Top 5 insurance CRMs

The insurance industry is rife with competition. One of the biggest industries on a global scale, its estimated global market value was nearly $5.5 trillion in 2021, and that number has grown since.

So how can insurance agents and brokers stand out in such a crowded marketplace? One way to differentiate yourself is to develop and nurture good customer relationships.

You can do this with the help of the right workflows and tools, and a CRM is one of the best tools for this. This software handles a variety of tasks in support of insurance agents’ efforts to build long-term connections with their customers, making the process easy to manage and maintain over time.

In this article, we take an in-depth look at CRM software for insurance, starting with what it is and what advantages it offers. Then we dive into the different ways you can use CRMs in the insurance industry, followed by suggestions for leading CRM insurance software.

The basics and benefits of an insurance CRM

A customer relationship management (CRM) tool is a software solution insurance agents and brokers can use to simplify many customer-related workflows, such as lead management, sales engagement, data entry, and more.

Put simply, a CRM for insurance saves you time by handling your caseload more effectively, and it allows you to have more meaningful customer interactions — both of which increase your chances for success.

“A CRM system is a powerful tool for insurance companies that can help them enhance their customer service, streamline operations, and increase sales,” says Evan Tunis, president of Florida Healthcare Insurance. “By utilizing a CRM software, insurance companies can have access to customer data in one place, allowing them to better understand their customers’ needs, provide better personalization, and increase customer satisfaction.”

The many advantages a CRM provides include

- Consolidated data: A CRM collects and stores information about your prospects and customers all in one place, from their contact information to their last engagement with a sales rep. This enables you to quickly learn a customer’s entire history in order to serve them more effectively.

- Collaborative processes: Often, multiple people are involved in serving a customer or working on a case. A CRM facilitates this collaboration by making all the necessary information available for the right people. CRMs also make it easy to import and export information as well as share it between departments and offices.

- Workflow automation: It’s easy to automate low-level tasks, such as sending follow-up or reminder emails, with a CRM. This allows you and your team to focus on higher-priority tasks.

- World-class security: Your leads and customers don’t want their confidential information in the wrong hands, which is why many CRMs have enterprise-level security features as well as role-based access features.

- In-depth analysis: CRMs are data treasure troves that you can use to understand trends, patterns, and anomalies in your prospect and customer base. This can help you make decisions about future workflows or insurance policies.

Ways to use a CRM in insurance

To reap the above benefits, it’s important to understand your CRM’s various features and applications so you can take full advantage of them.

“A CRM can be used in many different ways by insurance companies,” says Tunis. “For example, they can use the system to better manage leads and identify potential customers. The data collected from a CRM also enables insurance companies to track customer history and preferences, create targeted campaigns and advertisements, assess customer churn rate, and understand customer buying behaviors.

“Additionally, a CRM system allows insurance companies to automate services, such as reminders for policy renewals and payments. This enhances customer service while also saving time and resources.”

The many different applications for a CRM in insurance include

- Lead capture: You can integrate a CRM with your insurance company website in order to capture lead contact information and learn more about what products or services they’re interested in. Some CRMs also have lead prioritization features so you can automatically assign importance to each lead depending on their demographics or behavior.

- Customer segmentation: With a CRM, you can categorize customers based on different criteria, such as buying stage or demographics, in order to better cater to them with marketing campaigns and sales offers.

- Team management: You can use a CRM to assign leads and customers to different people on your team as well as follow up with team members for specific tasks and projects. Some CRMs can also automate lead distribution to ensure all reps have the right load.

- Sales forecasting: You can use a CRM to determine how many prospects are in the pipeline, when they’re expected to close, and where your sales gaps are. This way, insurance personnel can plan effectively for busy periods, determine budgets, and even innovate new services to attract customers.

- Report generation: Many CRMs come with report generation features so you can glean insights from lead and customer information. Identifying patterns and trends in this data can help you make long-term business decisions.

- Commission tracking: In the insurance industry, commission is a large part of compensation. A CRM can help the company keep track of sales by each representative to accurately calculate commissions. Many CRMs have accounting modules and sales leaderboards.

Leading insurance CRMs to check out

There are plenty of CRMs on the market, but which ones are best for the insurance industry?

“When selecting a CRM system for their company, insurance agents should look for one that offers comprehensive features to help them better understand and serve their customers,” says Tunis. “It’s important to choose a system with strong customer data management capabilities so they can easily access and analyze customer information.”

Check out these five leading options.

1. Jotform

Jotform is a popular survey maker that you can use as a CRM for your insurance business. Just use the many insurance form templates to capture information from leads and customers and build your custom CRM using a table template.

Jotform is intuitive and easy to use, and you don’t need to know how to code in order to customize your CRM. With your Jotform CRM, you can assign leads to reps, track lead and customer engagements, embed forms on your website, and much more.

Jotform is available for free, and it offers four tiers of paid plans starting at $34 per month.

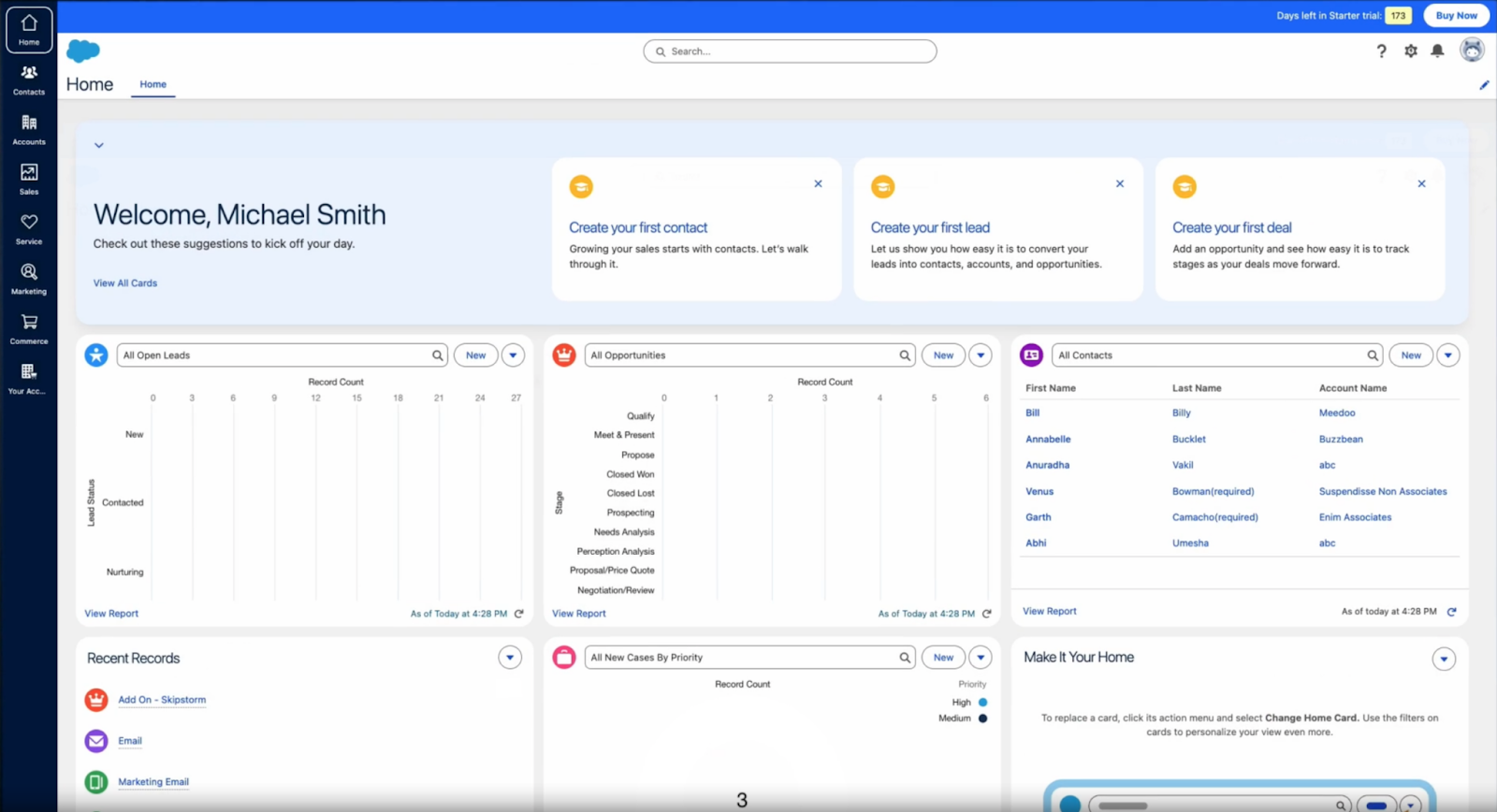

2. Salesforce

Salesforce is a CRM tool that offers special features for the insurance industry. With Salesforce, you can offer self-service tools to your policy holders, utilize the full Salesforce kit of marketing and sales resources, and make detailed logs of agent-customer interactions. Plus, Salesforce offers different solutions for different types of insurance companies, such as property and casualty, group benefits, and life and annuity.

Salesforce offers multiple CRM packages and products. Contact Salesforce for pricing details.

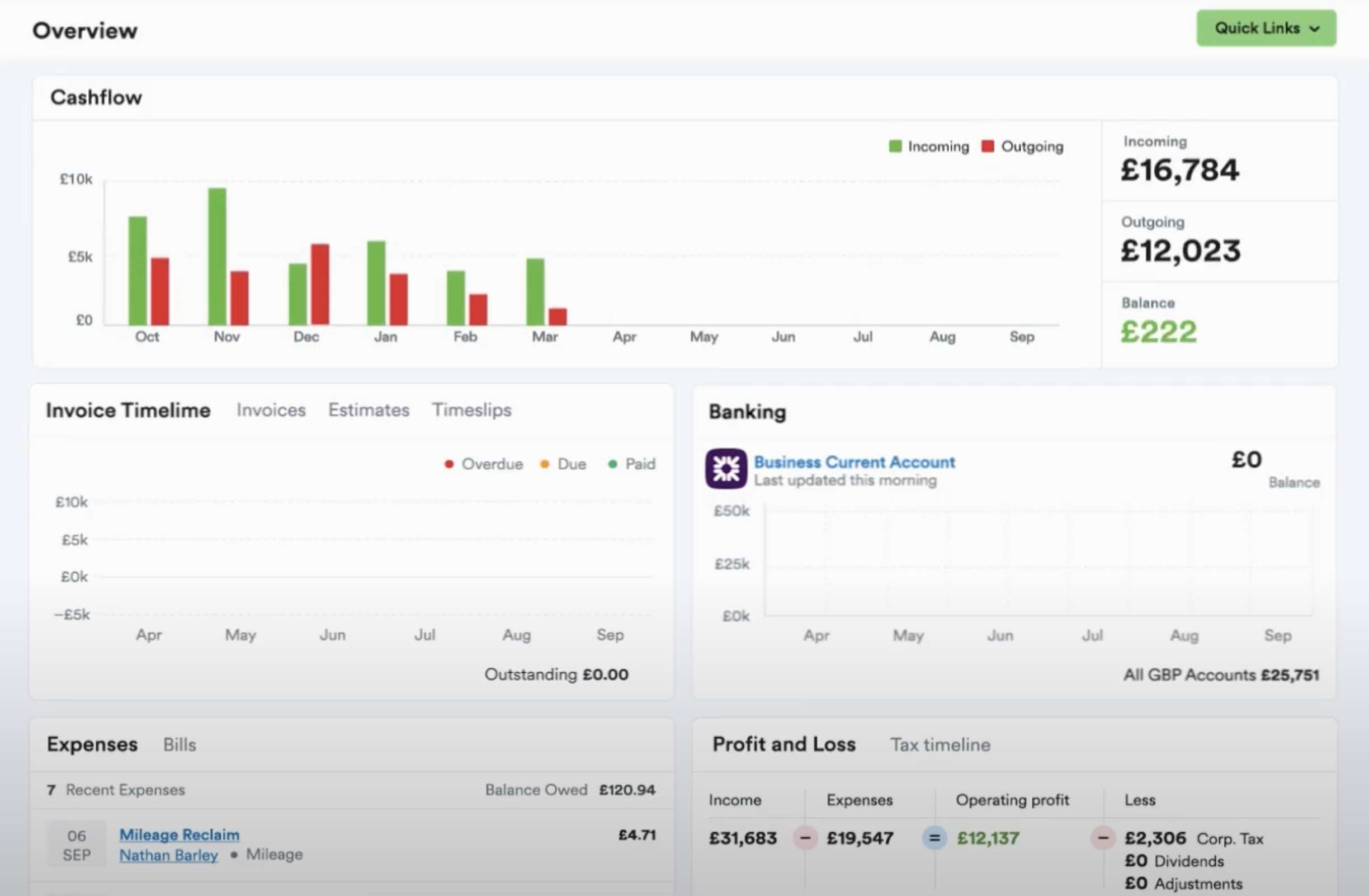

3. FreeAgent

FreeAgent is a CRM and team management platform that insurance agencies can use to ensure each agent stays on track with their caseload. It offers sales pipeline visibility, customer management and lead management tools, lead scoring ability, and sales forecasting for insurance policies. FreeAgent can consolidate activity over email, phone, text, meetings, and more.

FreeAgent offers a free trial and three tiers of paid plans starting at $35 per month.

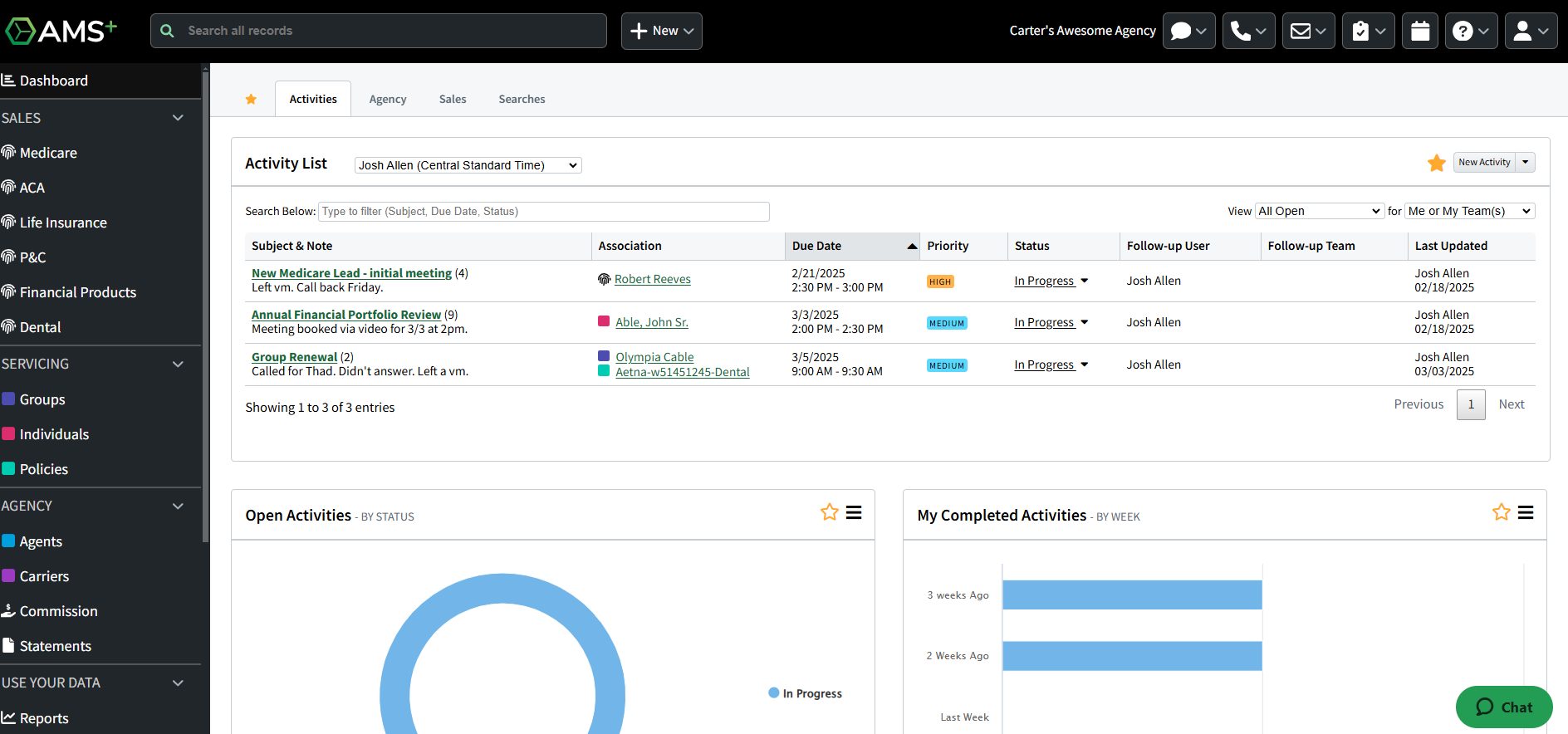

4. AgencyBloc

AgencyBloc is a CRM that’s specific to the life insurance and health insurance sectors. It offers insurance marketing automation tools, prospect and contact management solutions, and commissions tracking. You can also use AgencyBloc to generate quotes and proposals as well as manage policies for customers. It also has policy renewal automation features.

AgencyBloc has a free trial and offers customized plans starting at $75 per month.

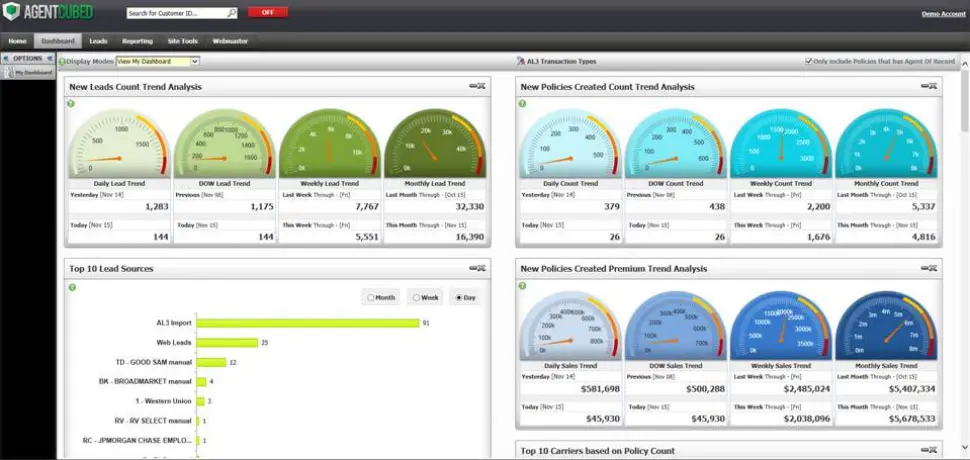

5. AgentCubed

AgentCubed is a customer relationship management tool specific to the insurance industry. It has features for policy management, automated renewals, marketing and sales automation, and more. AgentCubed lets you route leads to specific agents or teams, evaluate sales rep performance, manage custom proposals, and generate detailed reports.

Contact AgentCubed for a demo and custom pricing.

Jotform: An ideal CRM solution for the insurance industry

When it comes to easy-to-use, intuitive, and flexible CRMs for insurance, Jotform is an excellent choice.

This survey maker enables insurance companies to create a CRM based on their unique processes and workflows. Just find the form templates you want to use to collect lead and customer data and pair them with a CRM table template to view and manage the incoming information.

Jotform integrates with many business process tools — such as project management, cloud storage, and communication solutions — so you can ensure CRM information flows through different parts of the organization as needed. Plus, Jotform takes security seriously. In addition to our built-in industry-standard protection measures, you can also take advantage of our encrypted forms feature, which gives you a private key to your encrypted form data.

Jotform also has an ecosystem of business products you can use with your CRM. Try Jotform Approvals to automate any trigger-based workflows, such as assigning leads to sales reps. And if you want to create visually stunning reports of your CRM data, then Jotform Report Builder can help you with that.

If you want to stand out in the bustling insurance industry, nurture customer relationships with ease with Jotform.

Photo by: Thirdman

Send Comment: