As your business grows, the simple bookkeeping system you started with eventually becomes more elaborate. You start to need a greater understanding of financial standards and complex mathematical functions, as well as how to manage numerous stakeholders throughout financial processes.

For many businesses, keeping a team of accountants on staff to handle these duties day to day just isn’t feasible. That’s why so many business owners integrate financial process automation into their accounting systems. Automating financial tasks not only saves valuable payroll hours compared to manual accounting, but also protects your data, reduces errors, and provides greater insight into the overall health of your business.

What is financial process automation?

The financial industry is full of time-consuming and tedious tasks. Financial process automation is the use of technology to eliminate or minimize the need to complete these tasks manually. By automating these processes, your team can prioritize more complex, valuable tasks while simultaneously streamlining their workflows.

How financial process automation helps business owners

Many finance-related tasks (80 percent, in fact) are perfect candidates for automation, giving employers the opportunity to free up their team from monotonous tasks. In many businesses, financial process automation speeds up tasks in these common processes:

- Invoicing, including sending payment reminders to customers

- Accounts payable, such as paying invoices and handling approvals for expenses

- Account reconciliation

- Data recording

- Financial statement preparation

- Employee expense reports

- Expense management

- Payroll forms

- Employee benefit management

- Tax reporting and compliance

Automating these financial functions can lead to

- More time for executives to spend on tasks that require human intervention, including brainstorming, high-level decision-making, and planning

- Streamlined approval requests for every step in a process, with forms sent to each stakeholder in the workflow

- Instant data transfer from one organization or department to another

- The ability to auto-populate forms with information from connected databases

Why you should automate your finances

Automation eliminates the pesky element of human error. Even if you ensure your team inputs data correctly 99.99 percent of the time, that .01 percent will still cause headaches and backlogs. Errors are much more common in manual systems, while automated systems significantly improve accuracy.

When you eliminate errors, your team gains back the time they’d otherwise waste in correcting mistakes and gives your company a reputation for accuracy.

Automation systems also arrange data into reports and charts that help you make quicker, more informed decisions, saving you time and money. Above all, an interconnected system of automated financial processes allows you to continually monitor and optimize operations.

What are the challenges of finance automation?

Automation simplifies processes, but it can also cause friction in your company. It removes the need for some tasks that would otherwise be an employee’s responsibility, which may make some employees nervous about how automations will impact their positions. It’s important to reassure employees that automation works to their benefit.

Other common challenges include

- Collaborating with IT to implement automations

- Having insufficient funds or resources for implementation and training

- Dealing with a long implementation process

- Managing employees’ fear of termination or lack of advancement

- Obtaining buy-in from executives to invest in automation

By remaining transparent and strategic, you’ll minimize these challenges and get the most out of automation.

Why are existing financial processes not working?

Nearly 43 percent of finance leaders say their current accounts payable process is manual, and that they spend 53 percent of their week on these processes rather than financial strategy. The issue with these processes often boils down to the human element. Drawn-out, manual work leads to employee burnout, reducing productivity and employee morale.

Outdated financial processes are also not transparent, which prevents other team members from using your data to its full potential. This risks team members using outdated information or creating knowledge silos that make training more difficult.

There’s also always an inherent risk of fraud with manual financial processes. Without an automated system to cross-check and confirm data, you leave your business open to potential financial losses.

What processes should you automate in finance?

When you’re deciding what processes to automate, consider which will provide the most value to your business — as well as your employees. Here are some ideas.

- Bookkeeping: With advancements in technology such as Microsoft Excel macros and accounting software, finance teams are now able to automate inputting, compiling, and analyzing data and ensure higher accuracy without the burden of manual entry.

- Invoicing: You can automatically send invoice templates to clients and track their approval without having to manually update or transfer any data.

- Accounts receivable and payable: Tracking bills and keeping information up to date takes your team time. You can automate data entry by scanning invoices, tracking payment progress, and standardizing documentation.

- Tax compliance: Complying with tax regulations used to require specialists and third-party consultants to understand your tax responsibilities. Now, accounting software ensures compliance with tax laws across states or countries where you do business.

- Payroll: Terminations, promotions, hires, insurance changes, and salary raises all change payroll data and processes. Automation monitors and confirms data for your team, all while delivering paychecks to your employees on time.

- Expenses: Employees used to collect, submit, and confirm every business expense with the finance team. These processes included submitting receipts, invoices, and any other relevant form that required hours of administrative work to process. Automated receipt collection can now offer more accurate insights into your annual expenses and their impact.

What are some tips for automating financial processes?

Before you implement financial process automation, it’s important to consider a few key questions. These questions will help guide your automation strategy.

- What processes need automation most?

- Why do we need to automate this process?

- What value does automation provide for this process?

- How will this impact the current workflow?

- How long will this automation take to implement?

By considering these questions, your team will better understand how automation will upgrade their workflows, which will also make your employees more comfortable with the transition.

What are the steps for implementing financial process automation?

Automating your accounting and finance standards will help you better manage your business, improving your understanding of your organization’s financial process and eliminating friction that can cause backlogs.

Here’s how to get started.

Map out your financial process

Mapping out the individual steps of each process helps you organize your workflows and lays the groundwork for automation. Once you do this, you’ll see where to further automate auxiliary tasks and build a connected system of automated processes, creating new opportunities for efficiency.

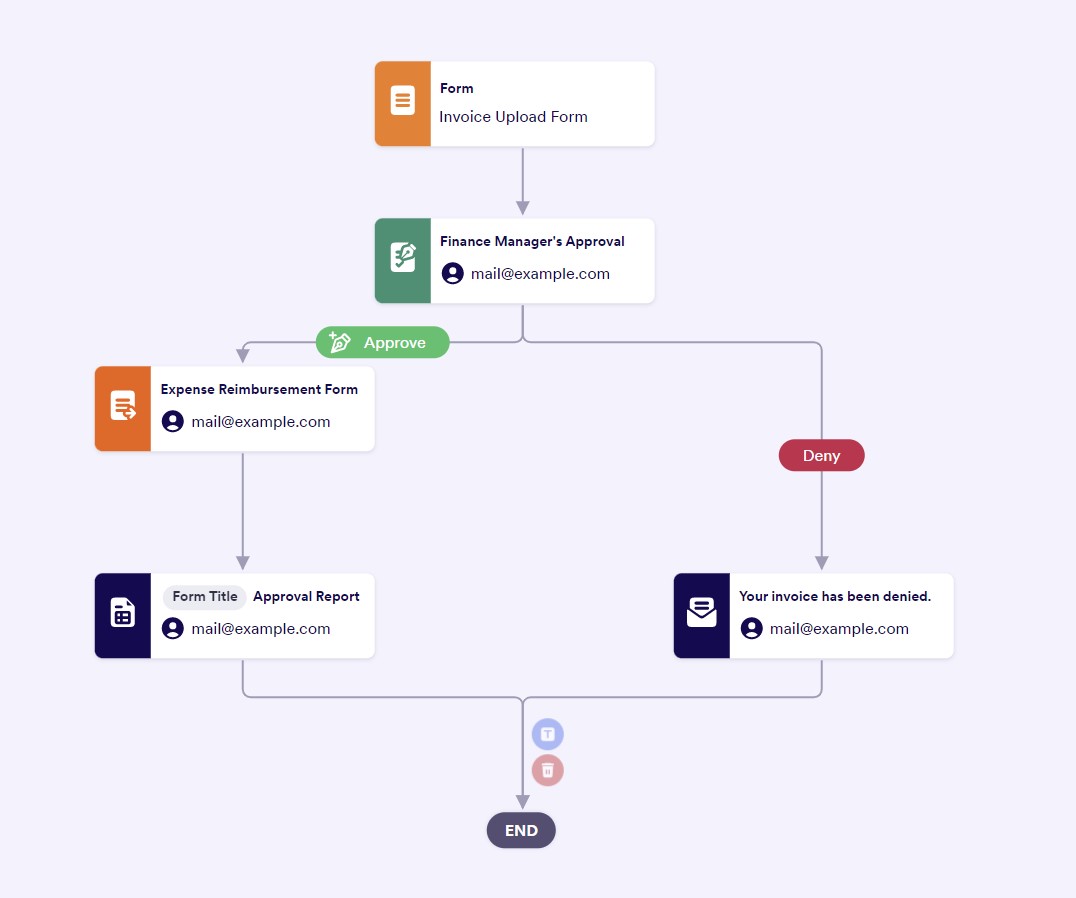

Whether it’s through an intensive, company-wide look at every stage of your financial processes or simply one big brainstorming session, account for each step and stakeholder involved in your accounting procedures. Use a flow chart to track how you collect and report data, then highlight the stages you can automate. These flow charts will eventually become guides to creating automated workflows.

Here are a some examples:

Budget approvals

After a department creates an annual budget, several managers need to review it for accuracy and feasibility before it’s presented to a CFO or CEO. Department team members can work together to plan a budget using forms, which will then enter an approval flow.

Invoicing

If you’re receiving invoices from freelancers, you can send the invoice form to a department manager and then a finance head to make sure the freelancer gets paid. In an approval workflow, you may need other forms to release the funds from the budget.

Purchase requisition process

To ensure that necessary purchases won’t go over budget, one person in a department may be responsible for filling out purchase requisition forms and sending them to a finance department manager for approval. Whether the requested purchase is for office supplies or even new equipment, having an approval process ensures the company has enough funds to make purchases.

Tie automation to business objectives

Given the time you can save with automation, you might want to start automating all your processes all at once — but that’s not practical. Instead, tackle your most pressing needs first, as well as those that are most important to meeting your company goals. If your business is plagued by tight deadlines for financial forms at the end of every month, transform those tasks first and guide your employees through the changes.

Find an automation solution

Ultimately, you need a solution that matches your business’s processes and needs. Some tools automate several processes at once; others are suited for specific functions, such as invoicing and tax preparation.

If you need widespread automation, look for a company that will be a true partner through implementation, guiding you through each stage. If a particular process is causing you trouble, finding a specialized tool will likely provide you with higher value.

Whichever tools you choose, make sure that they’re low-code or no-code solutions, so all employees can use them, no matter their technical expertise. You should also be sure that your tools will integrate with the other programs you already use to prevent process silos and reduce unnecessary back-and-forth between departments.

How can Jotform help you automate your financial processes?

The right tools make automation seamless, and Jotform offers a number of them. Jotform Tables provides a number of finance sheet templates (including budgets and balance sheets) to keep information in one place.

These sheets are populated with data from customizable forms that will be the foundation of your financial processes. For example, these forms power approval flows with Jotform Approvals. This tool offers a number of financial approval process templates to keep stakeholders and employees informed of and accountable for each approval step. You can also build your own approval templates.

Pro tip

Check out Aytekin Tank’s new book Automate Your Busywork to learn how to use no-code automation to offload repetitive tasks, transform productivity, and maximize your time.

Eliminate the headaches of financial processes

Financial process automation improves how you handle each cent that leaves or comes into your company. When tasks run smoothly in the background, you won’t have to lift a finger, maximizing the value of all your processes while minimizing their impact on your team. Through automation tools like Jotform, your finance department can become more streamlined, productive, and engaged.

Send Comment: