For business owners and freelancers, trying to choose the best accounting and bookkeeping software can be an overwhelming experience. Some come with daunting learning curves, while others are known for their intuitive design and layout. Some offer time tracking and clock-in features, while others don’t. And with so many strong contenders, it can be difficult to match the right platform and plan to your business finance needs.

Two of the most popular options in business financial management software are QuickBooks and FreshBooks. The two platforms offer many of the same features and types of tools, allowing users to tackle the most common business accounting and bookkeeping-related tasks from their interfaces. Yet even with so much in common, they’re also very different products.

Let’s take a look at where QuickBooks and FreshBooks are aligned and where they differ so you can make the best choice for your particular needs.

FreshBooks overview

FreshBooks, a cloud-based accounting software program, uses a software-as-a-service (SaaS) subscription model. It boasts a user-friendly interface and intuitive navigation. It’s designed to help businesses and organizations with essential bookkeeping and accounting tasks.

The parent company of FreshBooks, 2ndSite Inc., started in 2003 in Toronto, Ontario (Canada), where it’s still headquartered. It first released FreshBooks in 2004 as a solution for micro, small, and medium-sized businesses as well as self-employed freelancers and solopreneurs. Its pricing plans and features make it useful across many different niches and kinds of businesses.

QuickBooks overview

QuickBooks is an accounting platform that features a suite of money management tools. Also built on the SaaS model, QuickBooks offers easy and user-friendly access to a variety of business finance features, including accounting, bookkeeping, inventory management, and more. Its target audience mainly consists of small to mid-sized businesses.

First released in 1992, the product platform has grown and refined its features and scope in the 32 years since its release. Intuit, Inc., headquartered in Mountain View, California, now owns and develops the software, offering versions developed for multiple languages and global markets.

Key features of FreshBooks

While both FreshBooks and QuickBooks offer the standard features and tools of any reputable accounting software, FreshBooks is primarily known for one feature above all others: its ease of use. Whether you’re working from a desktop, laptop, or the mobile app, you’ll appreciate the way FreshBooks has streamlined its product without skimping on performance.

A robust report generation tool gives you access to the most commonly used business finance and accounting reports. With it, you can run a profit and loss statement, a sales tax summary, or expense reports (to name just a few) to get a better grasp of your business’s financial condition.

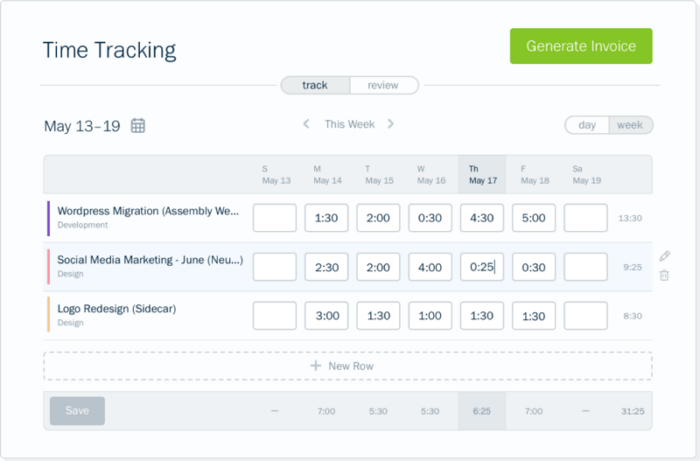

Time-tracking and invoicing features appeal especially to service providers and freelancers as well as solopreneurs who bill based on the time they’ve spent on a project. Its project management tools, which let you collaborate with team members, contractors, and others, are also valuable features.

On the independent customer review site G2, FreshBooks currently has a rating of 4.5 out of five possible stars, with over 750 submitted reviews.

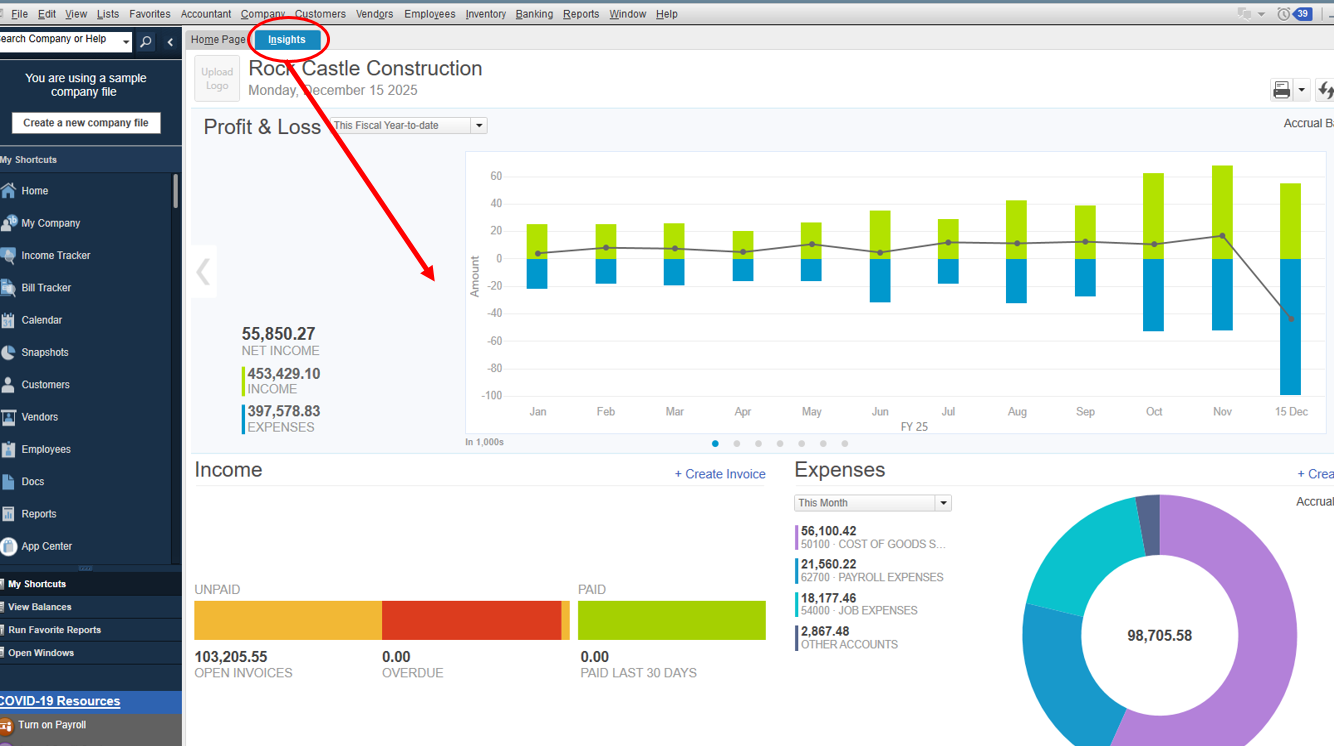

Key features of QuickBooks

Many reviewers cite QuickBooks’ significant scalability as the reason for their high marks of the platform’s performance. QuickBooks can easily accommodate growing companies simply by giving them the ability to move to the next plan level as they add users. This ease of tapping into increased access means that a company can stay with QuickBooks throughout its life cycle, from early launch to late-stage success.

Other key features of QuickBooks include over 750 available integrations with other apps and sites, such as Etsy and other shopping cart sites. It also has a wide array of customer service tools, meaning users can access the help they need in the format that works best for them. Users can also easily share their books with outside accountants, bookkeepers, and other relevant service providers.

On G2, QuickBooks has a four-star rating from over 3,000 reviews submitted.

FreshBooks pricing and plans

FreshBooks offers four plans at price points starting at $19 per month, with each successive plan adding valuable premium features and tools.

The Lite plan includes the ability to send an unlimited number of invoices to up to five clients, as well as an unlimited number of estimates. This plan also enables subscribers to accept payments via credit cards and ACH bank transfers, track expenses without limits, and run financial accounting reports that will help you prepare tax filings.

FreshBooks’ Plus plan includes the Lite features and adds more. For example, you can send unlimited invoices to up to 50 clients (instead of five), set up recurring invoices and retainers, and have all your receipt information automatically captured to make tax and expense reporting easier. What’s more, at this level and above, you can invite your accountant to access your FreshBooks records.

Premium subscribers to FreshBooks get additional premium features and enhanced access. You can send unlimited invoices to an unlimited number of clients, track project profitability, and customize email templates to make sending invoices and estimates even simpler.

Finally, at the Select level, users will have access to a data migration tool to make the switch from their old software simpler and quicker. With this plan, users also enjoy lower credit card transaction fees and can remove the FreshBooks branding from all emails to clients and customers.

In addition to the plan-specific features listed above, subscribers at every level can add team members for an $11 per user monthly fee and include payroll management tools (fees starting at $40 plus $6 per user per month, with the first month free). Finally, you can evaluate FreshBooks at any of the first three levels (Lite, Plus, or Premium) at no cost for a full 30 days.

QuickBooks pricing and plans

QuickBooks offers four plans, starting at $30 per month.

The Simple Start plan comes with tools for income and expense management, client invoicing, receipt data capture, mileage tracking, cash flow management, sales, sales tax, and more (including access to expert tax assistance). Users can connect one sales channel.

The QuickBooks Essentials plan adds enhanced reporting tools, access for up to three users, time-keeping tools, support for multiple currencies, and the ability to connect up to three sales channels.

In the Plus plan, subscribers get the same tools as those in the Essentials plan, plus more comprehensive reporting tools, access for up to five users, and no limit on connected sales channels. It also adds inventory management and project profitability tools.

The Advanced plan offers QuickBooks subscribers access for up to 25 users, as well as fixed asset tracking, data sync with Excel spreadsheets, employee expense tracking, and customized access controls. Advanced subscribers also get access to data restoration, revenue recognition, and around-the-clock access to support and training.

FreshBooks vs QuickBooks: A side-by-side comparison

Another helpful way to consider the similarities and differences between these two financial management platforms is with a side-by-side comparison.

| FreshBooks | QuickBooks | |

|---|---|---|

| Target audience | Best for solopreneurs and freelancers | Suitable for businesses of all sizes, but may be more than micro-businesses and freelancers require |

| Integrations | 149 integrations with different sites, platforms, and apps | Over 750 integrations with various sites, platforms and apps |

| Pricing and plans | Four plans with pricing starting at $19 monthly; 30-day free trial period | Four plans with pricing from $30 to $200 monthly; 30-day free trial period |

| Scalability | Relatively scalable unless your business grows very fast, in which case client/user account limits might prove challenging (unless you pay extra per-user fee) | Highly scalable by just moving up to the next plan level |

| Scope of features | Full-scale business finance platform for accounting and bookkeeping, including tools to manage cash flow, invoicing and more, including payroll as an add-on for a separate fee | Full-scale business finance platform for accounting and bookkeeping, including tools to manage cash flow, invoicing and more, including payroll as an add-on for a separate fee for some plans (others plans include it) |

| Customer service | Support available through phone, email form, and chatbot, as well as through an expansive knowledge base | Support available through phone, web chat, community forum, and an extensive resource library; 24-7 access to individual support from experts for subscribers at Advanced level |

Jotform: A versatile tool for your bookkeeping and business finance needs

Jotform is another powerful platform you can use to meet your company’s bookkeeping and invoicing needs, thanks to its advanced features, integrations, and templates.

You can easily generate invoices for your company’s clients with Jotform’s online invoice generator. Jotform’s invoice templates can further simplify this process and make your invoicing workflow nearly seamless.

Another key area that business owners must control for a healthy bottom line is expense management. With Jotform templates designed for expense tracking, such as the expense report form, the process is easier than ever. Jotform even simplifies the expense approval process with Jotform Approvals.

What’s more, you’re not restricted to Jotform templates and native features. You can craft your own custom solution by using Jotform together with your favorite accounting platform. Integrate your Jotform directly with QuickBooks, or use Zapier to integrate with FreshBooks if you prefer. Best of all, Jotform is continually adding new features and integrations.

The bottom line

Choosing the right accounting and bookkeeping solution for your business may always be a challenge, but there’s never been a better selection of top-shelf software to get the job done well. Whether you decide to stick with easy-to-use FreshBooks, easy-to-scale QuickBooks, or infinitely customizable and award-winning Jotform, taking the time to make the best decision for your company will pay dividends in the long run.

Photo by Karolina Kaboompics

Send Comment: