Top accounting apps

Keeping accurate financial records is key to understanding your business’s financial position — and avoiding issues with your taxes.

At its core, accounting involves recording, classifying, and summarizing financial transactions to monitor financial health and meet regulatory requirements. Accounting apps have revolutionized this process, automating tasks and freeing up valuable time for business owners.

The power of automation in accounting apps

Many accounting tasks are repetitive by nature. With every transaction, sale, and inventory change, you’ll find yourself performing similar tasks in your accounting ledger. This repetition makes accounting practices ripe for automation.

Modern accounting apps automate these repetitive tasks, enhancing efficiency and ensuring accurate and timely financial data. Accounting apps can handle invoicing, expense tracking, payroll, and financial reporting with minimal manual input — ensuring everything’s in order for when it’s time to file your taxes.

How to choose an accounting app that fits your needs

Selecting the perfect accounting app for your business involves understanding your specific needs and how the app’s features align with them. Consider the following:

- Identify your business type. Are you a freelancer? Or do you run a small business or a large enterprise?

- Evaluate business and industry-specific needs. Do you require specialized features, such as inventory management for retail or time tracking for service-based businesses?

- Check integration capabilities: Ensure the app can integrate with your existing tools and platforms.

- Assess user-friendliness. In some fields, employees may already be comfortable with complex apps, but in others, complexity could hamper adoption.

- Consider scalability. It’s possible that you’re a solopreneur and plan to stay that way. But if you’re a startup looking to expand rapidly, you’ll want a tool that doesn’t force you to change platforms at the first sign of growth.

Top 11 accounting apps

1. Jotform Apps

- Key features: customizable templates, drag-and-drop app builder, invoicing and expense apps, integration with payment processors

- Pros: very customizable, user-friendly, excellent for automating form-based tasks

- Cons: not a dedicated accounting platform

- Plans and pricing: free Starter plan; paid plans starting at $34 per month

- Available platforms/devices: web, iOS, Android

- Ratings: App Store 5/5, Play Store 4.8/5 (for Jotform Mobile Forms)

Jotform Apps allow you to create an accounting app that’s tailored to your needs. With easy drag-and-drop functionality, you can design forms for your app to accept orders, enter expense reimbursement requests, and more. You can also integrate forms with payment processors effortlessly. This flexibility makes Jotform Apps an excellent choice for businesses looking to streamline form-based accounting tasks without the need for a dedicated accounting platform.

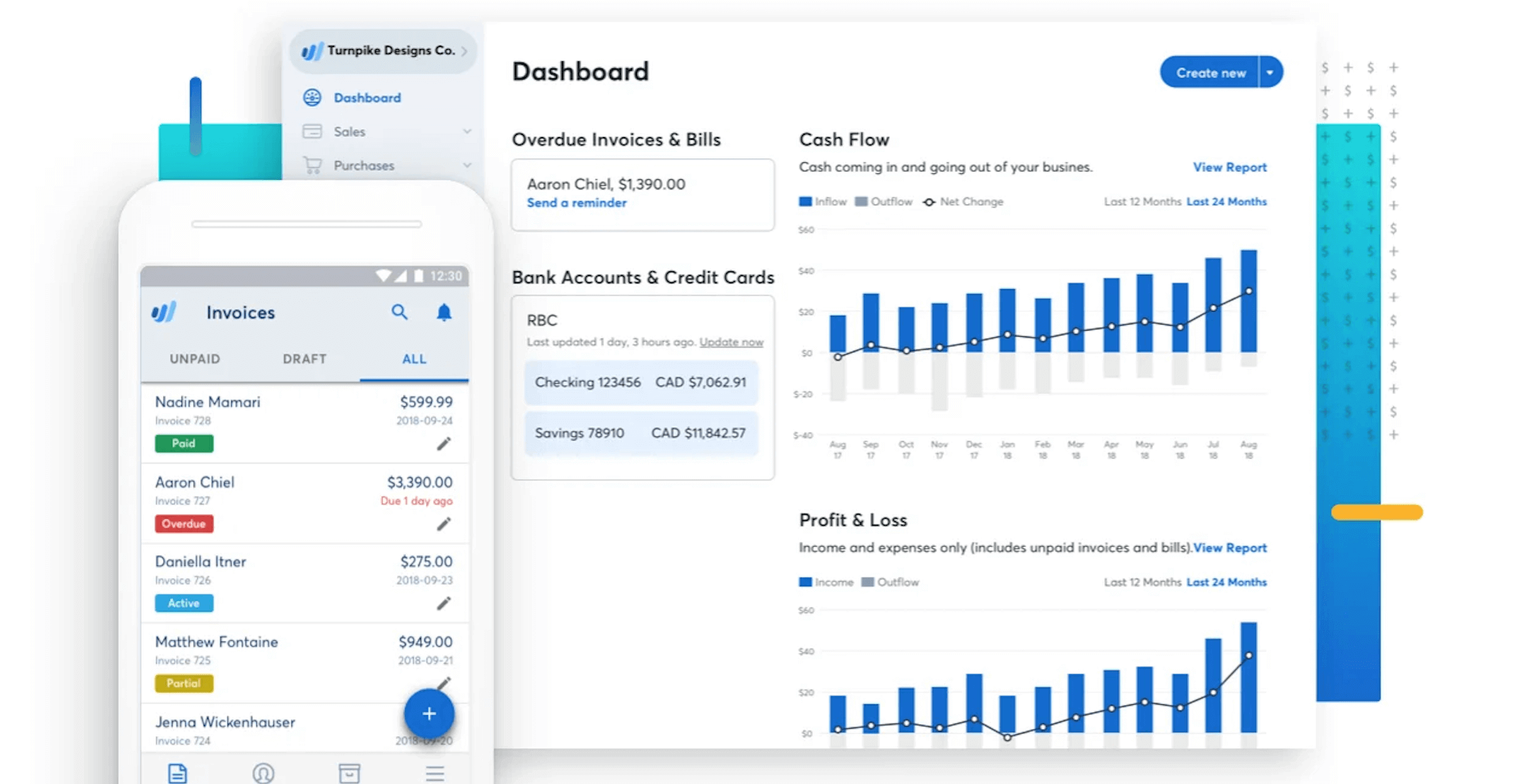

2. QuickBooks Online

- Key features: invoicing expense tracking, payroll, reporting, bill management, loan access

- Pros: industry standard solution, scalable, additional products, full-feature accounting suite

- Cons: Users can feel overwhelmed by the quantity of features. Since it’s general accounting software, it may lack project-specific features.

- Plans and pricing: starts at $30/month

- Platforms: web, iOS, Android

- Ratings: 4.7/5 on App Store, 4.1/5 on Google Play

QuickBooks Online offers a comprehensive, scalable accounting solution trusted by businesses of all sizes. Its intuitive interface and wide range of features make managing finances seamless, from tracking expenses to handling payroll. Despite the plethora of features that might seem overwhelming, the platform is designed to grow with your business.

Check out this article to explore alternatives to QuickBooks and discover robust accounting solutions.

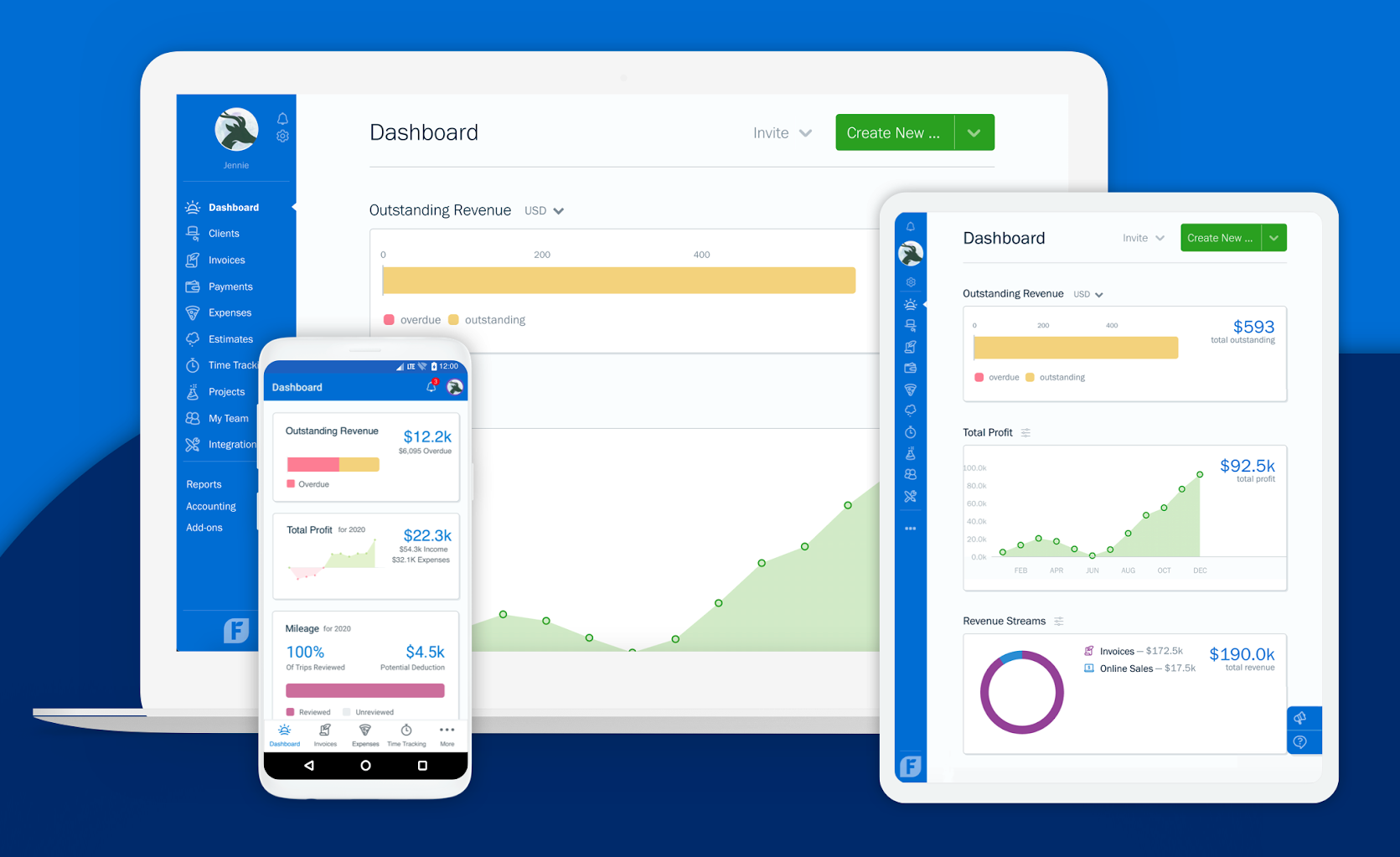

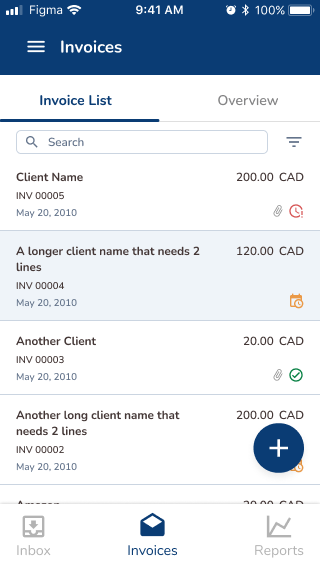

3. FreshBooks

- Key features: simple digital invoicing, time tracking, client management, automated billing, financial reporting

- Pros: user-friendly, great for service businesses of all sizes, central Accountant Hub built for accountants serving multiple clients

- Cons: limited customization options, add-on features like additional users priced separately

- Plans and pricing: four plans starting at $19 per month

- Platforms: web, iOS, Android

- Ratings: 4.7/5 on App Store, 4.5/5 on Google Play

FreshBooks is perfect for service-based businesses looking for an easy-to-use accounting solution. Its emphasis on simplicity and efficiency makes invoicing, time tracking, and client management a breeze. The platform makes it easy to collaborate with accountants, ensuring your financial records are always in top shape so you can focus on what you do best.

If you are interested in exploring alternatives to Freshbooks, you can check out our article that delves into various accounting tools and their features.

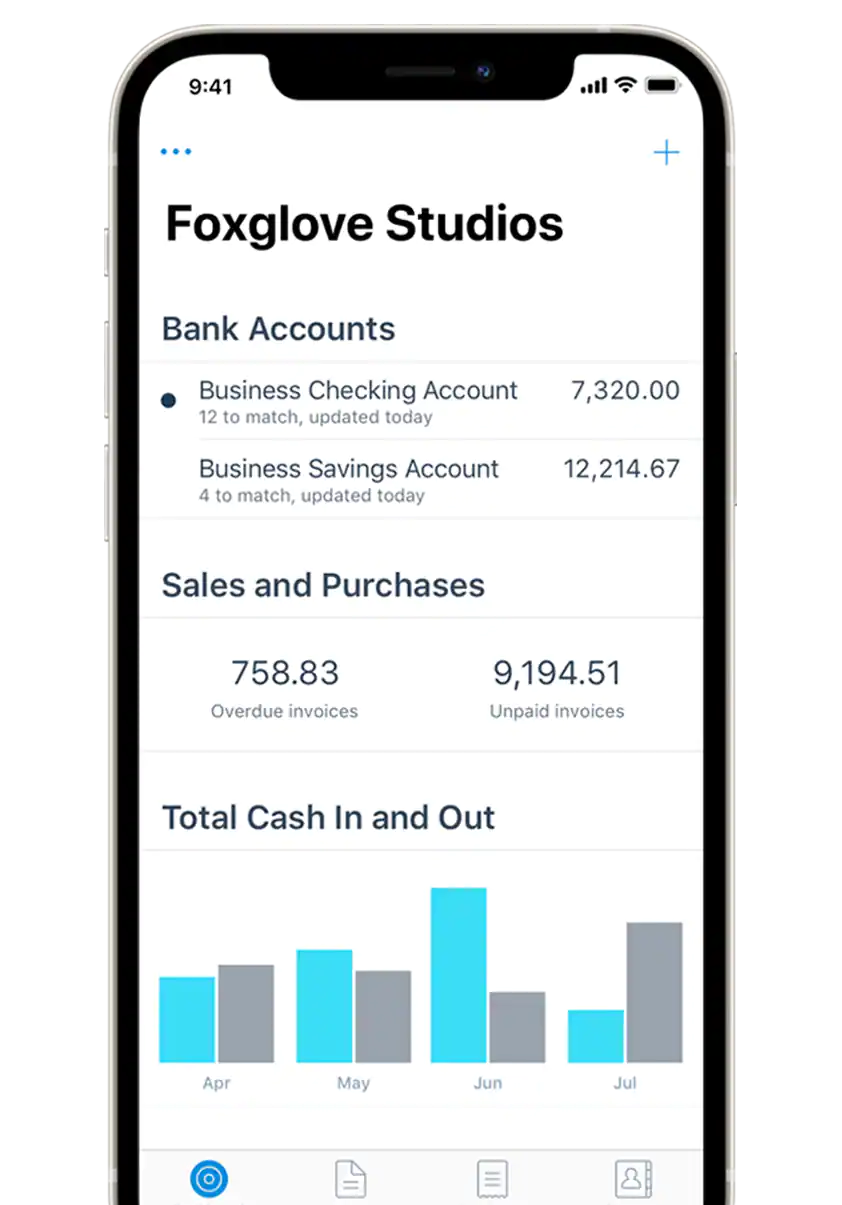

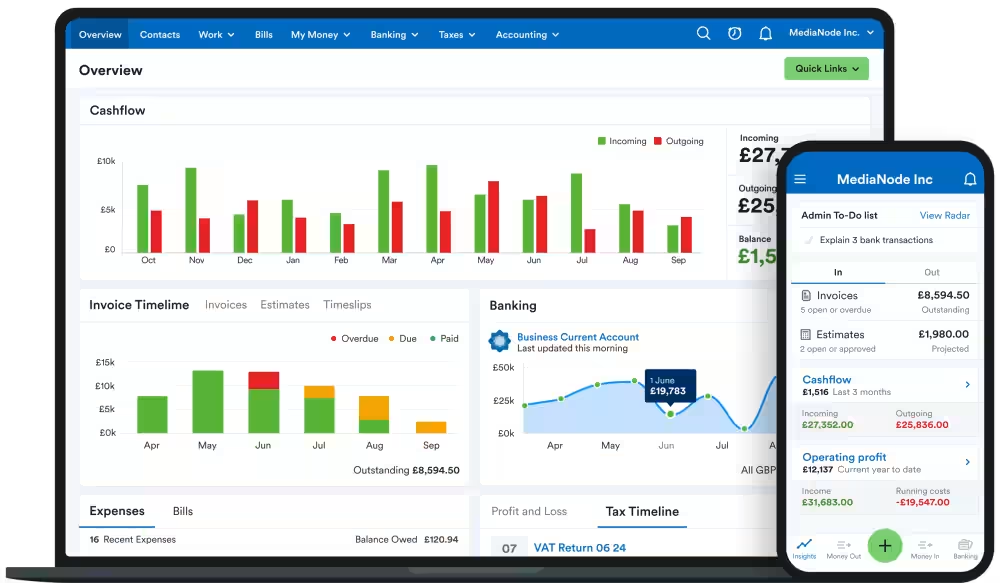

4. Xero

- Key features: invoicing, inventory management, bill management, project tracking

- Pros: robust features, integrates well with other apps, easy to use

- Cons: It doesn’t offer phone support.

- Plans and pricing: three plans, starting at $15 per month

- Platforms: web, iOS, Android

- Ratings: 4.6/5 on App Store, 4.3/5 on Google Play

Xero’s robust feature set and user-friendly design make it a favorite among small to medium-sized businesses. Its integrations with other apps ensures a smooth workflow, while its comprehensive accounting tools provide a complete solution for managing everything from invoicing to project management. Despite occasional bank syncing issues, Xero remains a powerful tool for efficient and effective financial management.

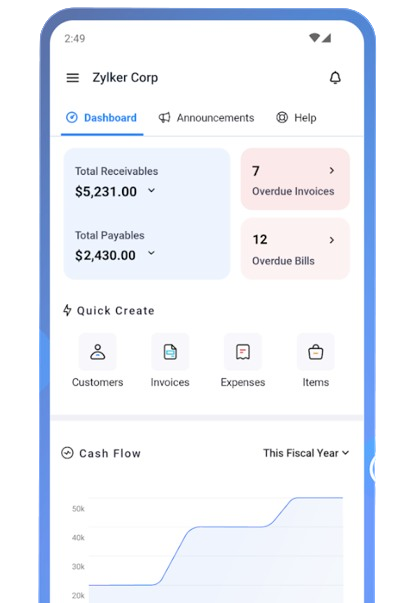

5. Zoho Books

- Key features: automated workflows, multi-currency support, project billing, vendor management, custom templates

- Pros: benefits from being part of the Zoho ecosystem of tools, multi-currency support enables global sales

- Cons: The highest tier (Premium) only supports 10 users.

- Plans and pricing: free plan and paid plans starting at $20 per month

- Platforms: web, iOS, Android

- Ratings: 4.8/5 on App Store, 4.8/5 on Google Play

Zoho Books is a versatile accounting solution that excels in automation and global sales support. Its seamless integration with other tools in the Zoho ecosystem makes it ideal for businesses that are already using Zoho products. The platform’s focus on detailed financial management helps your business stay on top of its financial game, even as it scales.

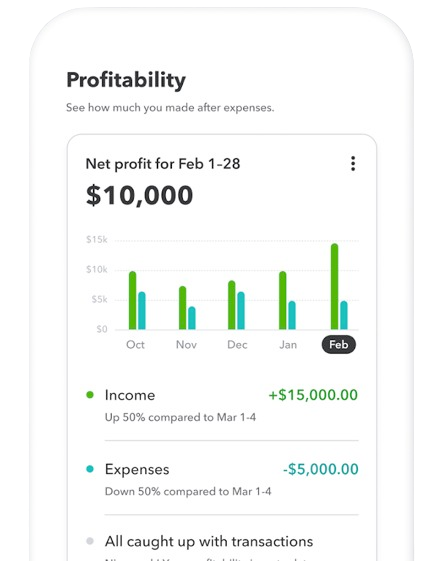

6. Wave

- Key features: invoicing, receipts, payroll, advisor support, extensive accounting features

- Pros: smart dashboard prepares you for tax time, easy to use, security-conscious bank connections

- Cons: limited support, payroll options can be limited

- Plans and pricing: free tier; paid plans start at $16 per month

- Platforms: web, iOS, Android

- Ratings: 4.4/5 on App Store, 3.5/5 on Google Play

Wave offers an unbeatable value with its free tier, making it an attractive option for startups and small businesses. Its user-friendly interface simplifies essential tasks like invoicing and receipt management, so you’re always ready for tax time. While support options are limited, Wave’s robust features and security-conscious design provide a reliable accounting solution.

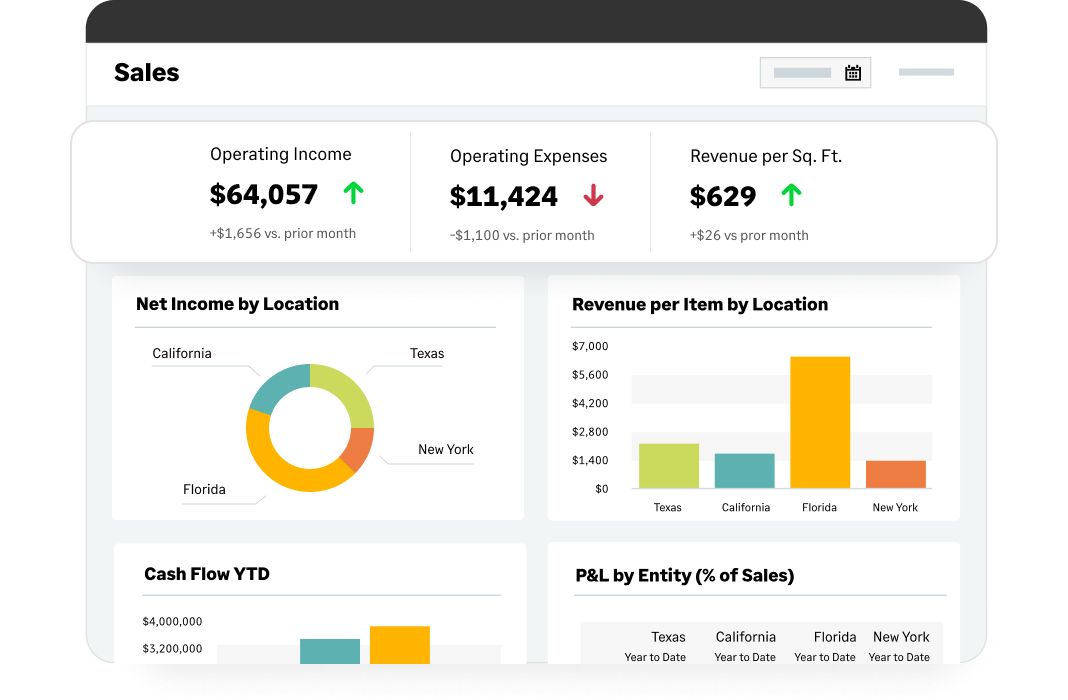

7. Sage Intacct

- Key features: AI-powered accounting, payroll, HR, integrations, dashboards, and reporting

- Pros: comprehensive reporting, strong support, powerful search functionality

- Cons: Users say it’s difficult to create custom reports.

- Plans and pricing: Pricing is available on request.

- Platforms: web, iOS, Android

- Ratings: 4.1/5 on App Store, 3.2/5 on Google Play

Sage Intacct is a powerhouse for medium to large businesses that need detailed financial oversight. Its AI-powered features and comprehensive reporting capabilities provide deep insights into your financial health. Sage Intacct’s strong support and robust search functionality make it an excellent tool for businesses seeking advanced accounting solutions.

8. Kashoo

- Key features: Simplified bookkeeping, automatic transaction importing, invoicing, expense tracking, reporting

- Pros: Simple to use, good for small businesses

- Cons: Only offers basic features

- Plans and pricing: Starts at $324 per year

- Platforms: Web, iOS, Android

- Ratings: 4.1/5 on the App Store

Kashoo’s straightforward approach to bookkeeping makes it an excellent choice for small businesses. Its simple interface and automatic importing features streamline financial management, allowing you to focus more on running your business and less on accounting. While focused on basic features, Kashoo delivers reliable and hassle-free bookkeeping.

9. Pandle

- Key features: intuitive invoicing, bank transaction imports, expense tracking, financial reporting

- Pros: affordable, user-friendly

- Cons: limited features, doesn’t include payroll functionality

- Plans and pricing: free plan, paid Pro plan for £5 per month

- Platforms: web, iOS, Android

- Ratings: 4.5/5 on Capterra software review site; no ratings in App Store or Google Play

Pandle combines affordability with ease of use, making it a solid choice for small businesses and freelancers. Its intuitive design simplifies invoicing and expense tracking, though it could benefit from more automation features. For those seeking a cost-effective accounting solution without complex bells and whistles, Pandle fits the bill.

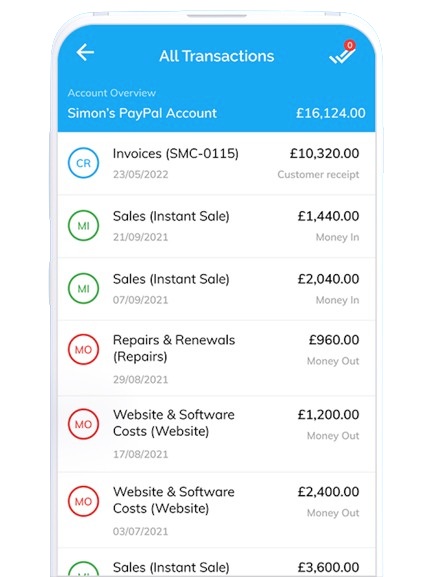

10. FreeAgent

- Key features: automated invoicing, receipt capture through photos, time tracking, project management

- Pros: food for freelancers and small businesses, intuitive interface, makes it easy to export data

- Cons: limited scalability, limited reporting functionality

- Plans and pricing: $27 per month

- Platforms: web, iOS, Android

- Ratings: 4.6/5 on App Store, 4.5/5 on Google Play

With its intuitive, user-friendly interface, FreeAgent caters to freelancers and small businesses. It streamlines processes like invoicing and expense tracking, making financial management more efficient. While it lacks scalability for larger operations, FreeAgent is perfect for solo entrepreneurs looking for an easy-to-manage accounting tool.

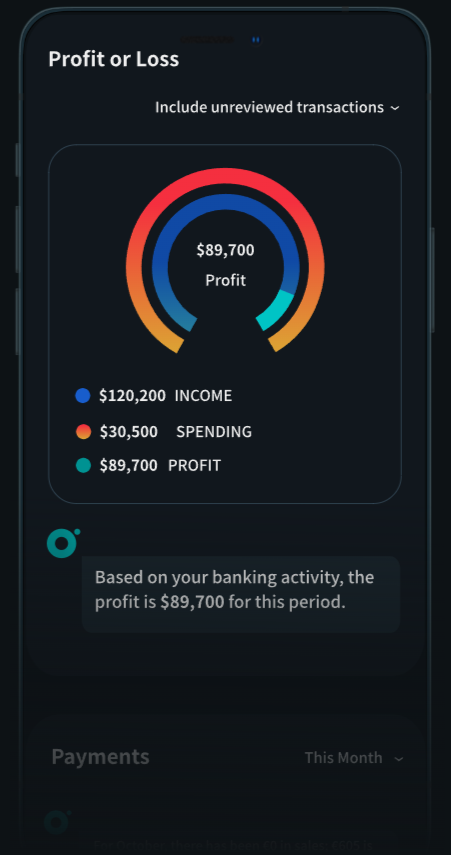

11. OneUp

- Key features: sales tax calculation for invoices, AI-assisted categorization of transactions, financial performance dashboards

- Pros: combines banking and general business tools

- Cons: limited accounting features

- Plans and pricing: Pricing is available on request.

- Platforms: web, iOS, Android

- Ratings: 2.7/5 on App Store, 3.9/5 on Google Play

OneUp integrates invoicing and AI-driven categorization with banking tools, offering a transparent financial solution. This integration ensures your business tools and financial management work seamlessly together, providing clear insights into your financial health. Although it may not have extensive accounting features, OneUp’s combined approach is ideal for small businesses seeking a robust banking platform.

Customize your accounting solutions with Jotform Apps

Imagine having an accounting app tailored precisely to your business needs. Jotform Apps makes it possible. Jotform offers a range of app templates designed to streamline your accounting processes.

You can customize these templates effortlessly using Jotform’s intuitive drag-and-drop builder. Whether you need to add invoices or expense forms, the process is straightforward. This flexibility ensures that your app meets your specific requirements, making it a perfect fit for your business.

Additionally, Jotform integrates with over 30 payment processors, allowing seamless transactions. You can also track all submissions within your accounting app using Jotform Tables to stay organized and on top of your finances.

By leveraging Jotform Apps, you gain a powerful, customizable solution that grows with your business, making accounting hassle-free and efficient. Try it for free today.

Photo by Kelly Sikkema on Unsplash

Send Comment: