Business budgets don’t have to be all work and no play — they’re not just about buying office supplies and paying for dull training sessions. In fact, many situations call for spending some of your budget on fun.

In fact, you can show your appreciation to employees with a special outing or a company party. Or maybe you want to rent a booth at a public event to introduce your company to the local community.

Some extra spending is also necessary to woo potential clients and maintain a positive relationship with long-standing ones. For example, maybe it takes two rounds of golf and three lunches to bring in a lucrative client. Or when the CEO of a client company retires a few years down the line, you may want to send them a congratulatory gift, such as their favorite bottle of wine.

These situations represent just a few examples of meal and entertainment expenses — the operating costs that finance some of the most memorable milestones in the life of a business. These expenses may also fall under the broad travel and expense category.

If you don’t handle these expenses properly, they can become more trouble than they’re worth, draining your budget and putting unwanted pressure on your accounting department. But by establishing proper policies and workflows, you can create unmatched efficiency for your employees and clients without breaking the bank.

Entertainment expense basics

On the surface, meals and entertainment expenses may sound like frivolous spending. However, they actually represent an investment.

For example, if you spend money on an annual picnic for your employees, it shows how much you regard not only their success at the company but also their happiness. This can lead to less turnover and a good reputation in your industry that brings in high-quality candidates and clients.

Similarly, gifts and donations to the public show you care about the community and build trust with customers.

Businesses are usually willing to take on these costs, as they’re deductible business expenses. Today, business owners have to pay more attention than ever to meals and entertainment expenses thanks to the Tax Cuts and Jobs Act of 2017.

Before this law, business owners enjoyed a 50 percent deduction on these expenses, sometimes even a full deduction. Now, entertainment expenses are no longer deductible, while business travel meals are 50 percent deductible.

In addition, the IRS has implemented more detailed definitions for these expenses and changed other deduction rules. As if those changes weren’t dizzying enough for business owners, the Consolidated Appropriations Act, enacted during the pandemic, made business meals from restaurants fully deductible for 2021 and 2022.

Several of these expenses are still worthwhile, even if they have lower or no tax write-offs. As long as you’re following tax laws when claiming deductions and carefully adjusting your budget accordingly, entertainment expenses are a great complement to other sound business practices.

However, you won’t reap the benefits of meals and entertainment expenses — tax or otherwise — unless you keep these transactions organized with proper policies and an automated expense approval workflow.

Make expenses work for you

A 2014 survey found that businesses cite travel and entertainment expenses as some of their most challenging operating costs. Reduce the burden of these expenses with these steps.

Write new policies

As the new tax laws illustrate, it’s important for a business to have detailed policies that clearly show employees and managers what expenses the company will reimburse them for. It also keeps executives on the same page when it comes to more significant or even extravagant expenses.

If you haven’t in a while — or at least since the last tax law passed — take some time to comb through your meal and entertainment expense policies, brushing them up for clarity and breadth of coverage.

Invite your finance teams to give their opinions and suggestions as well. Also, ask your employees, especially those who do a lot of traveling, to mention any rules they find confusing or hard to follow. Then make sure you brief all employees on changes.

Document everything

Whether you’re buying dinner for a client or sending employees to an industry conference in another state, make sure you can back up every cent with documentation. It’s a good practice for internal analysis but absolutely vital for tax purposes. You need clear records to back up your claimed deductions and protect your company in case of an audit.

The best way to organize these documents is to digitize them. Reimbursement forms should be housed online, and they should be able to accommodate digital receipts.

For example, you might have a good travel meal reimbursement form but no way to back it up with a receipt. Being able to attach a photo or digital copy to the form will save you and your employees the headache of multiple pieces of paper cluttering your wallets and filing cabinets — which would be a great relief since receipts are perhaps the easiest pieces of paper to lose.

Automate your approvals

Your online reimbursement forms will drive your meal and entertainment expenses. Unless they use a company credit card, employees have to file a reimbursement claim for the money they’ve spent on business. But this doesn’t mean that you’ll blindly reimburse each claim employees turn in.

Even when you trust employees to be financially responsible and prudent, managers and finance professionals still have to oversee spending to make sure purchases align with expense policies.

Allowing rogue spending gives employees too much leeway, resulting in them believing that they can bend the policies — all while siphoning funds allocated for entertainment spending. This is why expense approval processes that require multiple people to sign off on claims are important for all businesses.

Automated processes are the best; they save time, effort, and paper. Online platforms can save forms, receipts, manager comments on approvals, and notes from accountants, making the process transparent and swift.

Along with expense apps, approval automation software is the ideal way to not only oversee expenses but to track and analyze them as well.

Track expenses with Jotform

You don’t have to buy new filing cabinets to manage dining and gift receipts. You can store all your expense paperwork electronically in one place with Jotform.

First, you can create any kind of reimbursement request form with Jotform’s customizable templates. This particular template automatically totals expenses and allows form fillers to attach digital receipts. Workers can access these forms on mobile devices using the Jotform Mobile Forms app.

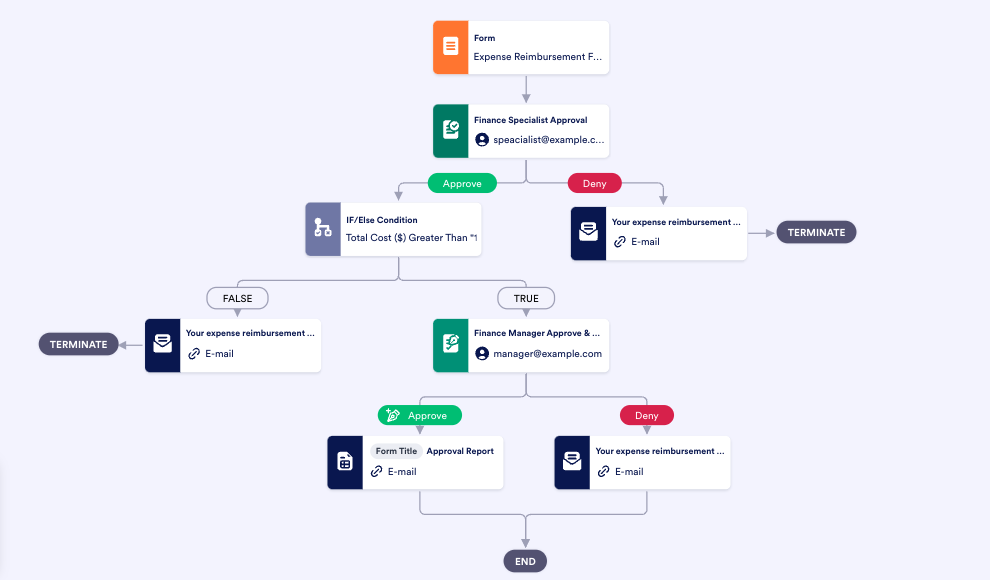

Using these forms as a base, you can set up an approval workflow in minutes with Jotform Approvals. Drag and drop approvers and forms, manage conditions, and set up approval branches to design a review process that you can manage via email or Jotform Inbox.

Jotform also helps your business control spending. Jotform Tables, a spreadsheet-database hybrid tool, acts as a central workspace where you and your accountants can view submissions and generate sophisticated reports.

When you have automated processes, stellar forms, and some tax know-how, incurring meal and entertainment expenses can be as enjoyable as it was meant to be — and it can ultimately make your business more profitable.

Send Comment: