Every year, tax season in the U.S. sends workers and accountants into a weeks-long frenzy. Between February and April, taxpayers scramble to deliver accurate and timely reports to the IRS, hoping to avoid any issue and — fingers crossed — get a nice return.

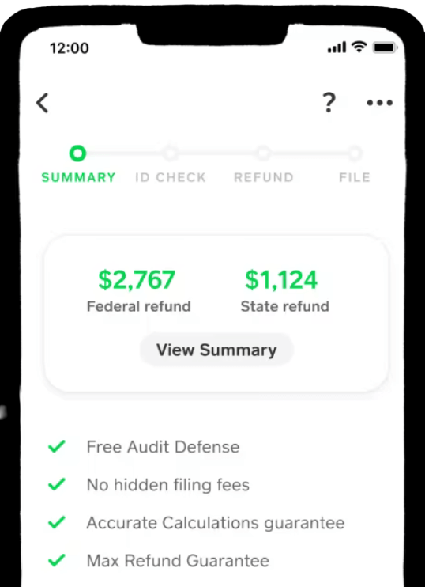

During the 2021 season, Americans received an average refund of $2,827, which, along with the stimulus checks issued during the COVID-19 pandemic, provided a significant financial boost. Federal measures are designed to protect 97 percent of small businesses from income tax increases, making the upcoming tax seasons particularly favorable for business owners.

With this influx of cash, new government regulations, and the lasting impact of increased digital filing during the pandemic, choosing the right tax software is crucial. There are numerous options available, ranging from free to paid, with varying levels of complexity and interactivity.

When considering the right option for you and your business, make sure to find what best suits your familiarity with the tax system, the time and financial resources you’re willing to commit, and the speed with which you want to tackle your taxes. Here’s a list of the best tax software to get you started.

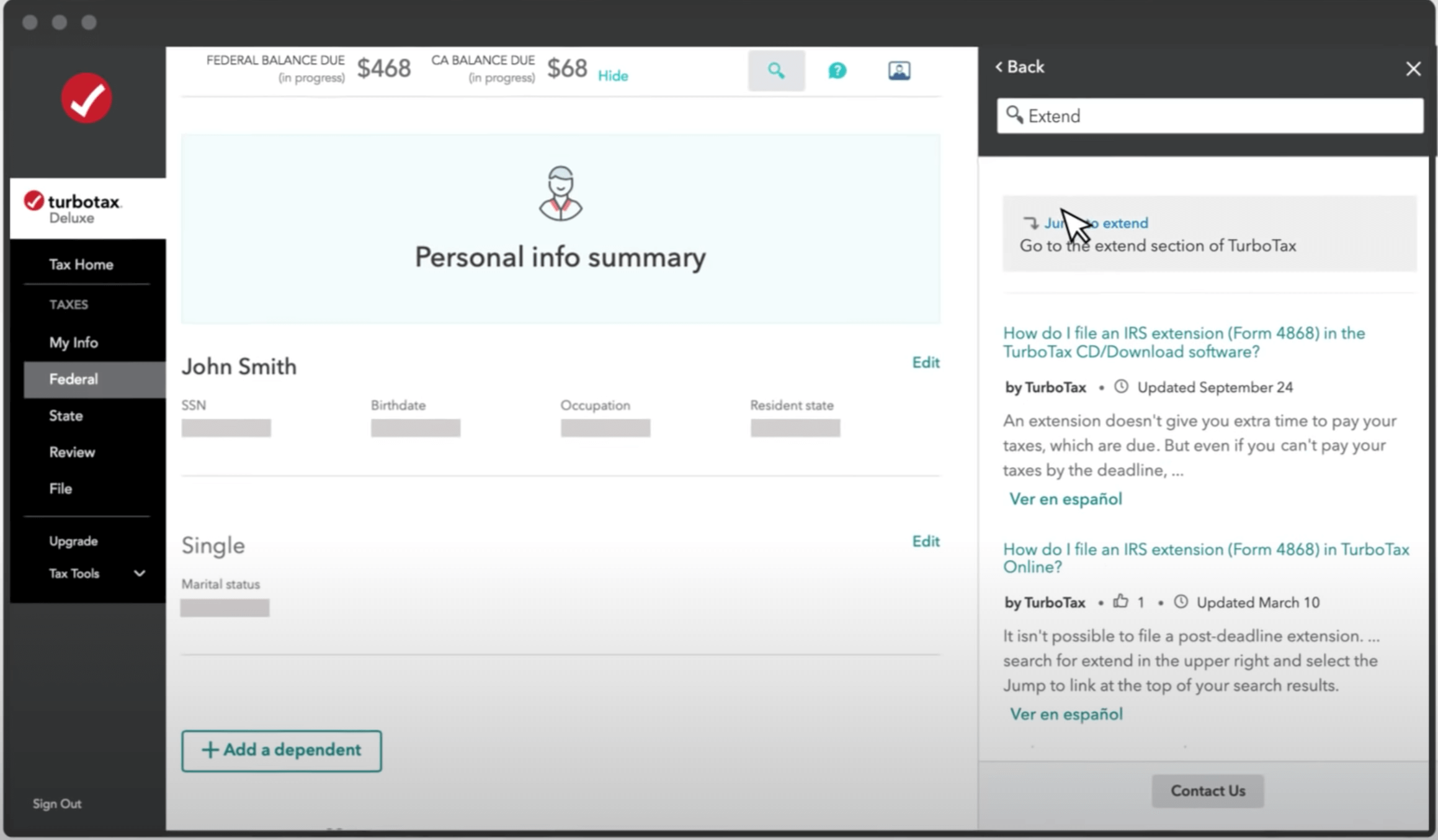

TurboTax

Intuit-owned TurboTax is one of the largest DIY programs on the market. The downloadable program works for small businesses and self-employed individuals. The online version, TurboTax Live, adds features like live support from certified public accountants (CPAs) — although the downside is an added cost that makes this option one of the more expensive on this list.

One bonus is TurboTax’s easy integration with other Intuit products. Business owners can complete tax documents by quickly drawing on QuickBooks to help tally important financial information. For individual filings, Mint users can sync their budgeting information into TurboTax for quick and easy filing.

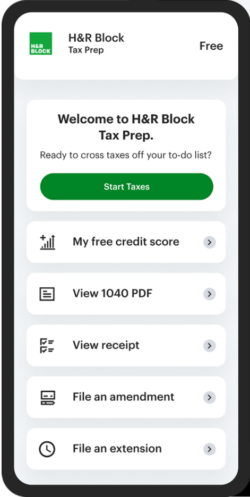

H&R Block

Another major industry provider, H&R Block is praised as one of the best tax software programs for its easy-to-use interface and top-tier user experience for small businesses. Similar to its main competitor, TurboTax, customers choose between downloadable and live options — and at an overall low cost.

One of the highlights of H&R Block’s leading user experience is an excellent mobile app. Though it’s not as sophisticated as the desktop programs, you can upload and scan tax documents, track your filing status, and review document PDFs, all from your mobile device.

TaxAct

Though it’s not a household name, TaxAct is an excellent option, offering great service as well as online and downloadable versions. With user-friendly options like unlimited free tax and technical support — as well as a “$100k accuracy guarantee” — TaxAct has a customer-centric focus on delivering service.

In the same spirit, TaxAct offers discount bundles for those filing both personal and business taxes. However, it falters with limited audit support, and the free option lacks many of the customer service bonuses that make it a great choice as a paid option.

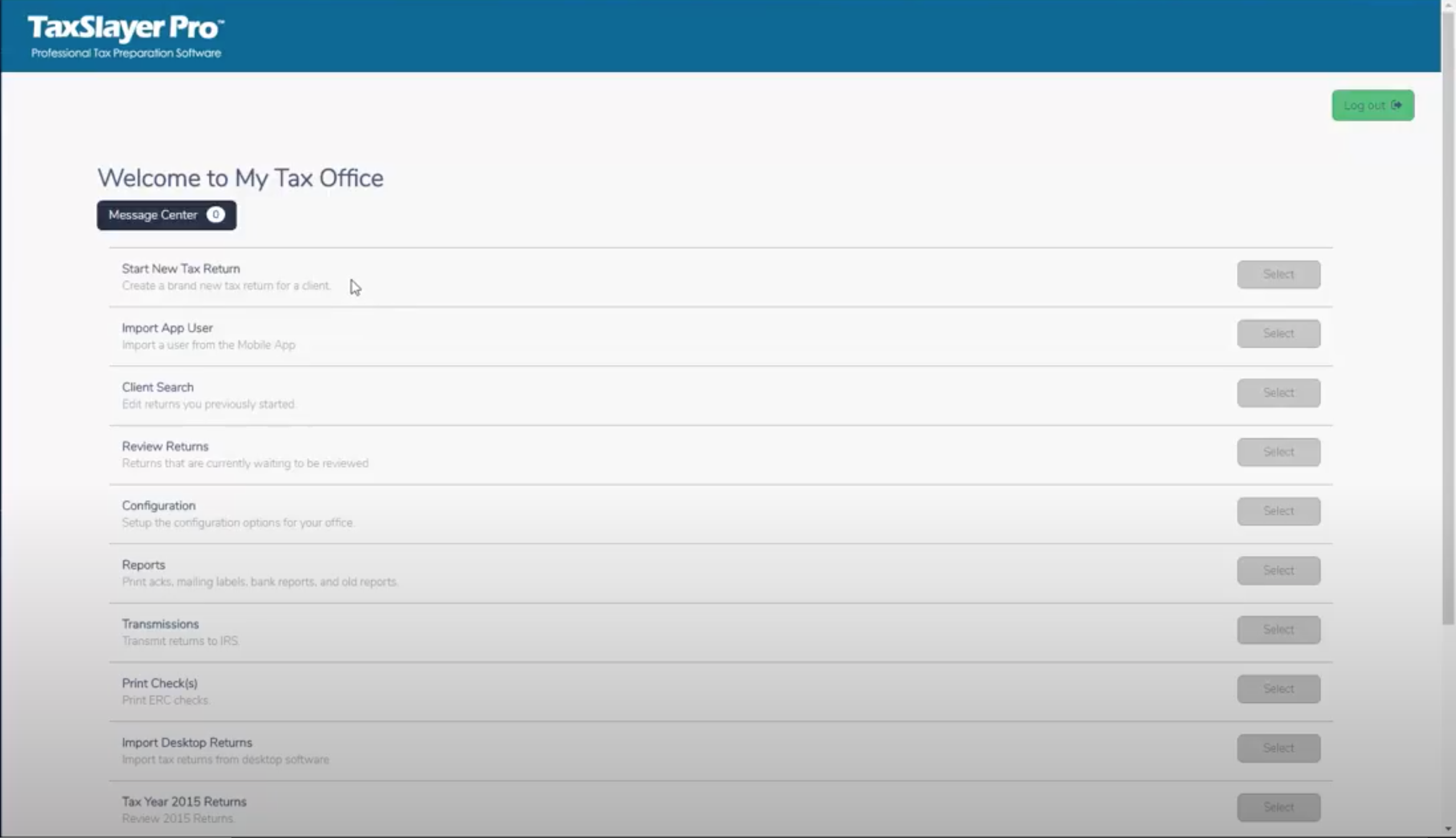

TaxSlayer

With lower pricing options and a top-notch online experience, TaxSlayer leads as one of the best tax software programs for self-employed filings. The independent contractor version of the software even includes access to a tax professional to guide the uninitiated through complex business tax jargon. Plus, that’s alongside its traditional phone, chat, and email support lines.

Unlike other tax software, TaxSlayer offers only online versions. Additionally, though the self-employed options are particularly helpful, the program doesn’t support forms for partnerships and corporations, making it incompatible for larger organizations.

Credit Karma Tax

For the most straightforward tax situations, Credit Karma Tax is considered one of the best free tax software programs. Individual filers will find a simple, well-designed online system that can connect W-2s, unemployment insurance, retirement accounts, and similar income sources for easy filing.

Credit Karma is admittedly limited — its only business option is for self-employed individuals, which costs extra and renders the “free” point moot. For individuals, there is no multi-state filing and foreign-earned income functionality, limiting the service to the basics. Still, if you’re seeking a no-cost, to-the-point option, Credit Karma should be high on your list.

Jotform

For a great no-code and less intensive approach to syncing up your documents, Jotform is an excellent free alternative to tax software. With Jotform Smart PDF Forms, you can digitize information efficiently by easily converting PDFs to HTML web forms.

Business owners can use Smart PDF Forms to collect W-4s from employees. The information from these forms automatically populates the associated table in Jotform Tables, where you can manage and track important tax information. If you’re an independent contractor or freelancer filing a W-9, Smart PDF Forms lets you upload and digitize this information and review and update it on any device. Or you can immediately fill out your W-9 form via Jotform’s W-9 generator.

Although tax season may still be a few months away, consumers and businesses are already stressing about it. By choosing the best tax software for your needs, you’ll equip yourself with the tools to tackle tax filing with ease and confidence — and, hopefully, get a nice return to line your pockets.

Photo by Kindel Media from Pexels

Send Comment: