A sale isn’t a sale until money changes hands. To get in on the $601.7 billion (and growing) of retail purchases that occur over the internet, your e-commerce business needs to accept payments online.

But a site’s payment system is more than just a matter of survival. A better checkout experience can also help your business grow.

In the e-commerce industry, where cart abandonment rates remain stuck in the 70 percent range, a smooth, intuitive payment experience is crucial. This guide will help you provide that experience. E-commerce experts and payment tech gurus will explain exactly how to accept payments online and which strategies can help entice visitors to cross the finish line.

Feel free to browse the table of contents and skip ahead. If you’re new to the topic, here are some of the key terms you’ll see mentioned throughout:

- A payment gateway is a software package that connects your website to payment networks. Gateway providers invest heavily in digital security measures, limiting risk for site operators and their customers.

- Merchant accounts are specialized bank services that facilitate credit and debit card payments. A merchant account holds funds until they’re fully authenticated and cleared to be transferred into a seller’s business account. Many payment gateways provide merchant accounts for their users, simplifying payment processing for sellers.

- Payment card is a catch-all term for the various types of cards buyers use to make payments, including credit, debit, prepaid, and charge cards. (Yes, they’re different, but don’t worry about the distinction just yet.)

- Payment methods refer to the particular financial instrument a customer uses to transfer funds. Credit cards, e-checks, ACH transfers, and digital wallets are all distinct payment methods.

- Payment processors are companies that submit transactions electronically on behalf of sellers. They provide the connection to credit card networks operated by card providers, while the payment gateway connects an online store to payment processors.

This guide speaks largely to online sellers, but the payment strategies we cover aren’t just necessary fuel for e-commerce. Nonprofits, B2B service providers, SaaS companies, and others need to provide streamlined and secure ways to send funds through the internet. In short, if you want to collect payments online, this guide is for you.

5 methods to accept payments online in a nutshell

- Digital wallets: An up-and-coming payment method, digital wallets store customers’ account numbers and allow them to send and receive money online.

- Credit cards, debit cards, and other payment cards: Taken together, payment cards are the second most used payment method in the global e-commerce industry.

- E-checks and ACH payments: Online ACH payments, including e-checks, processed 31.5 billion payments worth $80.1 trillion in 2023, up 4.8% from 2022.

- Local payment methods: Depending on where you do business, you may need to find payment gateways that cater to local preferences, such as online/cash hybrids and bank transfers.

- Cryptocurrencies: If your customers show a preference for blockchain-based digital money, it’s smart to find a gateway that will allow you to accept cryptocurrency.

We recommend bookmarking this guide for future reference. There’s a lot to learn about online payment systems, and you never know when you’ll want to try a new approach or build on an existing one.

Online payment gateways

A payment gateway is the technology that allows sellers to process transactions involving credit cards, debit cards, and alternative payments like e-checks and digital wallets. The term “payment gateway” also includes physical tools like credit card terminals, so experts differentiate between payment gateways and online payment gateways.

In this guide, we’ll focus on online payment gateways, which provide the software e-commerce merchants need to accept payments through their websites.

How online payment gateways handle a transaction

How does an online payment gateway work? Here’s the process a gateway uses to help a seller accept credit card payments online:

- A shopper selects an item to purchase and follows the prompts to the payment stage, providing a credit card number and authorizing information.

- The gateway’s software encrypts transaction data and securely transfers it to the payment processor, typically a bank-designated “acquirer.”

- The acquiring bank routes the payment request (again with strict data security) to card processing networks. Major credit card companies operate these networks; common examples are Visa and Mastercard.

- The card network verifies the card information, adding another fraud check to the process. Then it submits the payment request to the card-issuing bank.

- The issuing bank completes another fraud check and verifies that the customer has available funds for the purchase. Then it either accepts or declines the request and sends that decision back to the payment gateway.

- The gateway informs the buyer and the seller of the results. If the payment is accepted, the banks involved settle the payment, meaning they send the money from the buyer to the seller.

This entire process, right up to the settlement, is nearly instant. (Settlements, on the other hand, can take a few days.) The gateway acts as a connection between your customers, your site, and the payment networks that make digital fund transfers possible.

While online payment gateways allow sellers to accept credit card payments through their sites, payment cards aren’t the only method customers will use to buy your products.

Usage of digital wallets — software that stores funds in a secured electronic account (think Apple Pay and PayPal) — rose by 30 percent between 2017 and 2019, potentially reducing consumer dependence on traditional banks. And for B2B transactions, ACH payments remain a favorite, thanks to low fees and lack of spending limits that restrict credit card use.

We’ll explore alternative payment methods in Chapter 2, but as you compare payment gateway providers, be sure your top choices can handle the payment methods your customers prefer.

Four factors to consider when choosing an online payment gateway

Which gateway is right for you? That depends on a range of factors, including customer preference, ideal payment methods, user experience, and more. To get started, consider the following four components of major payment gateways.

Onsite vs offsite (hosted) checkout

Mobile-friendly design

Support for multiple payment methods

Fee schedules that work for your business model

Ronen Amit, senior e-commerce strategist and founder of SellerAct, says there are two options for gateway setup.

“The first way is probably the simplest,” Amit explains. “When you [the buyer] hit the button to pay, you will be redirected to another website, which is secured. After the payment is completed, you will be redirected back to the original website, usually to a thank-you page.” These types of gateways are also called “hosted payment pages.”

The second setup doesn’t redirect buyers to the gateway’s website. Instead, the user appears to enter their payment information directly into the seller’s site. What’s actually happening is a little more complicated, says Duston Sholtes, COO of e-commerce developer Blue Stingray.

He uses PayPal as an example of a gateway provider that offers both redirects and an on-the-page experience for buyers. “In one option, PayPal actually takes the user to their site,” Sholtes says. “But they also offer what’s called an in-context experience, where the site uses JavaScript to pull in the payment form from the PayPal website, so customers don’t have to leave the website they’re on.”

In general, redirects at the payment stage can be risky. “You have to understand that your user will be redirected to another website, and you might lose control over some of the process,” Amit says. Redirects during payment can also make shoppers nervous, contributing to more cart abandonment.

The faster implementation may make hosted payment pages best for beginners. If you have the resources, however, look for a gateway that offers an in-context payment experience.

By 2021, more than half of all online purchases in the U.S. will take place on mobile platforms. If your payment gateway offers a poor mobile experience, you’re limiting your customer base considerably.

Payment gateways accept varying combinations of payment methods. The more your site can accept, the better.

“Make sure you cater to the 56 percent of users who want multiple payment options,” says Travis McKnight of digital marketing agency Portent. “If you’re an e-commerce site, I recommend including Amazon Pay, Apple Pay, Google Pay, and PayPal alongside the standard credit card options like Visa and Mastercard. If you’re a B2B website, I advise you to check with your sales team to discover how most customers want to pay.”

Some payment gateways charge a monthly fee as well as per-transaction rates. Others only get paid when you do. Some per-transaction rates are fixed at, say, 10 cents each; others charge a percentage of the payment price.

Some gateways include customization out of the box, while others charge for advanced features. Compare these details to find the one that works best for your business.

Keep these factors in mind as you research competing gateway providers. Here’s a list of them to get you started.

Major payment gateway providers

Payment gateways are the software products themselves, but payment gateway providers are the companies that make those particular solutions. So which payment gateway provider should you choose? Here’s a short list of some of the major payment gateway providers on the market:

Many e-commerce platforms pre-integrate these and other payment gateways into their systems, simplifying the setup process. If you build a Shopify website, for instance, enabling your gateways could be as simple as choosing from a list. Other website platforms may require you to integrate your choice of payment gateways on your own.

Setting up an online payment gateway will allow you, the merchant, to start accepting online payments, but what’s the experience like from the buyer’s perspective? Let’s look at some of the major payment methods today’s consumers use to pay for goods and services online.

Online payment methods

Consumer preferences for payment methods are always changing, as trends in both online and offline payments demonstrate. As of 2018, paper checks were out, having fallen to just 5 percent of all U.S. payments per month, and debit cards were in, surpassing cash as the most frequently used financial instrument for the first time.

E-commerce providers benefit from following these trends. Online payments are major drivers of the changes, so e-commerce sellers who can give customers their favorite ways to pay will see fewer cart abandonments and more repeat business.

Below are some of the top ways to accept payments online in the current digital ecosystem. Staying on top of this information — and the ways your existing customers prefer to pay — will help you create a better checkout experience.

1. Digital wallets

An up-and-coming payment method, digital wallets store customers’ account numbers and allow them to send and receive money online. PayPal, Apple Pay, Android Pay, Alipay, and WeChat Pay are all digital wallets being used today, and their popularity is growing worldwide.

Digital wallets are now the leading payment method for online transactions globally, representing 42 percent of all internet-based payments in 2019, according to Worldpay’s 2020 Global Payments Report.

In China, more than 70 percent of all online transactions relied on a digital wallet. By way of comparison, that figure stood at 25 percent in Germany, 32 percent in India, and 24 percent in the United States — but those numbers are likely to grow, according to Worldpay’s projections.

If you plan to operate on a global scale, you should choose a payment gateway that accepts leading “Pay” apps: Amazon Pay, Samsung Pay, and Google Pay, in addition to those listed above.

2. Credit cards, debit cards, and other payment cards

Taken together, payment cards are the second most used payment method in the global e-commerce industry. Payment cards include credit and debit cards, as well as more obscure options like charge and prepaid cards.

Credit cards are the most popular form of card-based payment, representing 24.2 percent of global online payments in 2019. Debit cards came in at a distant second, with just 10.6 percent of transactions.

Most payment gateways can access popular card networks like Visa and Mastercard. These payment methods are enough to get started, but as your business grows, you may find that limiting your customers to cards increases cart-abandonment rates.

3. E-checks and ACH payments

Driven by robust growth in Same Day ACH and business-to-business (B2B) payments, the ACH Network securely processed 31.5 billion payments worth $80.1 trillion in 2023. Payment volume increased by 4.8% from 2022, while payment value rose by 4.4%. This marked the 11th consecutive year that the ACH Network’s value has grown by over $1 trillion.

These payment types are still growing online, and merchants often have questions about them. Let’s clarify the difference between ACH and e-checks.

What is an e-check?

E-checks are the digital equivalent of paper checks. They identify specific banks and bank accounts and provide authorization for the recipient to draw funds from the check writer.

What is an ACH payment?

An ACH payment is a funds transfer that takes place via the ACH Network, a centralized system that facilitates direct account-to-account transactions. ACH transactions typically charge lower processing fees than credit card networks. An e-check is a type of ACH payment — but not the only type.

Most U.S.-based online utility bill-paying services, whether they’re operated by banks or utility providers, use the ACH Network; many private-sector recurring billing systems do, too. If your company relies on recurring payments or conducts high-value B2B business, choose a payment gateway that allows you to accept ACH payments online.

4. Local payment methods

Depending on where you do business, you may need to find payment gateways that cater to local preferences, such as online/cash hybrids and bank transfers.

That’s the case in Brazil, for instance, where a cash-to-digital system called boleto bancário accounts for a full quarter of all online payments. In this system, at the point of payment, sellers provide a prefilled boleto bancário payment slip, similar to a printable bill.

“You take the bill to the bank, you pay for it, the bank scans it, and the payment is processed,” explains Amit. “It’s an online-and-offline combination of payments.”

Other unique local payment methods include SEPA Direct Debit in Europe, iDEAL in the Netherlands, and Giropay in Germany.

5. Cryptocurrencies

Cryptocurrencies like Bitcoin, Ethereum, and Facebook’s embattled Libra may seem like obscure novelties, but people do use cryptocurrencies to make purchases online. According to the Worldpay Global Payments Report, this payment method currently makes up less than 1 percent of the world’s total e-commerce transactions — but if your customers show a preference for blockchain-based digital money, it’s smart to find a gateway that will allow you to accept cryptocurrency.

As our preference for the word “customers” implies, we’ve been focusing largely on e-commerce in this guide. But nonprofit organizations need ways to accept payments online, as well. The process of accepting those payments may look a little different once you enter the charitable giving space.

Nonprofits and online payments

Nonprofits have a lot to gain from online payments. Take Sacramento-based NPR member station Capital Public Radio. In 2017, 57 percent of the nonprofit’s yearly donations came from a sustaining membership program largely processed through the ACH online payments network.

Capital Public Radio’s experience is no outlier, either. Online giving to nonprofits increased by 12.1 percent in 2019 alone. And sustaining memberships aren’t the only reason nonprofits should accept funds through the internet. Other opportunities associated with online payments in the nonprofit industry include

- Donations. According to the 2018 Trends in Giving Report, 54 percent of donors prefer to make their donations online. Your supporters are accustomed to paying online and are often more likely to click a link than to mail a check.

- Merchandise sales. Nonprofits aren’t in business to make sales, but that doesn’t mean they can’t take advantage of opportunities to sell. One well-known example is the Girl Scouts. Proceeds from annual cookie sales go to local Girl Scout councils; one in North Carolina gets up to 70 percent of its yearly operating budget from fall cookie revenues. Taking your merchandise sales online can expose you to a much broader audience and raise revenue.

- Ticket sales. Fundraising events are a cornerstone of nonprofit fundraising, and selling those tickets online can tap into a growing consumer preference. Between 2014 and 2019, the online event ticket sales industry grew by an average of 8.3 percent each year, leading to a total revenue value of $10 billion in 2019.

- Dues collection. Does your nonprofit collect recurring dues payments? If so, consider setting up a recurring payments structure through the ACH Network or another processor.

The process of setting up online payments for nonprofits mirrors that of e-commerce merchants. You’ll need a payment gateway that can process your supporters’ favorite ways to pay online. Several nonprofit-focused payment services are available, or you can go with an e-commerce juggernaut like PayPal, which facilitated $7.3 billion worth of donations in 2016. You can even integrate PayPal into your online forms to support online giving and email fundraising.

Some nonprofit operators, and their for-profit counterparts, worry about security for online payments — and that’s a valid concern. The good news is that today’s online payment infrastructure has well-developed security technologies built in. Here’s how online payment systems keep payment information safe from bad actors.

Online payments and security

At a time when more than half of U.S. consumers “strongly distrust” online security, keeping payment information safe — and sharing your security efforts with customers — is critical for the success of every e-commerce operation. In some regions, business owners must comply with specific regulations to accept online payments legally.

In this chapter, we’ll cover some of those laws and regulations. We’ll also discuss a common security practice that site operators can use to improve online security for payment systems.

Online payment security standards and laws

The regulations that govern payment security differ from place to place. As of now, there’s no universal mandate for securing payments over the internet — although that doesn’t reduce the importance of strong payment security, if only to retain customers.

If you have customers in the European Union, or if you’re located there yourself, the key regulation is PSD2, “Revised rules for payment services in the EU.” The term PSD2 is shorthand for Payment Services Directive 2. The directive went into full effect on September 14, 2019, at which point online businesses had to be in full compliance.

The PSD2 standards are designed to strengthen protections for financial data transmitted online. One of the biggest changes under PSD2 is the requirement for “strong customer authentication,” or SCA. Specifically, SCA requires the use of at least two of the three elements below to assure the validity of an online payment transaction:

- A detail that only the user would know. Factors like PINs and passwords fall under this knowledge-based authentication.

- Something only the user would possess. That could be a mobile phone, as in the case of multifactor authentication strategies that involve texting a single-use code to the user’s phone on each request.

- Biometric or body-based identifiers. Currently, these include technologies like touch ID and facial recognition.

The main safety standard outside the EU is PCI DSS, a set of security requirements maintained by the Payment Card Industry Security Standards Council.

The PCI DSS affects every entity involved in online payments, including merchants, processors, and gateway providers. Global credit card processing networks typically require some level of compliance with PCI DSS, which means even EU-based businesses that meet PSD2 standards should comply.

Broadly, PCI DSS introduces six distinct requirements outlined in the Requirements and Security Assessment Procedures:

- Build and maintain a secure network and systems

- Protect cardholder data

- Maintain a vulnerability management program

- Implement strong access control measures

- Regularly monitor and test networks

- Maintain an information security policy

While meeting these requirements may seem daunting, you don’t have to handle these challenges alone. Often, the best way to ensure PCI compliance is to partner with payment gateways and processors who meet these six obligations consistently.

SSL certificates for payment security

If you’re planning to start an e-commerce site — or want to make your existing payments infrastructure more secure — start by asking your payment gateway(s) about PCI DSS compliance and other fraud prevention services they employ. Don’t forget to inform your customers about these efforts on your site.

There’s one important step site owners can take to both improve security and improve confidence for your customers: Obtain an SSL/TLS certificate to prove to visitors that your site encrypts sensitive data before transmitting it over the internet.

The terms SSL and TLS stand for Secure Sockets Layer and Transport Layer Security. While TLS is the latest protocol, SSL remains a more familiar term. These certificates are available from web hosting services. Ensure that your provider includes SSL/TLS certificates before signing any agreements.

A browser that doesn’t have an SSL/TLS certificate may not be able to accept payments. “Most browsers today alert you if there’s any kind of information that is transferred insecurely,” says Amit. “Sometimes they won’t even allow entry into that page.”

Payment security beyond the e-commerce industry

While digital security is essential for the growth of e-commerce, anyone who accepts payments online needs to address the issue. As we covered in Chapter 3, nonprofits and other non-business organizations can benefit greatly from online payments. Peer-to-peer payments are also on the rise, with 44 percent of respondents to a 2018 survey saying they had used them, and 37 percent saying they hadn’t.

Businesses of all types can also use online payment systems within their companies. You might collect online payments internally to cover shared expenses for company events, for instance. Find out how to easily set up safe, secure intra-organization payment forms.

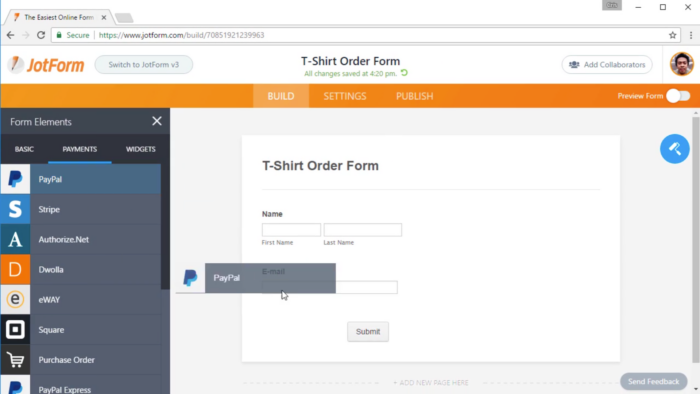

This type of payment form isn’t the only one that Jotform provides. Let’s look at the role Jotform can play in the structure of your payments, regardless of your goals.

Collecting payments with online forms

The payment form is a crucial step in the sales process. Form design and usability have a direct impact on conversion rates. Luckily, it doesn’t take a team of web developers to create a user-friendly payment form.

Jotform makes the form-building process easy with an intuitive drag-and-drop interface and exactly zero coding experience required. Advanced users can always edit in HTML if they prefer.

Jotform has been helping site owners around the world build payment forms for more than 12 years. In fact, payment forms are one of the top reasons our customers reach out to us. You can even add payment fields to existing forms, giving your audience one-stop payments access through the most popular pages on your site — even on social media.

All you have to do is add a widget through our intuitive interface and provide the relevant details.

Jotform’s Form Builder makes it easy to implement payment systems into online forms, each of which provides users with

- Industry-leading security. When your customers submit payment information through Jotform, that data is protected by the most stringent security protocols in the industry. Jotform servers never store user payment data, and all data remains secured by 256-bit SSL encryption on its way to your gateway provider. Jotform is also PCI DSS compliant, with a PCI Service Provider Level 1 certificate. Security certificates are available on request — simply talk to the Jotform support team to learn more.

- Payment versatility. Do you collect recurring payments? Do you need to make auto calculations based on users’ choices? Jotform provides simple access to payment structures of all types, from a single product purchase to ongoing ACH deductions.

- Integration with your most successful channels. Add a payment form to your website or allow secure payments directly through your Facebook page. Learn more about Jotform for Facebook payments.

- No commissions or added fees. Jotform doesn’t collect fees for the payments you accept. We also don’t collect commissions or add any costs to your payment gateway’s transaction fees.

- Customized payment experience without coding. Build a form with a payment integration to collect customer information and payments at the same time. Because Jotform is highly customizable, you can create your own payment experience without hiring a development team.

To be clear, Jotform doesn’t operate a payment gateway. We simply make it easier for your customers to access the gateways you already work with through our integrations with payment gateways. And odds are, if you use a payment gateway, Jotform can integrate with it.

Payment gateway integrations with Jotform

Jotform provides simple integrations with leading gateway providers to create quick, hassle-free payment forms. And this is worth saying again: We don’t charge any additional fees when you accept payment through a form. (You’ll need an account with your preferred payment gateway before adding it to your form, of course.)

A few examples of the payment integrations available through Jotform include

- PayPal. Collect payments with any of PayPal’s leading payment services, including PayPal Checkout, PayPal Pro, and PayPal Invoicing.

- Stripe. Stripe is a developer-friendly gateway with a simple per-transaction pricing structure. A parallel service, Stripe ACH, allows users to accept e-checks and other ACH payments. Learn how to add Stripe and Stripe ACH to your form.

- Square. In the last quarter of 2019, Square’s payments volume surpassed $28 billion. The platform allows both single-instance and recurring payments. Learn how to add a Square integration to your form.

- Moneris. In Canada, Moneris is the top payment processor for both online and in-person transactions. Learn how to add Moneris to your form.

These are just a few of the payment gateway integrations available through JotForm. Our integration options are always growing, and all of the most popular payment services are available through our platform. Search the complete list of payment integrations available on JotForm.

If you have questions, resources are always available. Read our user guide on payment form integrations or contact our support team directly. If you’re ready to build your first payment form now, keep reading.

How to build an online payment form

Building your first online payment form is simple with Jotform’s drag-and-drop Form Builder. To start, you’ll need to have an account already in place with your preferred payment gateway. After that, you’re ready to use a payment form.

There are lots of payment options available from Jotform, and the list is always growing. If you have questions or don’t see something you need, check out our user guides or reach out to our customer support team. One of the following form types works for most businesses:

- Order forms. Use order forms to sell products, collect donations, register visitors for paid events, and more. Start your own publishing wing by selling white papers, e-books, and reports in PDF format. Take advantage of our templates or build your own forms. List a single product or many different products, with or without custom modifications for each item. Learn more.

- Recurring payments. Recurring payment forms are perfect for collecting payments on a regular, repeat basis for services or publications; charging monthly dues for organization memberships; or giving nonprofit supporters the option of making recurring donations. No matter what the recurring payment is for, you can set up an order form through Jotform that simplifies the process. Learn more.

- Purchase orders. Actual payments for many B2B transactions are handled through company accounting departments. In this scenario, you don’t make a sale by collecting the payment; you do it by generating a purchase order, or PO. Jotform’s Form Builder includes a dedicated purchase order payment tool that simplifies B2B conversions.

After you choose a general payment form type, you have two options: You can either use a premade template to get your form published as quickly as possible, or you can build your own payment form with Jotform’s Form Builder.

Payment form templates

Jotform offers dozens of payment form templates for all sorts of payment scenarios. When you use a template, most of the work is already done for you. Just customize the template to reflect your branding and display your information, and then embed the form directly into your website.

Building a payment form from scratch

You may envision a form that doesn’t quite match any of the available templates. In that case, log into your Jotform account, click the Create Form button, and you’re ready to use the Form Builder.

You can choose from traditional forms, which display all questions on a single page, or the advanced Jotform Cards experience, which offers users a single question at a time. This approach gamifies the payment experience, and can even include friendly micro-animations that reflect your brand and keep customers engaged.

Follow this step-by-step guide, complete with video instructions, to create your first order form from start to finish. There are tips available on how to build the most effective form possible. Once your form is complete, you can even add a customized “thank-you” page to let your customers know the payment is complete.

Your site can’t collect payments without a form of one type or another, and building those forms shouldn’t be an obstacle. Sign up for a free Jotform account to start collecting payments online today.

Send Comment:

4 Comments:

More than a year ago

I'm interested

More than a year ago

WHY U DO NOT TELLUS ABOUT THE COST

More than a year ago

I am interested in how you can handle online local payments. Is there a Bluetooth card payment device that you would propose. I currently used IZettle

More than a year ago

I was afraid let alone purchasing something online, even clicking the related link once. You can call me old-fashioned but I tend to have a conservative personality and not easily adapt to change.

Like every business, my record store also got negatively affected by the pandemic. I had to close up shop. I was so bummed out that I once thought about dropping everything, it was a financially challenging time too.

I am incredibly thankful to my son who forced me to open up a website and keep my business going by selling my records online. As you might have guessed, I was really not comfortable with the situation at first, but then we created an online product list form, with the prices and images. I cannot even tell you how big of a rush it was for me when I shipped my first online order record! If anybody told me that I would have my own website with an order form inside, I would just laugh in their faces.

I'm ecstatic about being able to do what I love once more and make some money again. I love it when new technology is easy to use!