process is faster, you can distribute reimbursements promptly, making for happy employees.

Use Jotform to speed up approvals

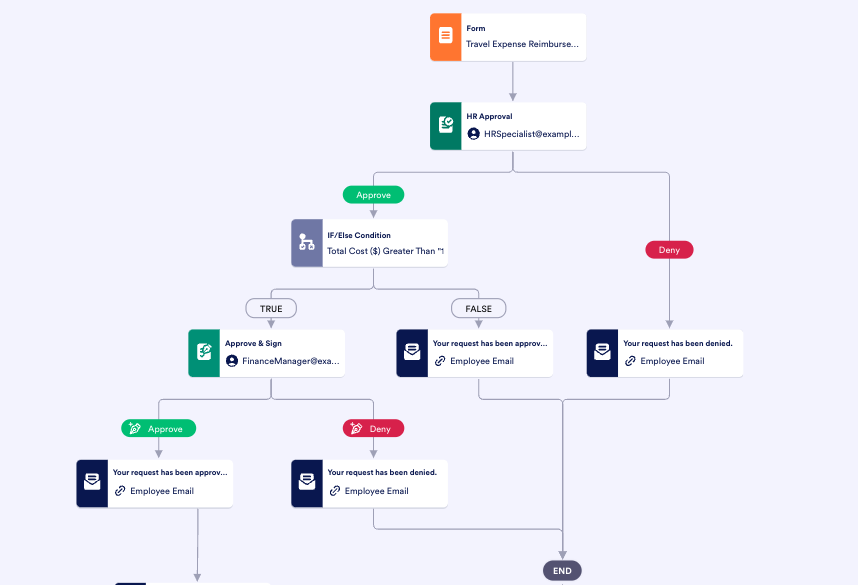

While it’ll take time to refine your policies and approval workflow, a good approval platform is pivotal to making this time worth the effort. With Jotform Approvals, you can build a workflow by simply dragging and dropping approvers and forms. You can also create parallel routes defined by if-then conditions.

Form submissions are accessible in one place with Jotform Tables or Jotform Inbox, allowing you to organize and display data and better track your budget.

As for the forms, Jotform offers many expense form templates, which you can customize to include as many fields as you need. Plus, multiple integrations increase the forms’ functionality and make them even easier to use by allowing you to, for example, attach digital receipts. And new employees can fill out moving expense reimbursement forms on any device or on the go with the Jotform Mobile Forms app.

Attracting new employees during and after the pandemic may require your organization to rethink its processes. Applying innovative thinking to your expense reimbursements for new employees moving closer to your business will keep these new team members happier and more productive while giving you a competitive edge in your industry.

Send Comment: